Are you thinking about throwing some money into XRP? Well, we tried to explore some Ripple alternatives together with AI considering XRP has a huge market cap already.

What you'll learn 👉

Why Consider XRP Alternatives?

With Ripple’s lawsuit nearing resolution and the company regaining traction in institutional finance, XRP is back on many investors’ radar. However, its massive market cap of nearly $130 billion makes big short-term returns challenging.

If you believe in XRP’s mission of improving cross-border payments and upgrading financial infrastructure but want greater growth potential, smaller-cap alternatives might make more sense. Two contenders worth examining are XCN (Onyxcoin) and XLM (Stellar).

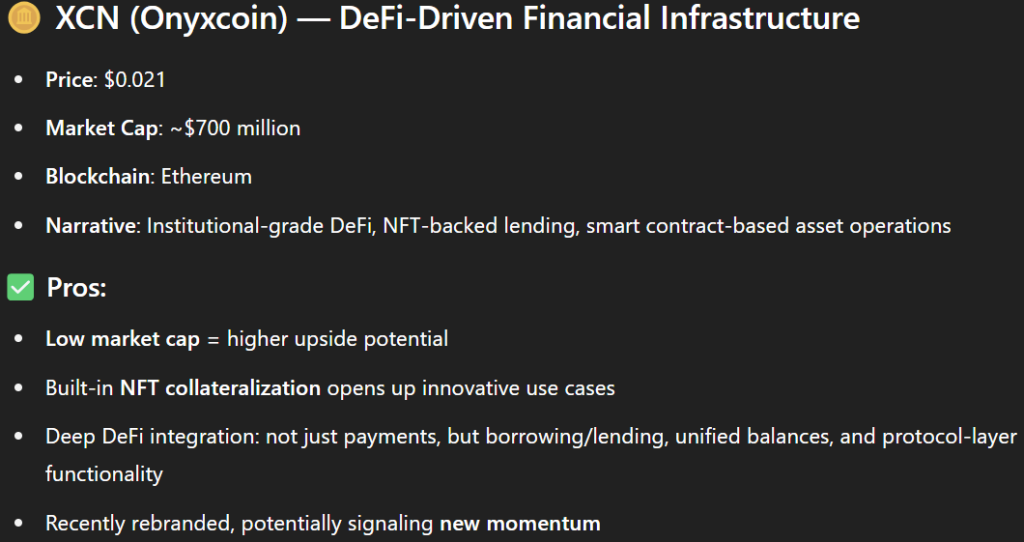

XCN (Onyxcoin) – The DeFi Innovator

Priced at around $0.021 with a market cap of approximately $700 million, Onyxcoin operates on the Ethereum blockchain. It focuses on institutional-grade DeFi, NFT-backed lending, and smart contract-based asset operations.

XCN offers considerably higher upside potential due to its lower market cap. Its built-in NFT collateralization creates innovative use cases beyond simple payments. The platform features deep DeFi integration, supporting borrowing, lending, unified balances, and protocol-layer functionality. A recent rebranding suggests possible new momentum for the project.

However, XCN remains relatively unknown to retail investors. Its reliance on Ethereum means exposure to gas fees and network stability issues. The coin also has limited exchange support compared to XRP or XLM and needs to develop more real-world institutional partnerships to fully match XRP’s vision.

Read also: Why OnyxCoin (XCN) Might Be the Altcoin Everyone Regrets Ignoring

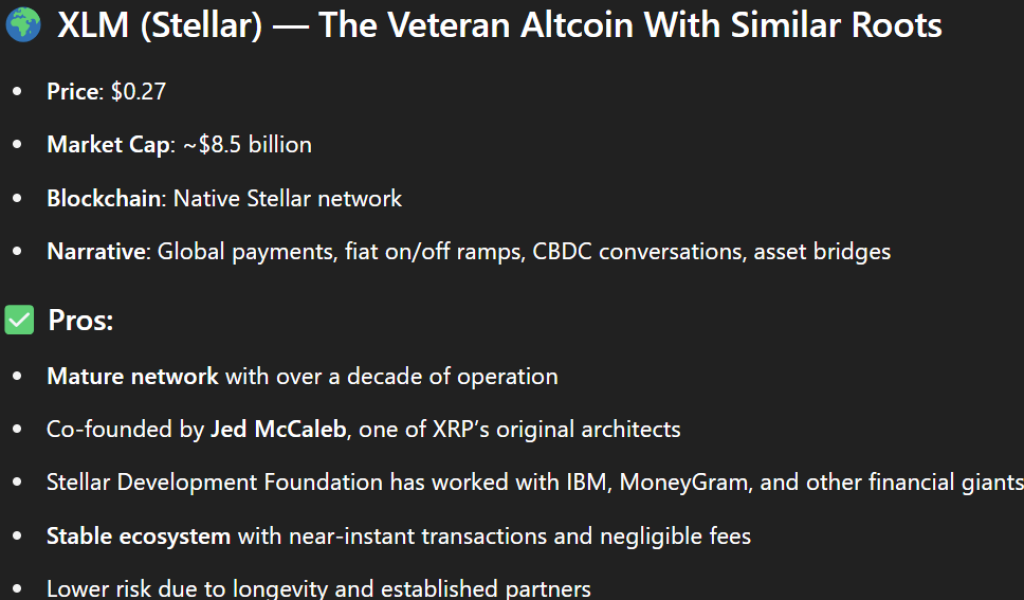

XLM (Stellar) – The Established Player

Trading at about $0.27 with a market cap of roughly $8.5 billion, Stellar runs on its native blockchain. Its focus includes global payments, fiat on/off ramps, CBDC development, and asset bridges.

XLM benefits from being a mature network with over a decade of operation. Co-founded by Jed McCaleb, one of XRP’s original architects, Stellar has established partnerships with major players like IBM and MoneyGram. The ecosystem offers stable, near-instant transactions with minimal fees, and its longevity provides lower risk.

On the downside, XLM’s higher market cap limits its growth potential compared to XCN. Its retail-focused adoption has outpaced institutional traction, and some investors question its pre-mined tokenomics from a decentralization perspective.

Making Your Choice

| Feature | XRP | XLM | XCN (Onyxcoin) |

|---|---|---|---|

| Core Mission | Cross-border payments for banks | Cross-border payments for individuals | DeFi-based institutional finance |

| Settlement Speed | ~3–5 seconds | ~5–10 seconds | Ethereum-dependent |

| Founders Overlap | Ripple Labs | Jed McCaleb (ex-Ripple) | Chain/Onyx team |

| Total Supply | 100B (capped) | 50B (capped) | 48B (max supply) |

| Market Cap (as of now) | ~$130B | ~$8.5B | ~$700M |

| Biggest Advantage | Legal clarity & adoption | Simplicity & efficiency | Upside potential & DeFi-native features |

When deciding between these XRP alternatives, consider your investment priorities:

If stability, established partnerships, and smoother adoption matter most to you, XLM represents the safer bet. It’s essentially the “Litecoin to XRP’s Bitcoin” – proven, efficient, and widely accessible.

If you’re seeking higher upside potential and early-stage innovation with DeFi integration, XCN has the advantage. With a market cap of only $700 million and broader infrastructure capabilities including NFT collateralization and smart DeFi lending, XCN positions itself as a next-generation version of what XRP started.

Both XLM and XCN offer compelling alternatives to XRP, but they target different investor profiles. Choose XLM for security and credibility, or bet on XCN for potential upside and innovation.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.