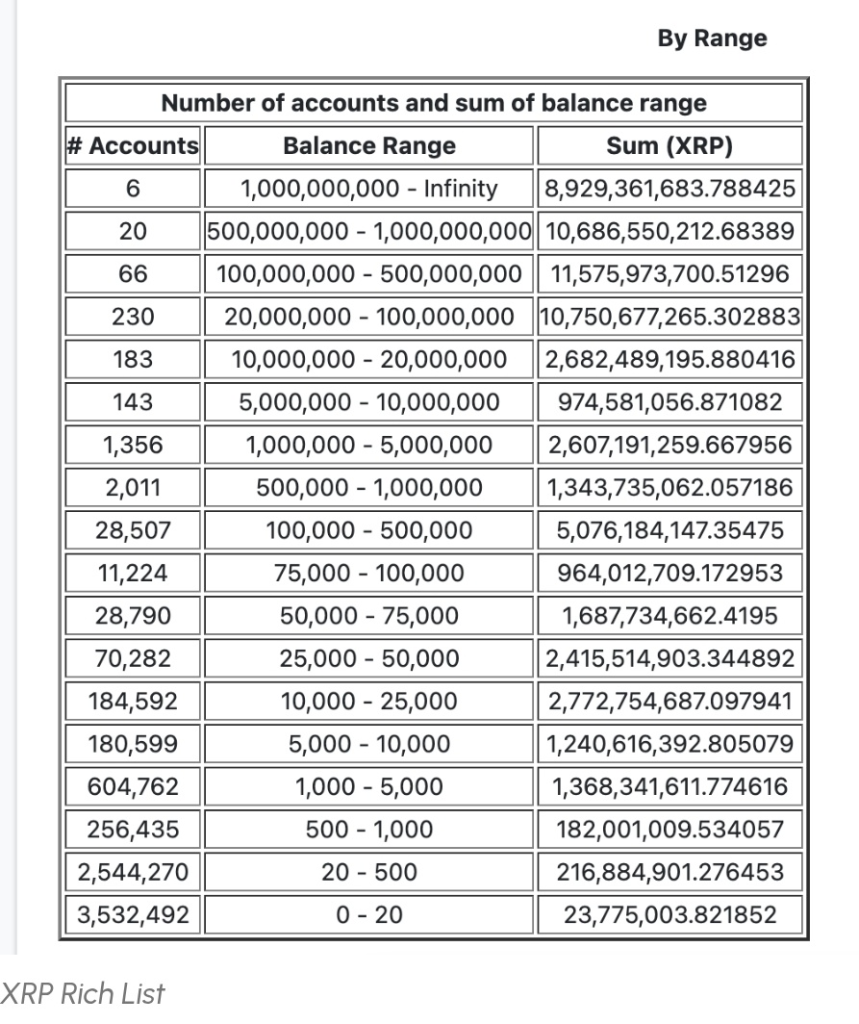

An image shared by an XRP community member is explaining how XRP ownership is distributed, and what that might mean for retail participants as prices rise.

The image, often referred to as the “XRP Rich List,” breaks down the number of wallets by balance range. One figure stands out immediately: more than 6 million XRP wallets hold 500 XRP or fewer. At the same time, accumulating larger positions is becoming noticeably more expensive. Holding 1,000 XRP now costs around $1,750, compared to roughly $500 just over a year ago.

That shift has sparked debate across the XRP community about whether retail investors are slowly being priced out.

What you'll learn 👉

What the XRP Rich List Data Shows

According to the table shared, XRP ownership remains heavily concentrated in smaller wallets by count, but not by value.

Wallets holding between 0 and 500 XRP make up the overwhelming majority of addresses on the network. However, they collectively control only a small fraction of total supply. In contrast, a relatively small number of wallets holding millions or even billions of XRP account for a significant share of the total balance.

For example, just 26 wallets hold more than 500 million XRP, while fewer than 100 wallets control balances above 100 million XRP. This type of distribution is not unique to XRP, but the widening gap between wallet counts and wallet value is becoming more visible as prices climb.

The discussion is less about manipulation and more about math.

As XRP’s price increases, the number of tokens a new participant can realistically accumulate with the same amount of capital naturally declines. A year ago, $1,000 could buy around 2,000 XRP. Today, that same amount buys closer to 550 XRP.

This does not mean retail interest has disappeared, but it does change behavior. Smaller holders may focus on maintaining positions rather than expanding them, while newer entrants may settle for lower XRP targets than those who entered earlier.

Is Retail Really Being “Pushed Out”?

Some community members argue that retail is being priced out. Others see it differently.

From a market structure perspective, rising prices typically favor early adopters and long-term holders. This pattern has played out across Bitcoin, Ethereum, and other large-cap crypto assets. XRP appears to be entering a similar phase, where accumulation becomes harder, but existing holders benefit from appreciation rather than expansion.

Importantly, the data does not show mass retail exits. Instead, it suggests slower accumulation at higher price levels, which is a normal shift as assets mature.

Read also: XRP Price Drop Raises Questions as Large Exchange Flows Hit Thin Liquidity

Bigger Picture for XRP Holders

The XRP rich list data highlights a transition phase rather than a breaking point.

Retail still dominates in terms of wallet count, while larger holders continue to control supply. As XRP adoption narratives focus more on payments, liquidity, and institutional use cases, ownership distribution may continue to skew this way.

For smaller holders, the focus may shift from chasing round numbers like 10,000 XRP to simply holding a position that aligns with their risk tolerance. For larger holders, the data reinforces XRP’s role as a long-term asset rather than a short-term accumulation play.

In that sense, the rich list is less a warning sign and more a snapshot of a network growing into its next stage.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.