The crypto market saw a significant pullback today, with the total market capitalization dropping around 3% to $1.37 trillion as of writing. The trading volume over the past 24 hours also declined by nearly 10% to $67.25 billion.

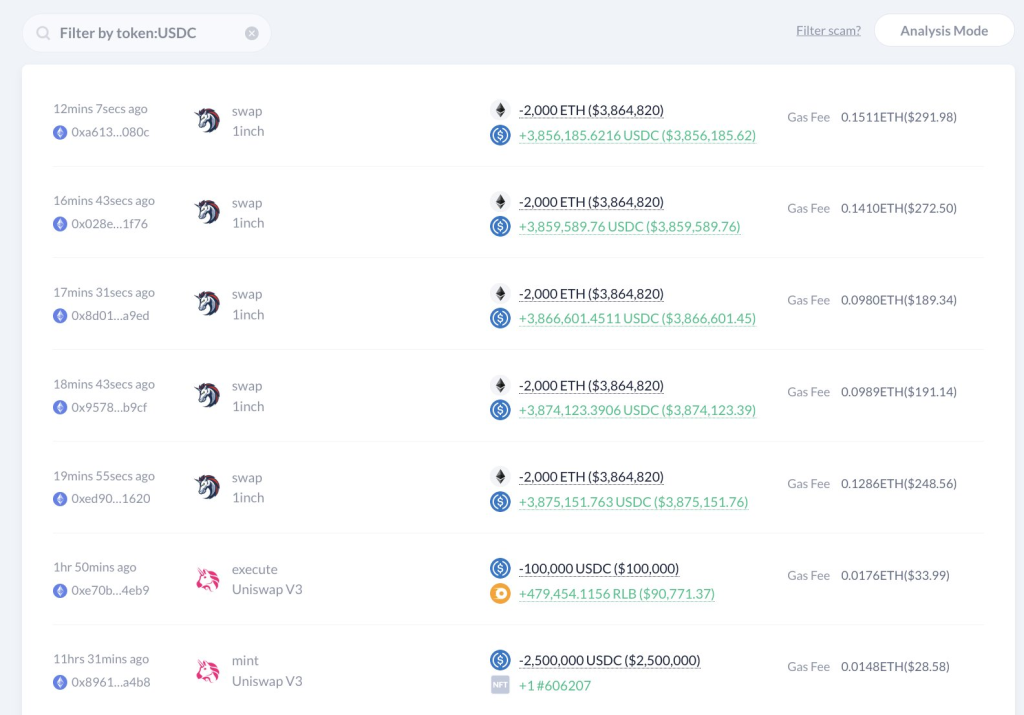

According to LookOnChain, some major crypto whales appear to be dumping holdings, contributing to the downward price pressure. For example, one Ethereum whale sold 10,000 ETH worth $19.33 million in just 20 minutes. This type of large-scale selling by “smart money” investors can spook markets and drive prices lower across cryptocurrencies.

In addition, the SEC had until November 17th to respond to pending Bitcoin spot ETF applications, including from Grayscale. However, the SEC deferred making a decision, despite growing hopes in recent weeks that approval was imminent. The lack of ETF approval in this window seems to have caused some panic selling, as traders who were betting on approval are now unwinding those positions.

Bitcoin is down 1% to around $36,000. Major altcoins like Solana, Cardano, Polygon, and Chainlink have fallen over 5%. Ethereum is down 4% to just above $1,900. The broad-based selling has brought the overall market down.

According to analyst Adam Cochran, some traders were specifically betting on ETF approval and are now discounting those bets since approval is less likely in the near-term. With the SEC pushing back timelines, the next window for potential approval is farther out.

“Think today’s sell off is driven by the Bitcoin ETF window bettors a bit. Today 17th is the last day of the first window for SEC to approval ETF with all participants not in comment period. Makes it less likely, although not impossible, for approval now.” said Adam

Finally, the upcoming holiday seasons may also contribute to hesitancy by regulators in approving a Bitcoin ETF. Government entities often get less active around holidays, dampening hopes for any major policy shifts.

In summary, a combination of whale dumping, lack of ETF approval, broad market selling, and holiday season uncertainty seems to be weighing down crypto markets today. But ongoing adoption and development continues to build a foundation for potential future growth.