Ethereum has long been the dominant player in decentralized finance and smart contract platforms, but its limitations are becoming more apparent. Meanwhile, upstart rivals like Injective Protocol (INJ) are rapidly advancing and pose a real threat to Ethereum’s supremacy.

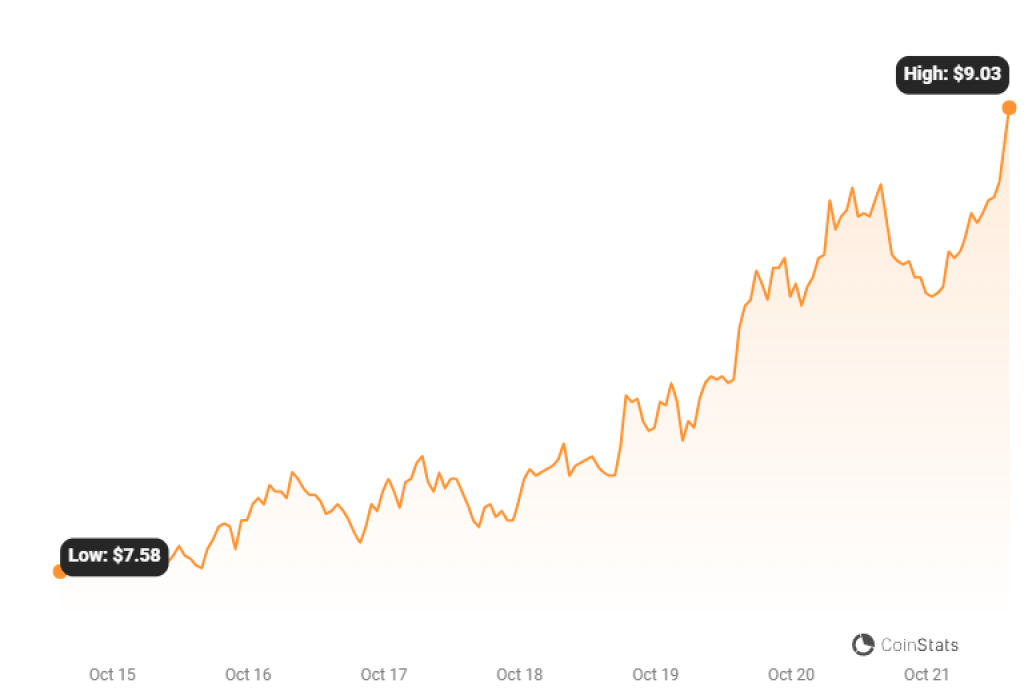

This week, Ethereum is up around 3% and trading near the $1600 level. Meanwhile, INJ is up over 20% and looking to break the psychological $10 level, currently trading around $9. Momentum is bullish for INJ, and the technical outlook is positive.

Ethereum’s small gains this week stand in contrast to INJ’s much stronger performance. While Ethereum continues to be plagued by negative headlines about delays and challenges, INJ is rapidly gaining ground as a leading decentralized finance protocol.

Injective Protocol is built from the ground up to be fast, scalable, and low-cost. It uses a novel layer-2 architecture to achieve speeds up to 100,000 transactions per second and fees as low as $0.0001 per trade. INJ also offers key features like cross-chain interoperability and robust decentralized governance.

What you'll learn 👉

INJ – Technical Analysis

From a technical analysis perspective, INJ looks poised for further upside. It appears to be forming an ascending triangle pattern on the daily chart, with potential for a breakout above resistance at $14-15.

The weekly charts also show a possible inverse head and shoulders pattern in the works. If confirmed, the measured move target would be around $100, representing massive upside of 1000% from current levels. Even if only half the pattern is achieved, INJ could reach $50, as King Chart analyst noted on X (Twitter).

Source: CoinStats – Start using it today

Momentum indicators like the MACD and RSI suggest bullish momentum is building. The MACD line recently crossed above the signal line, and RSI broke above 50 to signal a positive trend.

However, RSI is also at overbought levels above 70, meaning a short-term pullback is likely. Any retracement could provide an attractive area of support and entry point for traders eyeing the longer-term upside targets.

With its technical setup, upside projections, and growing adoption fundamentals, INJ presents an intriguing opportunity for traders willing to look past short-term volatility. The long-term chart patterns and momentum indicators align to support the bull case for this Ethereum rival.

Conclusion

For traders and investors, INJ presents a smart long-term investment as adoption of its protocol increases. Analysts point to a target of $100 if INJ can break key resistance levels.

While Ethereum has first-mover advantage, it seems to be stagnating technologically as hungry competitors advance rapidly. INJ has a legitimate shot at establishing itself as the premier decentralized finance chain.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.