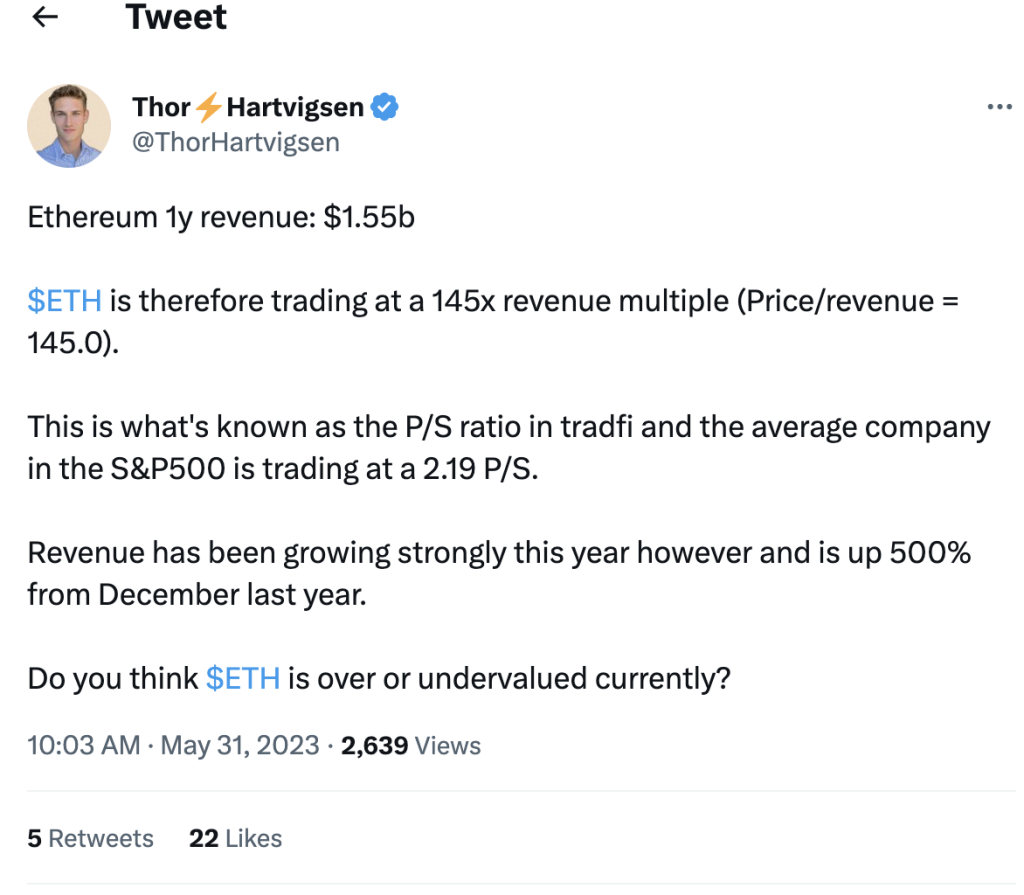

Ethereum, the prominent cryptocurrency, has sparked a spirited debate among market participants regarding its current valuation. The focus of contention lies in Ethereum’s remarkable 1-year revenue of $1.55 billion, resulting in an eye-catching price-to-revenue ratio of 145.0, significantly higher than the average of 2.19 observed in S&P500 companies.

Advocates in favor of Ethereum’s valuation argue that its revenue has experienced a staggering growth rate of 500% since December of the previous year, underscoring the platform’s robust expansion. They contend that this extraordinary revenue growth justifies the premium valuation bestowed upon Ethereum.

Conversely, skeptics question the alignment of Ethereum’s valuation with its utility, revenue, and overall value. They posit that the price-to-revenue ratio signifies an overvaluation, particularly when compared to more established entities such as Tesla, with a price-to-earnings (P/E) ratio of 7.8, and Apple, with a P/E ratio of 7.2. This perspective suggests that Ethereum’s valuation is inflated, primarily driven by narratives and hype rather than tangible utility, leading to potential depreciation over time.

Beyond the valuation metrics, the macroeconomic standpoint adds another layer to the debate. Some argue that Ethereum’s current valuation may still be undervalued, as global liquidity has yet to fully embrace the cryptocurrency market. These proponents anticipate increased institutional investment in Ethereum once macroeconomic conditions improve, potentially further bolstering its value.

Another dimension raised by market participants is the relevance of Ethereum’s P/E ratio. Since Ethereum’s revenues predominantly consist of base fees credited to stakers as earnings, a comparison with the S&P500’s P/E ratio, approximately 24, is proposed as a more pertinent benchmark for valuation analysis.

The ongoing discourse surrounding Ethereum’s valuation underscores the division among investors and analysts. Determining whether Ethereum is over or undervalued based on its price-to-revenue ratio remains a subject of contention. The cryptocurrency market’s inherent volatility and susceptibility to various factors further complicate the assessment.

As market participants closely monitor these developments, they seek a comprehensive evaluation of Ethereum’s worth, incorporating both the price-to-revenue and price-to-earnings ratios, as well as the platform’s utility and macroeconomic influences. The outcome of this ongoing debate will provide valuable insights into the trajectory of Ethereum and the cryptocurrency market as a whole.