JasmyCoin (JASMY) and Ripple (XRP) have continued to expand their ecosystems year after year. Development has not slowed, partnerships have grown, and infrastructure has matured across payments and data management.

Yet token prices have not delivered the explosive reactions many expected, especially in the case of JASMY. That gap between progress and price now raises a bigger question about 2026.

Ripple secured regulatory clarity in early 2025 after resolving its long-running SEC case. XRP was confirmed as not a security in public exchange sales. That milestone removed a major obstacle that had limited institutional participation. Confidence improved.

RippleNet now connects more than 300 banks and financial institutions. Around 40% use On Demand Liquidity powered by XRP. The network processes volumes near $30B across over 70 markets as payment corridors expand.

XRP Infrastructure And Institutional Adoption Continue To Expand

XRP operates at the center of RippleNet’s cross-border payment system. Institutions use the infrastructure daily. Settlement flows move through established corridors rather than pilot programs.

Acquisitions such as the $1.25B purchase of Hidden Road strengthened Ripple’s prime brokerage capabilities. Partnerships in global payments continue to deepen.

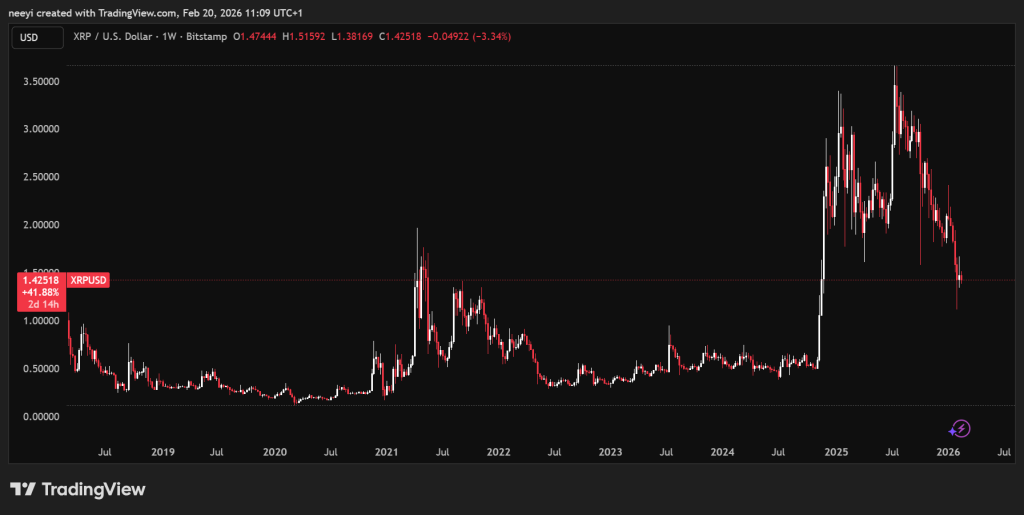

Current XRP price levels resemble zones seen before previous strong cycles. The difference now lies in maturity. Regulatory clarity exists. Institutional rails operate.

Payment volumes grow steadily. That foundation creates a scenario where valuation discussions may evolve if usage continues to expand into 2026.

JasmyCoin Advances Data Sovereignty And IoT Integration In Japan

JasmyCoin focuses on personal data sovereignty within Japan and across Asia. The project integrates its Personal Data Locker into Japan’s national digital identity framework through the JPKI system.

Governments and corporations can use secure user-controlled data storage built on blockchain infrastructure.

IoT integration progresses through edge computing, IPFS storage, and Smart Guardian security layers. Partnerships with Panasonic, Transcosmos, and VAIO support decentralized data exchange across connected devices.

JasmyCoin also works with Chainlink CCIP to enable cross-chain functionality. Community presence in Asia strengthens through sponsorship initiatives such as the Sagan Tosu football club.

JASMY price has not mirrored the steady rollout of these integrations. Product development has continued without excessive promotional cycles. That contrast between real-world implementation and muted price action fuels the undervaluation narrative.

Read Also: HBAR Is Not a Normal Crypto? Why an Analyst Calls Hedera “Alien Technology”

Both XRP and JASMY show expanding adoption metrics that extend beyond speculative narratives. XRP benefits from regulatory certainty and measurable payment volumes. JASMY embeds itself into digital identity systems and IoT networks in one of the world’s most advanced technology markets.

Token prices often lag infrastructure growth. Market cycles tend to recognize value after operational capacity matures. If cross-border volumes continue to scale and data sovereignty adoption deepens, 2026 could represent a year where price begins to align more closely with utility.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.