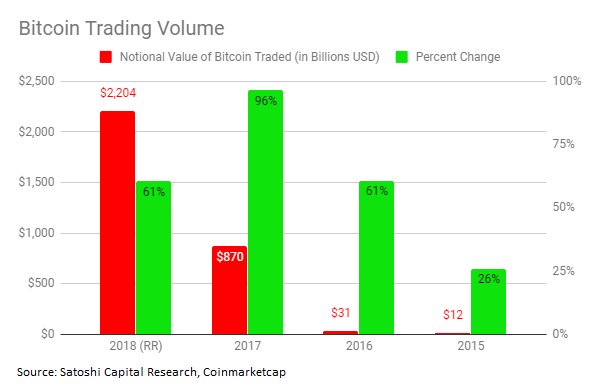

Bitcoin’s trading volume increased significantly compared to the previous year. The total number of Bitcoin traded in 2018 is estimated at 2.2 trillion US dollars. Last year, on the other hand, this figure was “only” 870 billion dollars. This means that the trading volume this year is 2.5 times larger than in 2017.

This is the result of a study by Satoshi Capital Research. The research company used Coinmarketcap’s figures for this and came to the following conclusions:

More Bitcoin derivatives in the future?

However, this data can give a distorted picture of the actual number of coins traded. Bitcoin derivatives were also included in this calculation. With derivatives, you can trade the crypto currency without actually owning Bitcoin at the time of trading. This is possible, for example, with Bitcoin futures.

Currently, these account for less than a third of Bitcoin’s total trading volume. However, according to Satoshi Capital Research, this could change in the future. The derivatives market could expand in 2019. This also depends on the position of various regulators on this issue. By the end of this year, for example, the US Securities and Exchange Commission will be looking at the Bitcoin ETF from SolidX and VanEck. Approval could also have a positive effect on trading volumes.

Bitcoin compared to Mastercard

In order to put the numbers of the crypto currency into perspective, we can compare them with the latest results of the credit card company Mastercard. Mastercard’s total transaction volume so far amounts to 4.4 trillion dollars. In addition, a current report states that an average of 12 billion US dollars are processed per day.

Bitcoin is currently not so far behind, considering that the crypto currency has only existed since 2009. The transaction volume of the digital coin is currently at 2.2 trillion dollars, half that of the credit card company. As the data from Coinmarketcap show, 5.3 billion Bitcoin were traded on all exchanges in the last 24 hours alone.

Just a few weeks ago, the trading volumes of various coins fell as the prices of crypto currencies fell. The crypto market now seems to have overcome this phase.