While the Bitcoin price, Ethereum price, and Solana price all declined in Q1 2025, the XRP price quietly moved in the opposite direction. According to the team at Messari, a web3 intelligence platform, XRP’s market capitalization increased by 2% over the quarter, while the combined market cap of BTC, ETH, and SOL plunged by 22%. This makes Ripple one of the few large-cap assets to post positive growth during the period.

The XRP price itself ticked up just 0.5%, but a small boost in circulating supply helped push market cap gains higher. More impressively, XRP’s fundamentals also strengthened.

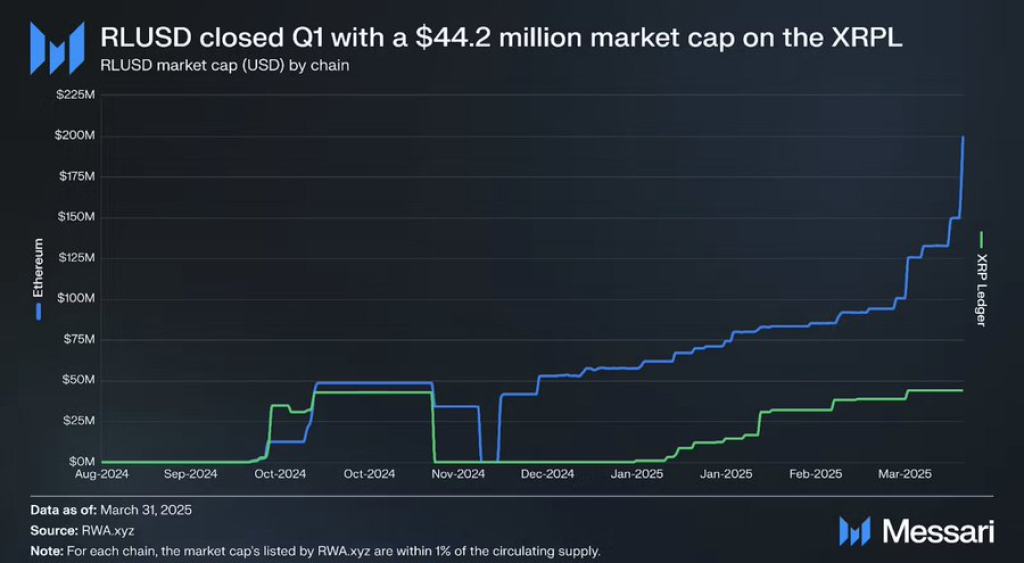

Ripple’s stablecoin, RLUSD, ended the quarter with a market cap of $44.2 million on the XRP Ledger, cementing its role as the network’s leading stable asset. This came after Ripple acquired Hidden Road, a global prime broker that plans to migrate its operations to XRPL and use RLUSD for collateral. That move alone signaled deep institutional interest in building on Ripple infrastructure.

Messari data also shows that the XRPL network itself is becoming more active. Daily active addresses surged 142% quarter-on-quarter, while average daily CLOB (central limit order book) volume jumped 74% to reach $13.7 million. These figures suggest the Ripple price isn’t just climbing on sentiment, but on real usage and expanding utility.

What you'll learn 👉

XRP Ledger Growth Points to Real Adoption

The growth in Ripple’s network activity is more than just noise. Messari notes that this is the first time since they began tracking the XRP Ledger in 2023 that all network metrics increased for two consecutive quarters. In Q1 2025, the XRPL averaged more than 2 million transactions per day. Payment transactions rose 36%, and active recipient wallets once again outnumbered senders, a sign of growing airdrop activity and broader token distribution.

Notably, the XRP Ledger is making serious moves toward programmability. On March 31, the long-awaited XRPL EVM Sidechain went live on testnet, opening the door to Ethereum-compatible apps and tools. Meanwhile, Ripple is preparing to launch native smart contracts on XRPL through a feature called Extensions, which lets developers attach logic to existing objects like escrows and tokens without needing full smart contract layers. This marks a turning point, as Ripple balances its minimalist design with new programmability to compete with Ethereum and Solana.

