The XRP price is trading in the $2.30 and $2.50 range for the past few days, and it’s now time to analyze the XRP chart and predict where the price could go from here. March is ending in a few days, and it was a bad quarter for most altcoins. However, XRP price actually had a pretty healthy correction and is one of the rare altcoins down less than 50% from its local high in January of around $3.30.

The lack of selling pressure on the XRP price in the last 2 months can be attributed to the XRP community anticipating the SEC dropping the case against Ripple.

What you'll learn 👉

Technical Analysis

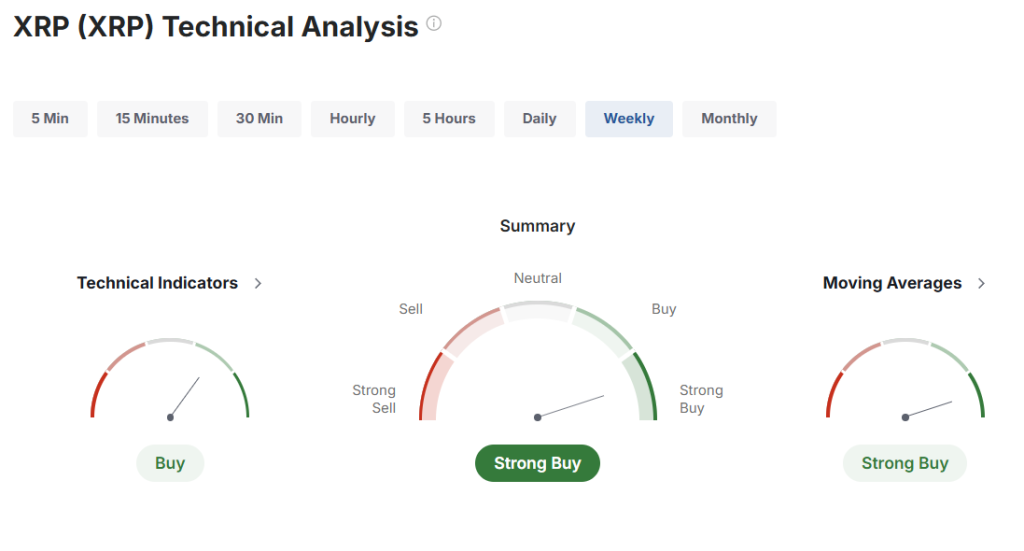

Let’s take a look at the key technical indicators for XRP on a weekly timeframe:

RSI(14) is 59: The Relative Strength Index (RSI) at 59 means it’s slightly more on the buying side, but still in a neutral zone — not overbought or oversold yet.

MACD(12,26) is 0.334: MACD helps spot trends and possible changes in price direction. A value of 0.334 means the short-term trend is a bit stronger than the long-term one, which can be a small bullish (positive) signal.

CCI(14) is -28.1247: The Commodity Channel Index (CCI) shows if the price is higher or lower than the average price over time. A value near 0 means the price is close to its average. -28 is still in the normal range, meaning there’s no strong signal to buy or sell.

Ultimate Oscillator is 54.064: This is another way to tell if something is overbought or oversold, using different timeframes. A value of 54 is pretty neutral, slightly leaning toward buying pressure, but nothing extreme.

ROC is 10.026: The Rate of Change (ROC) shows how much the price has changed over time. A value of 10 means the price has gone up around 10% compared to its past value — a sign of positive momentum.

Bull/Bear Power(13) is 0.1501: This measures the strength of buyers (bulls) versus sellers (bears). A positive number like 0.15 means bulls are slightly stronger right now, showing mild buying pressure.

XRP vs SEC Case Scenarios

Pro-XRP lawyer Jeremy Hogan outlined four possible scenarios for the XRP vs SEC case after the SEC deciding to drop the appeal:

- Ripple continues its appeal: This would lead to an appellate court ruling on critical questions, such as whether investment contracts require actual contracts. This scenario would require more time and is highly unlikely to result in any significant developments by the end of March.

- Ripple drops its appeal and returns to the trial court: In this scenario, jurisdiction would return to the trial court, and both parties would attempt to amend the existing judgment. Again, this would require more time and is unlikely to result in any notable news by the end of March.

- Ripple drops its appeal and reaches a separate agreement: The parties could enter into an agreement without trying to modify the judgment. This scenario could lead to faster resolution and potentially some big news by the end of March.

- Ripple simply pays the fine and moves on: Ripple could choose to pay the $125 million penalty and put the case behind them. This scenario could also result in faster resolution and potentially some big news by the end of March.

Read also: Crypto Expert Makes a Realistic XRP Price Prediction – Here’s What You Need to Know

XRP Price Prediction

Based on the current market conditions and the potential news in the XRP vs SEC case, here are some XRP price predictions for the next 7 days:

In a pessimistic scenario, if the XRP vs SEC case continues to drag on without any significant progress, the XRP price could remain in the $2.20 to $2.50 range, with the potential for a slight downward trend.

However, in an optimistic scenario, if Ripple and the SEC reach a separate agreement or Ripple decides to pay the fine and move on, the XRP price could see a positive surge, potentially reaching the $2.60 to $3.00 range by the end of March.

Overall, the XRP vs SEC case will continue to be a key factor in determining the XRP price movement in the near future. Another factor will be the broader crypto market of course and it does seem to be picking up a momentum in the past few days.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.