XRP’s recent endorsement by the World Bank has sent shockwaves across the financial world, reigniting confidence in blockchain-based payment systems. The acknowledgement cements XRP’s growing relevance in cross-border settlements — a goal Ripple has championed for years. Yet, while the spotlight shines brightly on XRP’s global recognition, seasoned Ripple whales appear to be looking elsewhere.

Their attention has shifted toward a $0.015 crypto token that’s drawing comparisons to early-stage XRP, not as a rival remittance model, but as an unconventional liquidity model. This emerging project, Paydax Protocol (PDP), is gaining traction for its architecture that blends DeFi accessibility with real-world asset backing, presenting a new frontier for investors seeking growth beyond established giants like XRP.

What you'll learn 👉

World Bank Endorses XRP, But Ripple Whales Pivot

For years, XRP has been the poster crypto token for regulatory battles and institutional hesitation. But 2025 marks a turning point for XRP and Ripple whales. The World Bank’s latest acknowledgement of XRP as a viable cross-border settlement solution has propelled the token back into the global spotlight.

Analysts see this as a major win for Ripple Labs, validating its long-term goal of digitizing international remittances and transforming legacy payment rails. Yet, beneath the surface of this triumph, something unexpected is unfolding. Ripple’s largest holders — aptly called Ripple whales — are diversifying into a low-cap crypto token that’s been steadily rising in visibility: Paydax (PDP).

Trading at just $0.015, PDP is building what XRP hasn’t — a fully decentralized liquidity network that integrates real-world assets into on-chain finance. This new model allows users to borrow, stake, and trade tokens backed by tangible assets without relying on traditional intermediaries. Despite the World Bank’s nod at XRP, Ripple whales are betting that Paydax’s hybrid DeFi model could represent the next leap in blockchain utility and yield.

Beyond Cross-Border Payments — Paydax (PDP) Outperforms With Real Yield Potential

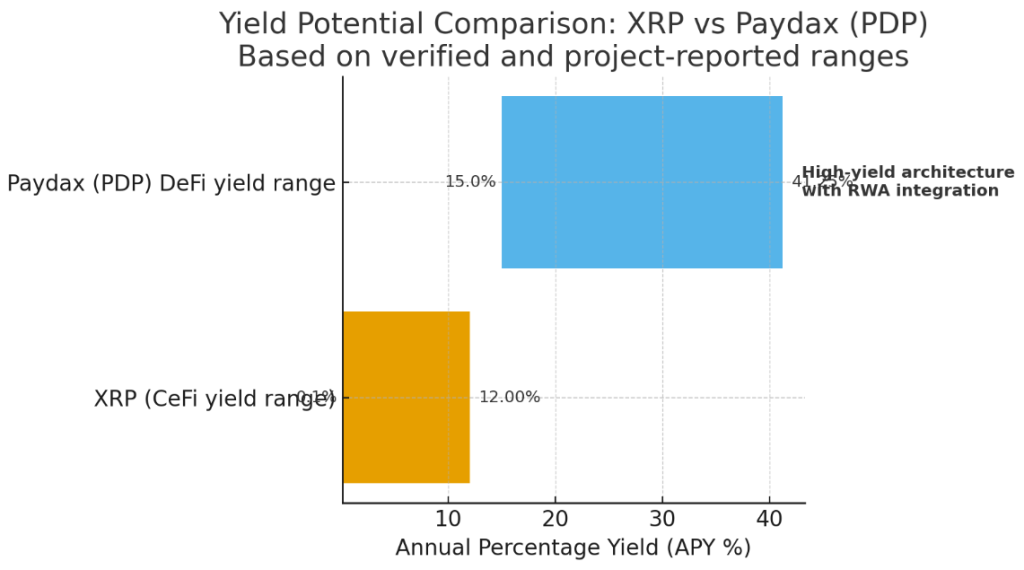

While XRP’s validation by the World Bank cements its credibility in global finance, its returns remain limited by design: focused on transaction efficiency rather than investor yield. In contrast, Paydax offers investors active earning potential through its integrated DeFi architecture. With staking rewards reaching up to 20% APY, PDP transforms idle holdings into income-generating assets.

Source: Paydax Protocol

This crypto token’s liquidity model allows users to borrow against both digital and real-world assets — from Bitcoin (BTC) and Ethereum (ETH) to tokenized gold and collectibles — without forced liquidation. This creates a circular economy where value compounds rather than stalls. For Ripple whales accustomed to waiting for market cycles to take profit, PDP’s system provides consistent ROI through staking, lending, and governance rewards.

In short, while XRP powers cross-border payments, PDP powers personal growth by delivering utility and yield in equal measure. It’s this combination of decentralized flexibility and real-world backing that’s driving Ripple whales to smartly accumulate Paydax before its next price stage.

XRP’s Maturity Meets Its Match As Paydax (PDP) Redefines The Upside Curve

XRP’s trajectory remains promising. The World Bank’s acknowledgement solidifies Ripple’s long-term role in global settlements and institutional finance. However, while Ripple’s stability anchors its strength, that same maturity limits its upside. The real opportunity for exponential growth appears to be unfolding in an alternative crypto token in PDP.

