XRP is still stuck in a tight range, hanging just above a key support zone after losing steam over the past week. There haven’t been any fresh bullish catalysts lately, and the price keeps getting rejected at short-term resistance levels.

That has kept things under pressure, and the technicals, especially on the hourly and 4H charts, still point to bearish momentum.

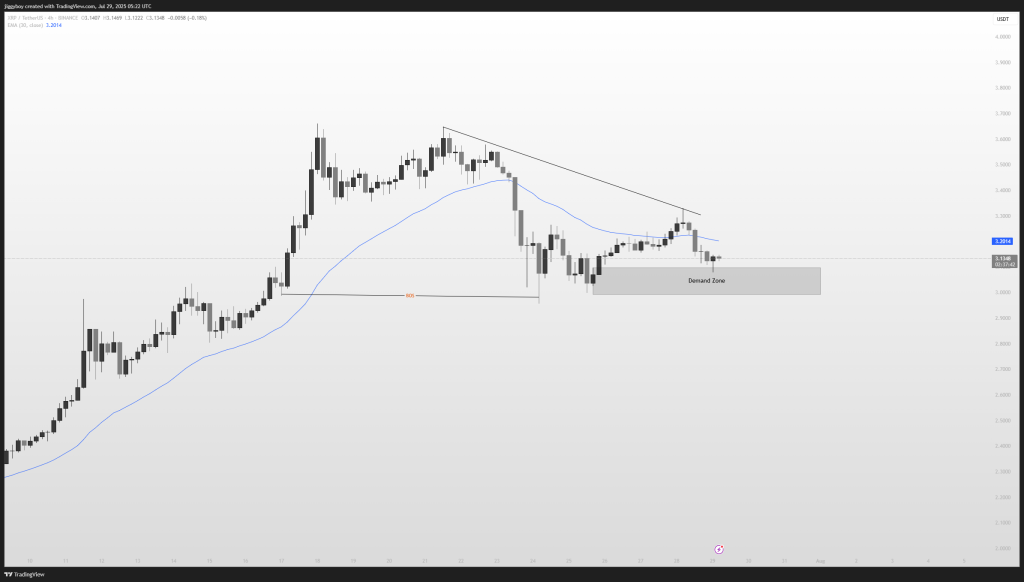

At writing, the XRP price is trading slightly above $3.12 and sitting right on top of its demand zone. It couldn’t reclaim the $3.30–$3.35 area, and that failure has left the $3.00–$3.14 range as the critical battleground for what happens next.

Let’s take a closer look at today’s setup.

What you'll learn 👉

📅 What We Got Right Yesterday

In yesterday’s outlook, we projected a range-bound move between $3.12 and $3.38, with a slight bullish tilt as long as $3.00 held. We also highlighted that a breakout above $3.30 could open the path to $3.65 and $3.82.

Price played out within this projected zone, failing to breach the trendline resistance and drifting lower into the demand zone. No bullish breakout occurred, and momentum continued to weaken, exactly as anticipated.

We also noted that a break below $3.00 would trigger downside toward $2.80, and so far, that risk remains active if buyers fail to step in.

📊 XRP Daily Overview (July 29)

- Current Price: $3.128

- 24h Change: -0.18%

- 1H RSI (14): 40.14

- Volume: Flat and decreasing

XRP price remains stuck in a tight range between $3.00 and $3.20, and neither way is displaying any real momentum at the moment. Price is sitting right below the 30 EMA, and every time it tries to go up, the sellers intervene and suppress it. The current structure reflects market hesitation near a key zone.

🔍 What the XRP Chart Is Showing

The 4H chart shows a confirmed bearish structure, marked by a Break of Structure (BOS) and a series of lower highs. The descending trendline and sloping 30 EMA both signal active bearish pressure.

XRP price is now retesting a critical demand zone between $3.00 and $3.14. While this region previously triggered strong bounces, the momentum this time is weaker. Candle bodies are small, and wicks are shallow, signaling indecision and fading volume.

Unless XRP closes above $3.30 with strength, the structure will remain bearish.

📈 Technical Indicators (Hourly Timeframe)

| Indicator | Value | Signal / Interpretation |

| MACD (12,26) | -0.022 | Bearish crossover, fading momentum |

| ADX (14) | 70.88 | Very strong trend, downside dominant |

| CCI (14) | -39.92 | Neutral, but leaning bearish |

| RSI (14) | 40.14 | Bearish, not oversold yet |

| ROC | -0.94 | Weak negative momentum |

| Bull/Bear Power (13) | -0.0261 | Bearish pressure confirmed |

Summary: Most key indicators show clear bearish bias. ADX signals a strong trend, while MACD, ROC, and RSI reflect continued downside risk. No bullish divergence has appeared yet.

Read Also: Optimism (OP) Price Prediction for August

🔮 XRP Price Prediction Scenarios

Bullish Scenario:

If XRP can reclaim $3.30 and break the trendline, a push toward $3.65 and $3.82 could follow. No confirmation of this setup yet.

Neutral Scenario:

If the $3.00–$3.14 zone holds, XRP price may continue ranging between $3.10 and $3.35 with low momentum.

Bearish Scenario:

If XRP drops and closes under $3.00, we may begin a quicker decline to $2.80, with the next more substantial support at close to $2.44, roughly around the 200-day moving average.

🧠 Wrapping Up

XRP price is testing an essential demand zone with weak momentum and no short-term bullish signals. The short-term trend still leans bearish, especially on the lower timeframes where sellers are clearly in control.

While the $3.00 to $3.14 zone is holding up as support for now, it won’t mean much unless bulls can push past $3.30. Until that happens, price is likely to keep chopping sideways or drifting lower.

The session is more likely to remain in a close range today between $3.12 and $3.38, and the break above or below this band requires confirmation for the next move.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.