Bitcoin’s 3rd halving is almost here. On Thursday, Bitcoin rallied a jaw-dropping 10% in 20 minutes, surging higher from $7,050 to $7,800 within a short period.

In the Bitcoin history, block reward halving seems to be a bullish event. At the first halving in November, 2012, Bitcoin price rallied from a bottom price of $2.01 to the top of $270.94 with an increasing rate of over 13,000% during approximately 513 days. While after the second halving in 2016, BTC price went up to $2,500 with 288.6% increase and reached the all-time high of $19,783 in late 2017, a year after the halving.

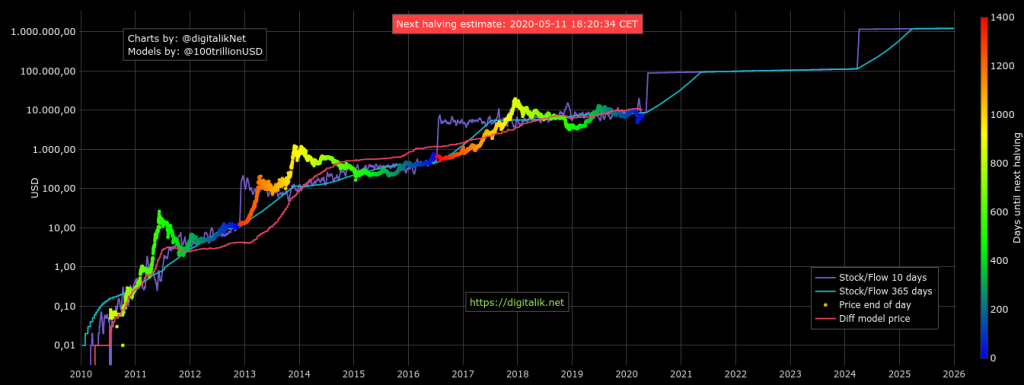

It’s uncertain if it will repeat its history. However, the Stock-to-Flow model indicates that bitcoin will moon to $30K after this halving.

Introduction on Bitcoin Stock-to-Flow Model

In simple terms, the Stock to Flow (SF or S2F) model is a way to measure the abundance of a particular resource. The Stock to Flow ratio is the amount of a resource held in reserves divided by the amount it is produced annually.

Due to Bitcoin’s limit supply and scarcity feature, Stock-to-flow can be also applied in bitcoin. It measures the issuance of new Bitcoins each block against Bitcoin’s existing supply, which has proven highly accurate in charting price performance.

SF = Stock (Bitcoins already in circulation) / Flow (new Bitcoins entering circulation).

How will Bitcoin Halving Affect Bitcoin Price?

Bitcoin’s current stock is 16.8 million, while the supply of new Bitcoins, or the flow, is 0.7 million a year. This puts bitcoin’s SF ratio at 24. Given that the flow of Bitcoins is fixed, and it halves roughly every four years, with the next halving event, Bitcoin’s current SF of 24 will double to 48. The higher the ratio, the more valuable will Bitcoin be.

According to the model’s latest incarnation, BTC/USD should hit $30,000 by the end of 2020.

Recently, some well-known cryptocurrency figures have criticized the concept, arguing it is simply too optimistic. However, regardless of whether bitcoin will surge or plummet, there will be many fluctuations that we can take advantage of and make profits.

Bitcoin futures trading is a popular instrument that allows trader to profit on the market fluctuations. It enables investors to go long or short BTC price, that is both uptrend or downtrend are profitable. Besides, one of the reasons why so many traders are attracted to BTC margin trading compared to spot trades is that you can usually get higher leverage. Leverage involves borrowing a certain amount of money to increase your initial money.

Here takes 100x leverage as an example. If you are required to deposit 1% of BTC as margin and you intend to trade 100 BTC contracts. Thus, with 1:100 leverage, you just need to invest in 1 BTC to open a 100 BTC position to short or long BTC price. When there is 1% price fluctuation, your profit/loss will also be 100%.

Bexplus is a popular BTC futures exchange that provides BTC, ETH, LTC, XRP and EOS futures trading with 100x leverage. Investors in Bexplus can enjoy No spread charge, NO KYC, trading simulator with 10 Free BTC and 100% deposit bonus.

Join Bexplus now and claim up to 10 BTC deposit bonus!