XRP has shifted back into focus after reclaiming key technical levels and showing renewed strength across momentum indicators. The latest breakout above the $2.30 macro resistance has flipped short-term structure bullish, and analysts now point to a potential continuation move if current support holds.

One of the clearer breakdowns comes from Tara, who shared a detailed 4-hour XRP chart outlining an impulsive wave structure now firmly in play.

What you'll learn 👉

Tara’s XRP Chart Shows a Clean Impulse in Progress

As per Tara’s analysis, the XRP price has completed a strong Wave 3 extension, pushing beyond the 2.618 Fibonacci level and decisively clearing the long-watched $2.30 resistance. This move did not occur in isolation. It was supported by expanding volume and a sharp acceleration in price, which typically confirms impulsive price behavior rather than a simple relief bounce.

On her chart, the breakout places XRP above the macro 0.236 Fibonacci retracement, a level that often acts as a dividing line between continuation and failure. As long as price remains above this zone, the broader bullish structure stays intact.

Tara highlights $2.49 as the next upside reference, aligning with a 0.618 extension for a potential fifth wave. However, she also flags the likelihood of a short-term pullback before that move fully develops.

XRP Indicators: RSI Signals Strength, But Cooling Is Healthy

Momentum indicators add context to the price action. XRP’s Relative Strength Index has pushed into elevated territory following the breakout, reflecting strong buying pressure. Historically, XRP tends to pause or retrace slightly after RSI spikes at this pace.

That does not invalidate the trend. Instead, Tara notes that a brief RSI cooldown would allow the next push higher to form with better structure. In other words, consolidation above support would strengthen the case for continuation rather than weaken it.

Short-term supports, marked in green on her chart, become critical here. Holding those levels would keep the impulsive count intact and support the idea that the market is preparing for another leg higher rather than rolling over.

Read also: Ripple Just Confirmed the XRPL 2026 Roadmap—and It’s Stacked

Futures Market Activity Adds Confirmation

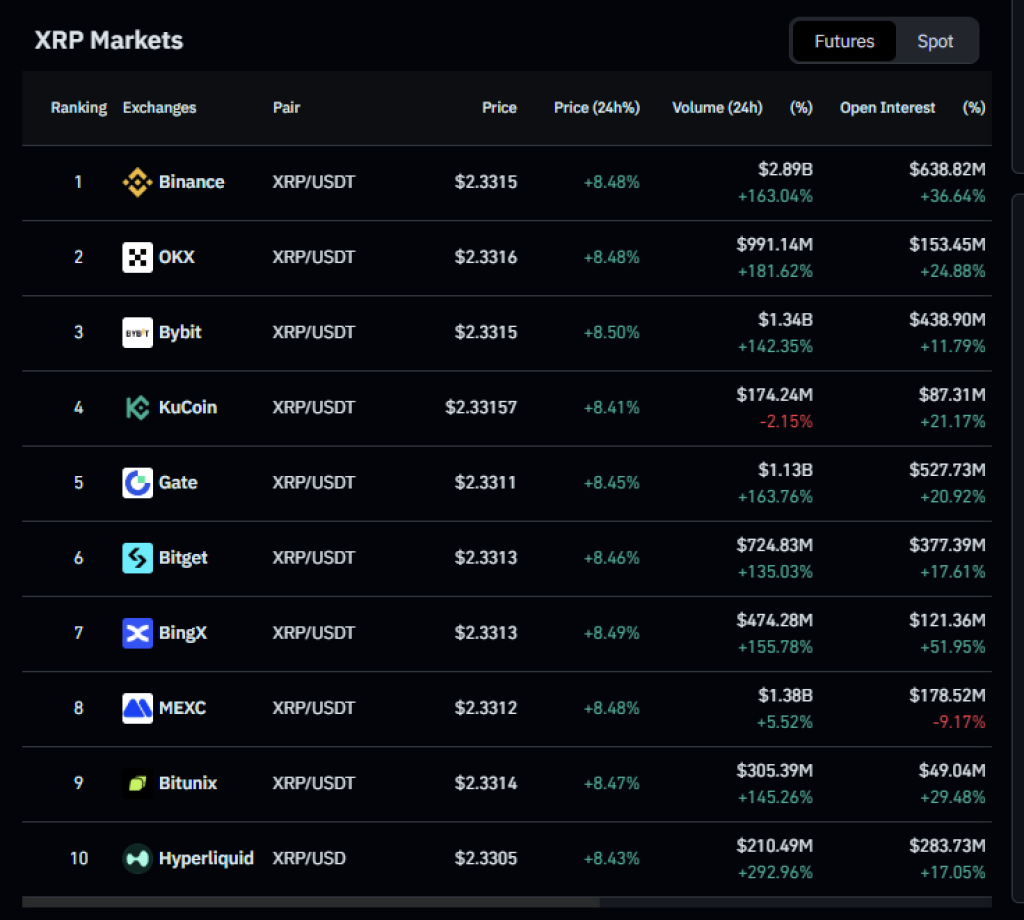

Beyond spot price action, derivatives data adds another layer to the picture. XRP futures open interest has risen 21%, reaching roughly $4.65 billion according to CoinGlass. This rebound follows a period of reduced exposure during December’s risk-off environment.

At the same time, perpetual funding rates sit near 0.0081%, which remains neutral. This balance matters. Rising open interest alongside neutral funding suggests traders are rebuilding positions without excessive leverage. In past cycles, XRP tops often formed when funding rates became aggressively positive, signaling overcrowded long trades. That condition is not present yet.

In the current setup, futures data supports the bullish trend without flashing the typical overheating warnings.

Short-Term Outlook for XRP Price

The main takeaway is that the XRP price is no longer reacting defensively. The reclaim of $2.30 shifts market psychology, and both technical structure and derivatives data point to sustained interest rather than a one-day spike.

A controlled pullback would not be a failure scenario. Instead, it would likely serve as a base for the next advance, provided price remains above the key Fibonacci supports Tara outlined. If that structure holds, the $2.49 zone becomes a realistic near-term objective.

For now, XRP bulls appear to have regained control. The next phase will be defined not by how fast price moves, but by how well it holds its newly reclaimed levels.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.