Remittix (RTX) has elbowed its way into every serious market conversation this year. The PayFi start-up has already moved 541 million tokens at $0.0781 apiece, raising $15.5 million toward an $18 million soft-cap. A slick RTX Wallet demo— slated for a public launch in Q3— promises crypto-to-fiat settlement in about 24 hours, and a limited‐time 50 % presale bonus doubles early allocations. With that backdrop, let’s see how RTX stacks up against two blue-chip peers chasing fresh highs in Q3.

What you'll learn 👉

XRP & Cardano: Springboards For Q3 Highs

Analysts tracking XRP note that the token sits near $2.61 and could tag $3.00 before June ends if RippleNet’s banking pipeline keeps expanding, according to a market brief at BraveNewCoin. Longer charts even place XRP in a $3.50–$5.00 channel for late 2025 once an ETF ruling lands. Cardano walks the same bullish path: a Chang hard-fork upgrade and Hydra scaling have traders eyeing $0.90–$1.20 by December, says the outlook in Changelly’s forecast hub.

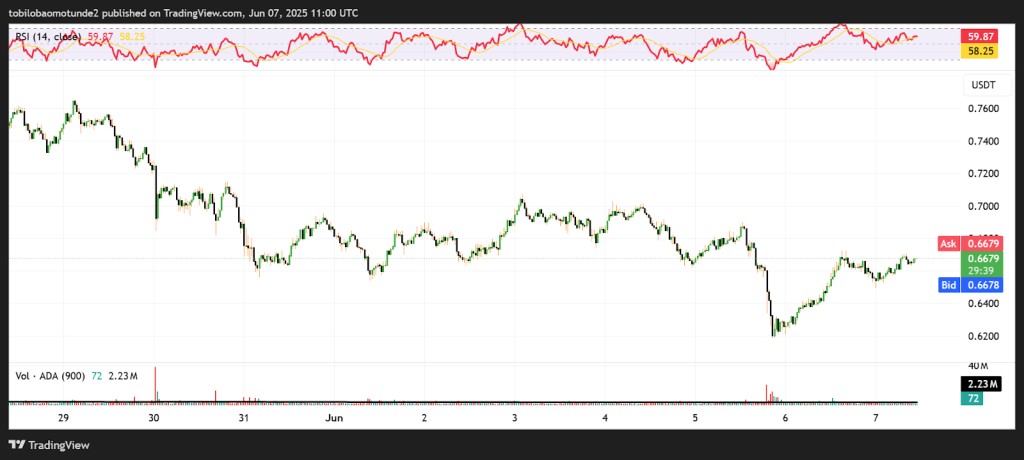

Source: TradingView

Volume, though, is the wedge issue. The Bitpanda Academy’s fresh take shows ADA trading volume still lagging price— a classic sign of weak follow-through. Even so, a cross-market note on TheCryptoBasic argues that whales continue to shuttle capital between XRP and ADA, prepping for a momentum burst once Bitcoin steadies above $75 k.

Remittix: Aiming For 10,000 % By 2026

While XRP and ADA chase incremental highs, RTX plays the moon-shot card. The presale flyer compares Remittix’s PayFi rails to Ripple’s early vision— but without looming legal baggage— and projects a headline 10,000 % upside by 2026. That leap depends on two milestones: landing payroll integrations for Latin-American gig workers and clearing the Q3 wallet launch without security hiccups.

A comparative study on Bitget News even flags RTX as the leaner rival investors missed during Ripple’s infancy. Early case studies back the claim. A Brazilian design agency recently settled €5,000 in under a day, bypassing SWIFT fees that once ate 7 % of its invoice. Meanwhile, a Spanish coffee-roaster rolled pilot payouts to Colombian farmers, each receiving pesos in a linked bank account within 30 hours.

Those stories underline why speculators treat RTX’s 50 % bonus as a once-only ticket— the effective entry cost drops to about $0.052, a price floor many see evaporating once the soft-cap locks.

Risk Map: What Could Go Wrong?

Macro conditions still drive every chart. Should the SEC delay an XRP ETF past June, sentiment could sour quickly— a scenario laid out in CoinDCX’s weekly brief. Cardano’s upside also hinges on developer traction; if TVL stagnates, the bullish track mapped by CryptoTimes AI models. RTX, for its part, lives or dies on execution: a smart-contract bug or banking push-back could sink the 10 k % dream overnight.

Still, history shows that first-mover payment tokens can five-bag in a single season. TokenMetrics’ 2025 ADA roadmap insight reminds us that outsized gains reward early conviction— but only when fundamentals prove out. RTX must therefore convert presale hype into seamless fiat ramps before copy-cats appear

Conclusion – Picking A Lane For Q3 And Beyond

XRP holds the regulatory catalyst; ADA owns the upgrade play; RTX flaunts raw asymmetry. If whales keep hoarding XRP and a favorable ETF headline drops, $3.50 could turn conservative. Cardano’s steady release cycle could nudge it past $1 once volume catches up, offering a lower-beta ride. Yet for traders willing to stomach start-up risk, RTX’s discounted tokens and pending wallet launch paint a very different risk-reward curve.

Calendar reality is clear: the 50 % bonus closes when the $18 million soft-cap hits or Q3 dawns— whichever comes first. Decide whether you prefer the regulated climb of XRP, the tech-driven grind of ADA, or the high-gear sprint of Remittix. Whichever lane you choose, make the move before Q3 narrative engines roar and leave passive spectators chasing distant tail-lights.

Join the Remittix (RTX) presale and community:

Join the Remittix (RTX) Community

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.