Ripple beefed up its custody offering with fresh staking and security integrations, essentially letting banks offer Ethereum and Solana staking without the headache of running their own validators. Meanwhile, Jump Trading reportedly struck deals to snap up minority stakes in prediction market giants Polymarket and Kalshi, a pretty clear signal that Wall Street liquidity is pouring into crypto-native platforms faster than most expected.

XRP price news today is confirmation of the token’s institutional momentum, even as XRP itself slid alongside a broader market sell-off. But if your XRP market developments are whetting an appetite for something with explosive upside, there’s a glowing, glinting alternative in the form of DeepSnitch AI.

This is an AI-powered scam detection and whale intelligence platform that has crossed $1.53 million raised at $0.03906, a 158% climb from its $0.01510 initial price. And DeepSnitch AI is approaching its final stretch before a potential 1000x launch, so now’s the critical moment to buy into the presale.

What you'll learn 👉

Ripple bolsters institutional custody while Jump Trading backs prediction markets with billions

Ripple’s latest upgrade plugs Securosys hardware security modules and Figment’s staking infrastructure into custody workflows, letting regulated institutions manage cryptographic keys and earn proof-of-stake rewards with compliance baked in. This follows Ripple’s corporate treasury platform and its RLUSD stablecoin crossing $1 billion in market cap.

And Jump Trading’s play for equity stakes in Polymarket and Kalshi underlines the broader trend, as Polymarket raised $2 billion from NYSE parent Intercontinental Exchange at a $9 billion valuation. Kalshi secured $1 billion at $11 billion, and industry estimates suggest the prediction market sector could generate trillions in annual volume by the end of the decade.

Institutional capital is validating crypto infrastructure at a serious scale, and the XRP price news is certainly reflecting that reality. Even as major assets sold off this week, with Bitcoin dropping out of the world’s top 10 assets by market cap and Ether treasury firms nursing billions in unrealized losses, the underlying infrastructure build hasn’t abated.

With this context, a presale like DeepSnitch AI, already live with AI tools and priced for massive upside, is exactly the type of project that could soar once it reaches the open market.

XRP price movement, DeepSnitch AI’s launch countdown, and Hyperliquid’s mid-cap ceiling

1. DeepSnitch AI: Raw data and clear decisions, all inside one system

Jump Trading is backing prediction markets because it sees an information advantage worth billions, while DeepSnitch AI is building a similar kind of advantage. Except, instead of predicting elections, it’s telling you whether a token is about to rug you.

Five AI snitches have been built by expert on-chain analysts to operate as a single system upon launch. The dashboard surfaces what’s trending and what’s causing alerts. Token Explorer provides deep dives with risk scores, holder data, and liquidity context. AuditSnitch scans contracts and returns a plain verdict: CLEAN, CAUTION, or SKETCHY, based on checks most people never perform, ownership control, liquidity locks, transfer restrictions, and known exploit signatures. And SnitchGPT translates everything into conversational language so the entire process feels like asking a knowledgeable friend rather than reading an audit report.

These are just a few of the tools that have already been shipped internally. And those early holders who have bought into the presale have access to them, so they’re getting a taste for the rare and powerful utility of DeepSnitch AI ahead of time.

The adoption potential here is powerful, not least because DeepSnitch AI reduces DYOR to a repeatable, step-by-step pre-buy habit, so it undoubtedly appeals to cautious investors and thrill-seeking degens alike. Higher adoption creates buying pressure, and buying pressure compounds the DSNT token price.

Staking is live with dynamic uncapped APR, so the more who buy in, the higher their gains will be. And though the token is still priced for presale, launch is essentially here, and that’s all likely to change once it arrives. DeepSnitch AI is a rare token, with 1000x potential after its platform goes live in early 2026, and for a short few days, it’s priced at $0.03906.