Ripple’s push toward DeFi compliance also continued. Several amendments were proposed or passed to bring features like decentralized identity, credential gating, and KYC-based domain permissions to XRPL. The aim is to let institutions build or access compliant DeFi protocols without leaving the XRP Ledger. These features will likely attract traditional finance players looking for safer ways to experiment with tokenization, lending, and automated markets.

Ripple and XRP Position for an Institutional Future

In April, Ripple announced it had acquired Hidden Road, a global multi-asset prime broker. This isn’t just a branding play. Hidden Road will shift its post-trade operations to the XRP Ledger and will use RLUSD, Ripple’s dollar-backed stablecoin, as collateral. This is the first time a crypto firm has directly taken over a prime brokerage infrastructure, and it underscores how Ripple is targeting institutional-scale adoption.

RLUSD itself is gaining traction. In Q1, the stablecoin saw a 304% jump in market cap on XRPL, becoming the network’s largest. Exchanges like Kraken, Bitstamp, and MoonPay have now integrated it, and it’s also being used for yield strategies, payment rails, and as a base asset in AMM pools on the native DEX.

Read Also: How Much Will 2,000 Kaspa Tokens Be Worth in 2026? KAS Price Prediction

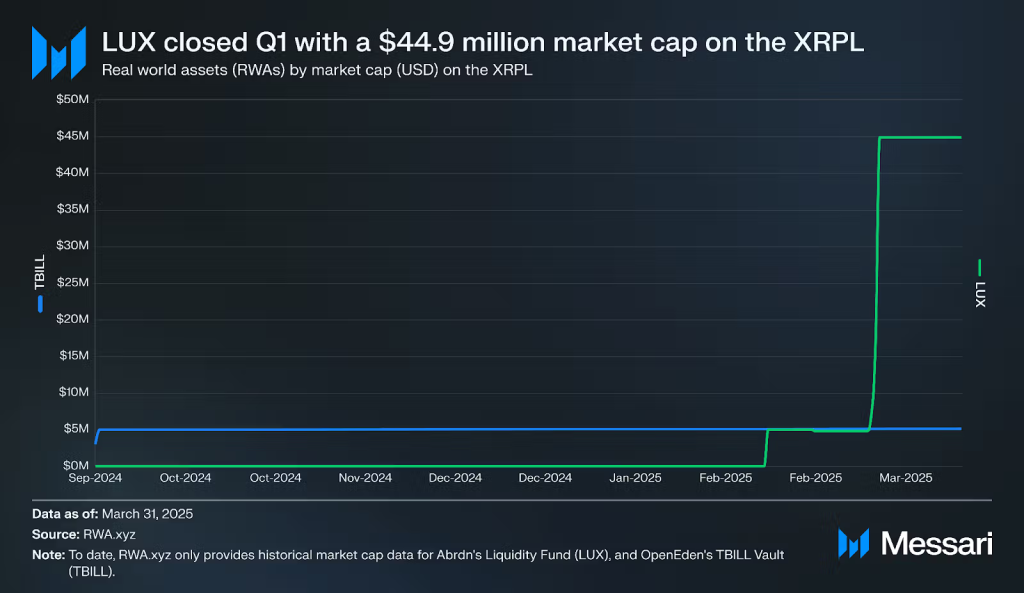

From wrapped real-world assets like U.S. Treasury bills and gold to NFTs and sidechains, Ripple is pushing every piece of the ecosystem forward. The XRP price might not have surged in Q1, but the foundation is clearly being laid for something bigger. With smart contracts on the horizon, institutional rails in place, and metrics climbing across the board, XRP continues to separate itself from the rest of the crypto field.

As Messari put it in their closing summary, Ripple didn’t just grow last quarter, it outperformed while the rest of the market shrank. That might explain why analysts are keeping a close eye on the next phase of XRP’s story.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.