PDP’s low entry price of $0.015 and wisely capped token supply create ideal conditions for early-stage expansion. Meanwhile, high-yield farming opportunities on the Paydax platform deliver returns of up to 41.25% APY for advanced users, amplifying its allure for Ripple whales reallocating from stagnant XRP holdings.

Behind this crypto token stands institutional-grade validation: Chainlink for pricing accuracy, Brinks for custody, Sotheby’s for asset authentication, Onfido for compliance, and Assure DeFi for smart contract audit — combining credibility with cutting-edge innovation.

Source: Paydax Protocol

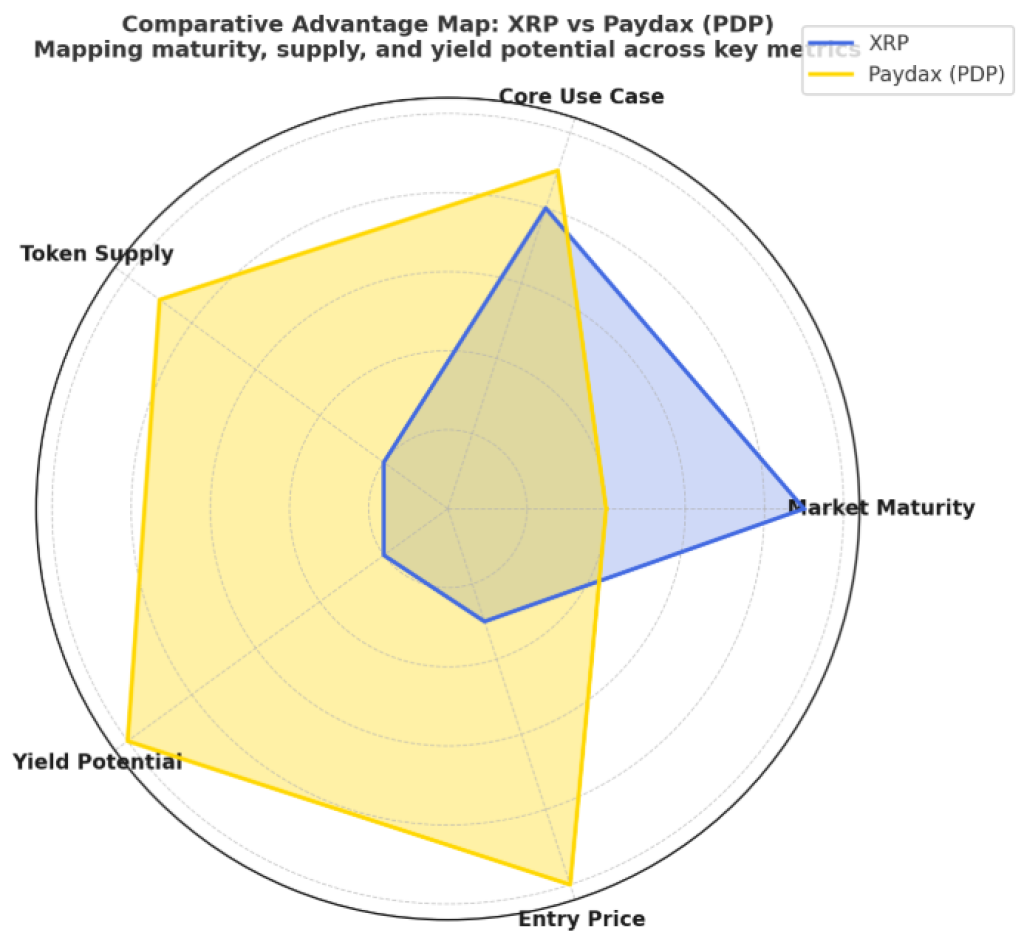

| METRIC | XRP | Paydax (PDP) |

| Market Maturity | Established and regulated | Early-stage, explosive growth potential |

| Core Use Case | Cross-border payments | Decentralized lending protocol |

| Token Supply | High (over 100B) | Low, deflationary design |

| Yield Potential | Minimal returns | Between 15.2 % to 41.25% APY through DeFi and staking |

| Entry Price | High | $0.015; prime for early accumulation |

In summary, Paydax (PDP) is a compelling opportunity while XRP pursues institutional validation. And for investors who move early, that difference could define the next cycle of crypto wealth.

Ripple Whales Are Already Moving Into New Crypto Token

As XRP basks in global approval, the next big move is already underway, and it’s happening fast. Rather than wait for validation, Paydax is creating it. Its PDP presale is selling out in record time, and with the crypto token still priced at just $0.015, early participants are locking in positions before the next price jump.

With Ripple whales already shifting from XRP into PDP, the question isn’t if this new crypto token will explode — it’s who will be in before it does. In addition, users can enjoy a PD25BONUS promo code to claim a 25% presale bonus before the opportunity closes.

Join The Paydax Protocol (PDP) presale and community:

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.