2. XRP: Ripple’s momentum is building, but the token has caught a downdraft

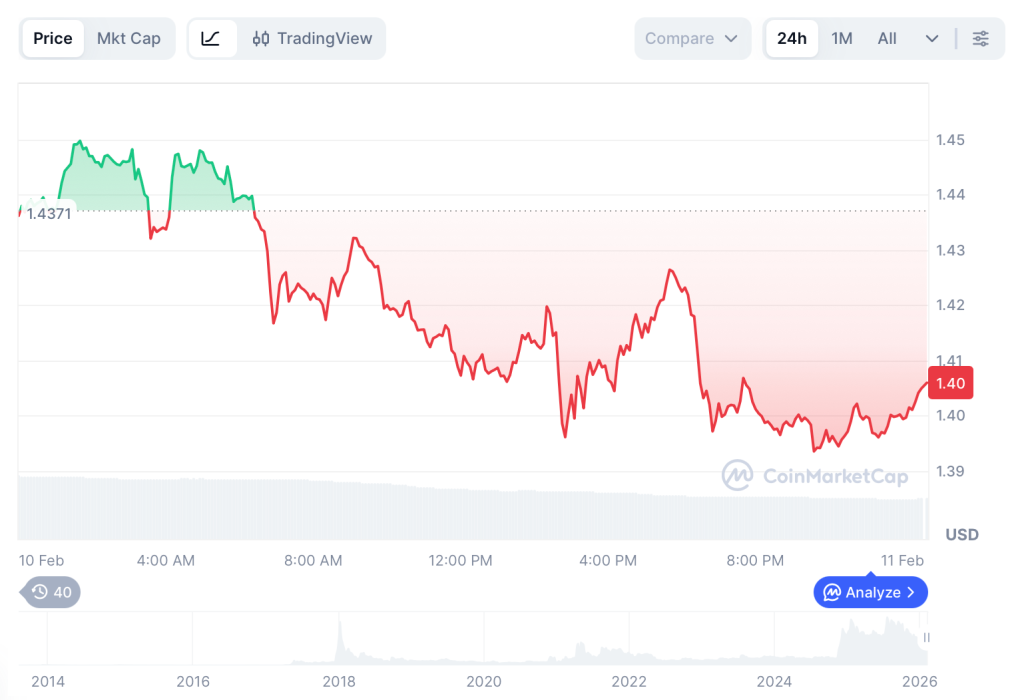

As Ripple updates keep coming, they’ve revealed that XRP has not been immune to the broader mood. On February 10, XRP was down about 2.6% to around $1.40, dragged lower by a market-wide sell-off fuelled by extreme fear sentiment.

Bitcoin’s decline pulled most majors with it, and XRP was no exception, despite the custody expansion providing a solid fundamental backdrop. If XRP holds above the $1.39 swing low, a bounce toward $1.43 looks plausible. But a break below risks a deeper slide toward $1.36.

Forecasts place XRP around $1.59 by year-end, roughly 10% from here. The XRP price news is one of strong infrastructure paired with modest return potential, which is precisely why a presale-priced token like DeepSnitch AI, offering 1000x potential with live tools and imminent launch, appeals to a totally different appetite.

3. Hyperliquid: Respected infrastructure, but with a lid on

On February 10, HYPE sat around $31.65, off roughly 2.4% amid the risk-off altcoin rotation. Canton Network’s Rooz highlighted HYPE’s 28% monthly surge as evidence that powerful business models get rewarded.

Year-end forecasts target above $62, as HYPE’s perpetual trading volume has earned it genuine credibility, and the project clearly has substance.

But at its multi-billion-dollar valuation, the kind of return that a presale-priced token like DeepSnitch AI can deliver isn’t plausible. HYPE is a good investment for incremental gains, not 1000x returns.

Last look

Even if the token itself is caught in macro crosswinds, XRP price news is optimistic enough for 2026. But for substantially higher gains, there’s a rare opportunity at the crossroads of AI, security, and retail empowerment in DeepSnitch AI.

With launch a hair’s breadth from going live, over $1.5 million raised, and Tier-1 listings on the horizon, it’s easily a pre-launch breakout in the making.

And right now, in addition to being priced for presale, DeepSnitch AI has bonus codes available to stack tokens at basement prices before it launches. While prospective returns are high to begin with, these codes have the potential to put them radically higher.

To apply the codes and buy into the presale, visit the official website. You can also stay up to date by following X and Telegram.

FAQs

What is driving the XRP price news in February 2026?

Ripple’s expanded custody platform with Securosys and Figment integrations, plus RLUSD’s $1 billion market cap, are the key Ripple updates powering positive XRP price news today, even as the token dipped alongside a broader sell-off. But for exponential upside alongside that stability, DeepSnitch AI offers a completely different tier of opportunity, with 1000x prospects for early 2026.

How does DeepSnitch AI fit into the market compared to the latest XRP market developments?

While Ripple headlines reinforce XRP’s institutional credibility, DeepSnitch AI targets a different gap, namely, AI-powered scam detection and whale tracking, while priced at $0.03906 with live tools, uncapped staking, and a launch date closing in fast.

Is XRP or Hyperliquid a stronger pick than DeepSnitch AI right now?

XRP projects roughly 10% gains and HYPE roughly 100% by year-end. Meanwhile, DeepSnitch AI offers asymmetric return potential that established tokens at their valuations don’t have in their toolkit without a catalyst of note coming in out of left field.

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.