Recently I wrote about crypto market caps and why you shouldn’t look at them as a defining factor when deciding if and when you should invest into a cryptocurrency. As noted before, market cap is an important metric that can tell you a lot about the coin’s value and potential but there are numerous other factors that go into one currency’s valuation. So let’s take a look at a couple of those in this article.

The website onchain.fx offers a good overview of these factors. An interested investor should observe all of the data presented and formulate an educated decision before going in and investing his money.

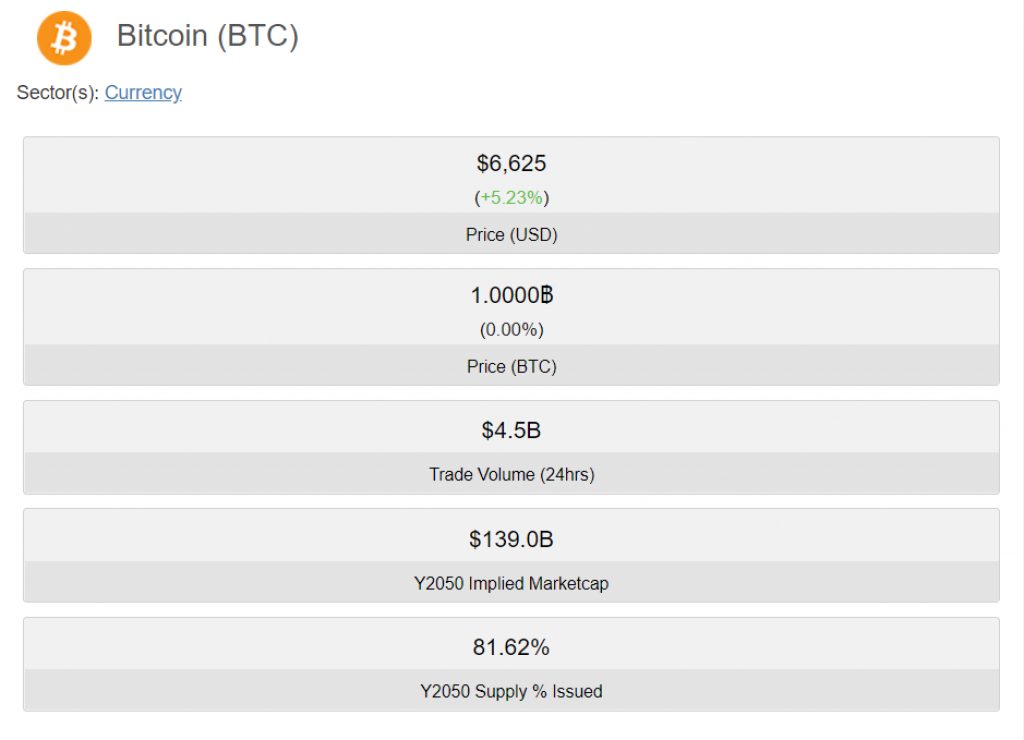

Looking at the overview, you can notice that the first factor listed is the trade volume. I’ve skipped the Price (BTC) as one BTC will always be one BTC (this factor does play a significant role in altcoin valuation, as you should always prefer your altcoin/BTC pairing going up rather than the altcoin/USD).

The trade volume metric shows you (in USD) the amount of coin that has been traded on the exchanges in the last 24 hours. It is an indicator of the speculative demand for the coin. Market caps help determine the total value of the project; trade volumes help determine liquidity. When observing two coins with similar market caps, the one with the higher trading volume will be more fit to handle large sell orders without experiencing an extreme drop in price. Therefore, coins with high liquidity and high market caps are usually the best ones.

Read here how to buy litecoin with paypal or credit card.

This parameter differs from the on-chain trade volume, as trade volume is made out of exchange transactions (which are done off-chain, on exchange servers). Generally, the higher the trade volume is the better, as most blockchain platforms struggle with acquiring interest for their coin. More volume doesn’t always mean a positive thing though; for example, in a bear market, when the price is falling while the volume is rising, this indicates that people are feeling extremely bearish about a coin and are looking to sell it off as soon as possible.

On-chain transaction volume is an important metric as well, which can show us how many coins are actually being used for their intended purpose – on-chain transactions. This metric is an indicator of the transactional demand for the coin. This metric should be observed differently on a chain with high transaction fees vs. a chain that has miniscule fees. The second chain makes it relatively cheap to run bots that will trade the coin to artificially inflate its volume; this means that rising volume on a blockchain with higher fees is usually a more bullish indicator than the one cited in the first example.

Ultimately both the trade volume and on-chain transaction volume can tell us more when observed over a longer time period, as daily volumes tend to fluctuate a lot in the world of crypto. Weekly/monthly indicators are much more telling than the single day volumes. The on-chain transaction volume metric can potentially become less valuable and will need to be reworked when two-way protocols like the Lightning Network are introduced in the future. Additionally, the metric is completely useless on privacy protocols like Monero which intentionally hide/blend their transactions.

The overview posted above also lists another important metric called Bitcoin-normalized price in 2050. First tweeted by @boxmining on Jan 4th 2018 and popularized by onchain.fx, the metric is the implied value of the total expected supply of an asset on Jan 1st 2050, if the asset had the same current supply as Bitcoin. The specific calculation onchainfx is using is simply: asset’s Y2050 market cap divided by Bitcoin’s Y2050 supply.

This metric puts the coin price in proper perspective with Bitcoin. People who bought coins that went for a dollar during the 2017 bull run sometimes did so because they thought how said coins will eventually reach Bitcoin’s valuation that was at the time over 10 thousand dollars; they neglected the fact that these coins regularly had supplies hundreds, if not thousands of times greater than the one that BTC has.

Ultimately, there are many more useful metrics to observe, with these three being just the top of the crypto iceberg. https://onchainfx.com/metrics offers a decent list of metrics that one can observe when determining the future of a crypto asset. Websites like Cryptocompare, CoinGecko, Coincheckup also offer extensive databases of metrics and data that any good analyst/trader will use. Try to at least get acquainted with the three listed in this article as they will serve you well in your future investment dealings.