The XRP price was mostly calm in the past few days following the news that SEC dropped their appeal against Ripple. Price quickly pumped from $2.30 to $2.50, but it was obvious based on on-chain data that this pump didn’t have legs as Ripple whales didn’t buy.

XRP price then cooled off around $2.40 and is now trading at this level. Let’s see where Ripple’s token could be headed this weekend.

First of all, let’s note that SEC didn’t officially close the case. They only dropped the appeal. However, based on pro-XRP lawyer insights, they don’t have many options from here and it’s hard to imagine anything huge will break this weekend.

🇺🇸 SEC still silent on the Ripple case? 🇺🇸

— John Squire (@TheCryptoSquire) March 21, 2025

The SEC hasn’t officially closed the Ripple case. Without an official statement, the uncertainty remains. Will they finally confirm what everyone’s been waiting for? 🤔

Drop a like if you’re ready for them to speak up! 👇🏽 pic.twitter.com/g15zcbmxsH

What you'll learn 👉

Technical Indicators Analysis

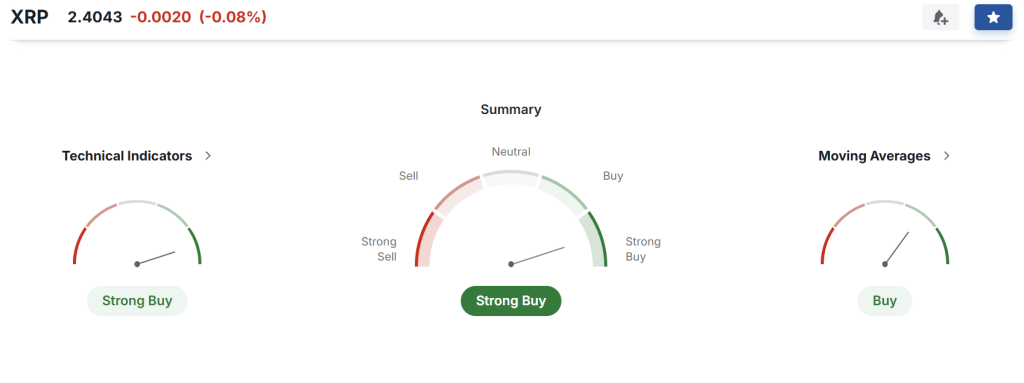

Technicals on a daily timeframe look like this:

RSI(14) is 50.344 – The Relative Strength Index is almost exactly at the middle point of 50, indicating that XRP is neither overbought nor oversold. This suggests a neutral momentum without strong pressure in either direction.

MACD(12,26) is -0.006 – The Moving Average Convergence Divergence is slightly below zero, showing minimal bearish momentum. The value is very close to zero, which suggests the bullish and bearish forces are nearly balanced.

CCI(14) is 62.8628 – The Commodity Channel Index is moderately positive but not in the overbought territory (which typically starts at +100). This indicates some positive price strength, though not extreme.

ATR(14) is 0.1649 – The Average True Range suggests moderate volatility in XRP’s price movements. This level of volatility is manageable and doesn’t indicate extreme price swings are likely.

Ultimate Oscillator is 51.047 – Similar to the RSI, this value is just slightly above the midpoint of 50, suggesting a balanced market with a slight bullish bias.

ROC is 3.196 – The Rate of Change is positive, indicating that XRP’s price has increased by about 3.2% over the measurement period. This shows modest positive momentum.

Read also: Can Ripple Really Overtake Ethereum? Analyst Weighs In on XRP Path to $100

Weekend XRP Price Predictions

Based on the technical indicators and current market situation, here’s what we might expect for XRP this weekend:

Base case scenario: XRP is likely to continue trading in the $2.35 to $2.45 range. The neutral RSI and near-zero MACD suggest a sideways movement rather than a strong directional move. The slightly positive indicators (CCI and ROC) may provide enough support to prevent significant drops.

Pessimistic scenario: If broader crypto market sentiment turns negative, the XRP price could test support around $2.25. Without strong whale buying interest, as mentioned earlier, there isn’t much to cushion a potential fall if selling pressure increases.

Optimistic scenario: If good news comes out or if the whole crypto market goes up, XRP might reach $2.50 again. If it can break through $2.50, it could possibly climb to $2.60. However, this would need more people to start buying XRP and trading volume to increase.

The moderate ATR suggests that extreme price movements are unlikely unless triggered by unexpected news or developments in the Ripple-SEC case.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.