Ripple’s XRP has been one of the most volatile cryptos in recent weeks, with plenty of ups and downs to keep traders and holders on their toes. Currently trading above $2.32, XRP is -9.9% from the previous week’s standing, but still up 11% on a month-to-month basis. With trading volume slipping to $3.3 billion as of May 20th market close and with declining network activity, the market’s already buzzing: can the XRP price still target $5 this autumn?

While this is possible, XRP looks at a tough road ahead. To achieve this price target, it must double its current price, at $2.35 as of May 21st, coupled with some strong catalysts. As XRP’s price remains on shaky ground, could other cryptos return bigger potential ROIs in a shorter time?

What you'll learn 👉

XRP Price- Near-Term Price Predictions According to Analysts

XRP’s volume has dropped to $2.6 billion

XRP was one of the best-performing cryptos in 2024, with its price surging from a steady $0.50 to $1, then breaking $3.30 at the height of the US elections frenzy. Today, XRP price is trading between $2.32 and $2.38, with analysts cautious on the asset’s price movement in the near term. There are projections for XRP’s price to hit $3, depending on sustained institutional interest and favorable regulatory conditions.

Polymarket lists an 83% chance that XRP ETFs will be passed this year

There are bullish forecasters on social media, picking the $4 to $5 range as XRP price targets, assuming macroeconomic developments and Ripple-related news. Interestingly, there’s one catalyst that can trigger another XRP price movement: SEC’s approval of the spot ETFs for XRP. As of this writing, there’s an 83% chance that ETFs for XRP will be passed before the end of 2025, which can boost institutional adoption and liquidity.

XRP Price Still Faces Rough Road Ahead

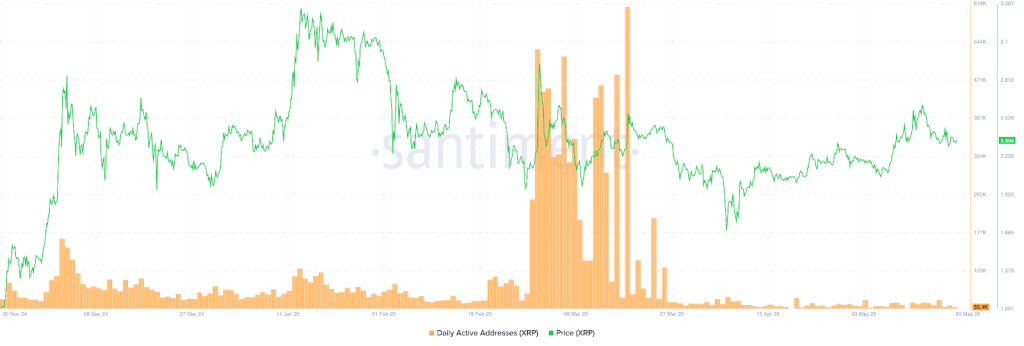

On-chain data also reveals some gloomy news for XRP traders and holders, which may impact price action. As XRP’s price consolidates above its short-term $2.28 support, network activity has been dipping in recent weeks.

According to Santiment, the protocol’s number of newly created addresses is estimated at 33,400, reflecting a huge 95% drop from its 1Q peak of about 612,000 addresses. With a huge drop in users, XRP is seeing a declining interest in the protocol. Also, based on the Supply Distribution metric, holders with 100k to 1 million XRP tokens have been downsizing.

Currently, whales account for 10.32% of XRP’s total supply, down from 10.76% last March 1st, and 11% from November 1st, 2024.

Remittix- Ready to Flip the PayFi Script and Bring Bigger ROI

Since its launch, Remittix has been dubbed the ‘XRP 2.0’ by some commentators and analysts. While both crypto projects are in the cross-border payment scene, Remittix’s roadmap is better and arguably more revolutionary—crypto-to-fiat settlements with zero FX charges, no hidden fees, with same-day processing.

Its Pay API is built on Ethereum, featuring a user-centric design similar to popular fintech apps. Users can enjoy the convenience of fiat while counting on the transparency and security assured by integrating blockchain technology. Its streamlined payments technology means recipients don’t need to understand crypto to receive transfers, opening the door for mass adoption in short order.

At the heart of Remittix is its ERC-20 token, the RTX, which is currently on presale. RTX is currently priced at $0.0781 with an increase to $0.0811 rapidly approaching. With almost $15.2 million raised already and more growth ahead for the presale pool, now is the perfect time to get into Remittix and join the PayFi revolution.

Learn more about Remittix and other presale information here:

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.