XRP has been trading in a clear downtrend since it hit its all-time high in July, dropping over 40% since that peak. EGRAG CRYPTO, a crypto analyst on X, points out that the real story lies in the RSI, a rarely discussed indicator that has historically predicted major shifts for XRP.

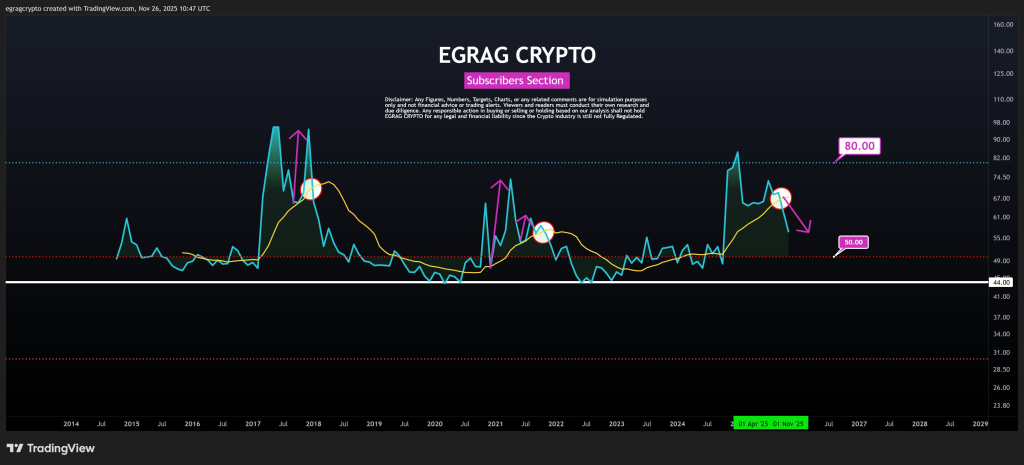

The chart shows XRP’s monthly RSI over the years. According to EGRAG CRYPTO, XRP price has only touched the 80 level twice before in its history.

The first time was in 2017, which marked a strong bearish cross and preceded a full bear market once RSI fell below 50. Now in 2025, XRP token has hit that 80 zone again. A bearish cross is forming on the chart, signaling that XRP could be entering another critical phase.

EGRAG CRYPTO notes that while the RSI is high, it is still above 50. This means XRP is not yet in a confirmed macro bear market. The current stage looks more like a late-stage bull distribution phase. Traders should be aware that a final macro leg up remains possible until the RSI closes below 50.

XRP Price Behavior and Risk Assessment

The chart also illustrates how Ripple price has reacted historically when the RSI reached extreme levels. Each peak near 80 has been followed by a distribution phase and eventual downward pressure once momentum faded.

XRP token’s current dip of over 40% aligns with this pattern, suggesting that market participants may be in a careful holding period while the network absorbs selling pressure.

EGRAG CRYPTO emphasizes that a confirmed bear market would only occur if XRP’s monthly RSI breaks below 50 and remains there. Until this threshold is crossed, traders may still see opportunities for a final push higher. The chart suggests a 60% probability that XRP remains in the late-stage bull distribution, while there is a 40% chance the macro bear market has already started.

Reading the Market Beyond Price Alone

XRP token’s movements remind us that price charts are only part of the picture. Indicators like RSI provide context for potential shifts in market phases. Monitoring Ripple price alongside these signals can give a more complete view of market dynamics.

Read Also: Crypto Market Rebound? Wallet Data Says ADA and XRP Are Still Bleeding

Watching how the distribution phase unfolds over the next few months will be key. Traders who understand the interplay between RSI and price could gain insight into whether XRP is preparing for one last rally or the start of a confirmed bear market.

The door for a final macro leg up remains open, but careful observation is needed. Historical behavior and current chart patterns suggest that the coming months could define XRP next big move.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.