Ripple and its native token XRP have been subjects of intense scrutiny and debate. The digital asset, often overshadowed by the likes of Bitcoin and Ethereum, is poised for a significant breakout according to analyst A Chain of Blocks who has over 113,000 subscribers on YouTube, and here’s why.

The Technicals: A Hidden Bullish Divergence

When examining XRP’s price action on a weekly timeframe, a hidden bullish divergence is evident. This divergence is characterized by the price creating higher lows while the oscillator forms lower lows. Such a pattern typically indicates a strong uptrend, and in the case of XRP, it suggests that the asset is far from reaching its peak.

A macro view of XRP’s price action hints at a potential surge of around 2,000%, propelling the asset to the $15 milestone. However, adopting a similar perspective to its previous cycle could see XRP ascending to approximately $150. This projection is further supported by XRP’s on-chain activity, which has spiked to a seven-month high, with adjusted volume growing by 112.57%.

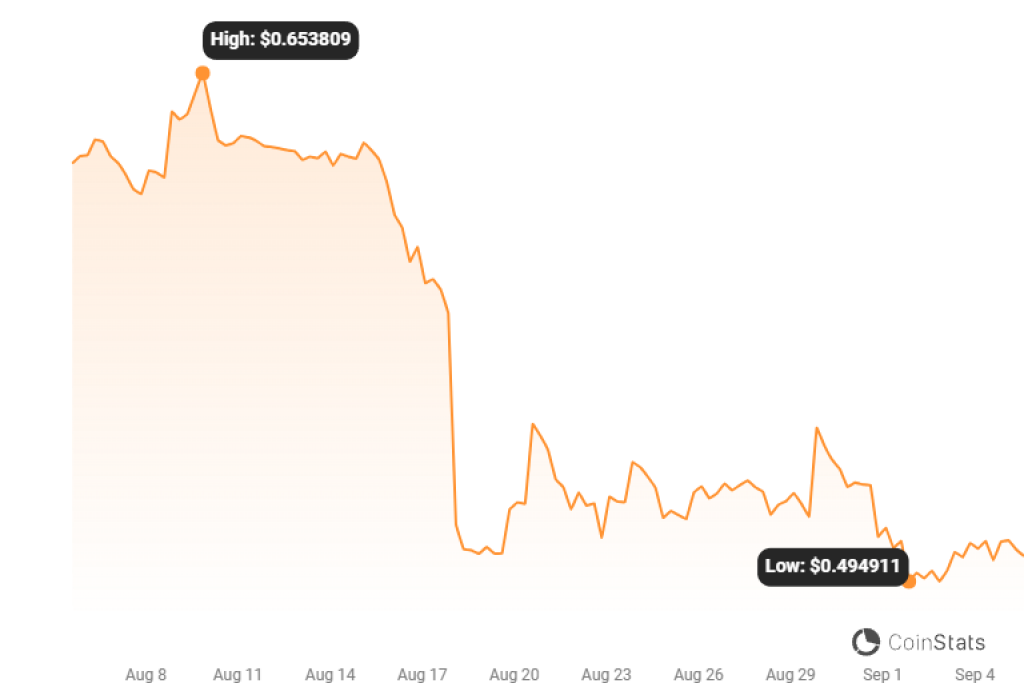

Source: CoinStats – Start using it today

The ongoing legal battle between Ripple and the U.S. Securities and Exchange Commission (SEC) has been a significant overhang on XRP’s price. Recent developments indicate that Ripple has filed a motion to oppose the SEC’s appeal over a landmark ruling. The only way a settlement could occur before the end of 2023 is if certain conditions are met, potentially forcing the SEC to pivot its stance.

Recent reports indicate that China, along with new BRICS member Saudi Arabia, has reduced its holdings in U.S. treasuries. This global reallocation of wealth could have implications for the cryptocurrency market, including XRP. Additionally, China has clarified that virtual currency is still legal property and protected by law, providing a more favorable environment for digital assets like XRP.

Ripple has announced a community celebration event on September 29th in New York City, fueling speculation about potential big announcements. While there may not be any immediate revelations regarding the SEC case or an IPO, the event is a testament to Ripple’s commitment to its community and could serve as a catalyst for XRP’s price action.

As we move into 2024 and approach the next Bitcoin halving, the fundamentals for XRP appear stronger than ever. Despite the regulatory hurdles and market volatility, the asset’s technicals and on-chain metrics provide a compelling case for its future growth.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.