The cryptocurrency market is seeing widespread declines over the last 24 hours, with the total market capitalization down 2.5% to $1.61 trillion. Major altcoins such as Ethereum (ETH), Cardano (ADA), Avalanche (AVAX), Dogecoin (DOGE), Polkadot (DOT), and Chainlink (LINK) are down between 2% to 10%.

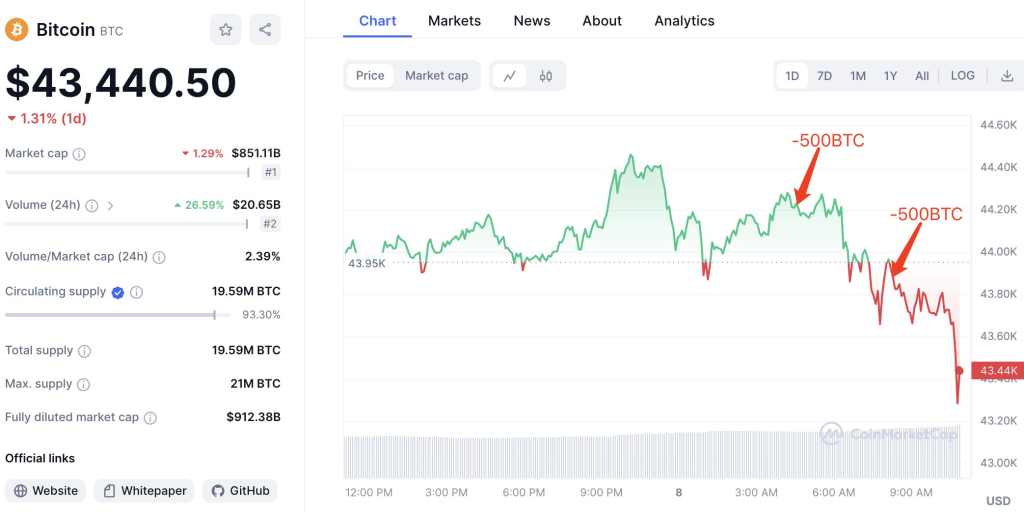

Bitcoin (BTC) is outperforming most altcoins, only declining 1% in the last day to trade around $43,560 at press time. However, this still represents a drop of over $1,000 in just the last 7 hours.

According to on-chain analyst LookOnChain, this Bitcoin price drop correlates with a deposit of 1,000 BTC (worth $43.96 million) from mining pool F2Pool to Binance. This comes just two days after another deposit of 1,000 BTC from F2Pool to the exchange. Significant BTC transfers from miners to exchanges often precede periods of selling pressure.

There are likely two main factors contributing to the broad-based crypto sell-off:

- Traders taking profits in case Bitcoin exchange-traded funds (ETFs) get rejected by the SEC and the market dumps. The SEC has a deadline of January 10th to approve or reject several Bitcoin ETF applications and the market is nervous.

- Money rotating out of altcoins into Bitcoin ahead of the ETF decision. There is speculation that Bitcoin could see significant gains if ETFs get approved, so traders may be rebalancing.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +In summary, nerves around the imminent Bitcoin ETF decision coupled with profit taking seem to be driving the cryptocurrency market decline over the last day. All eyes will be on the SEC in the coming week to see if Bitcoin ETFs become a reality, which could reverse the negative market momentum.

You may also be interested in:

- AVAX Cools Off After 200% Moonshot: Examining Path Ahead for Avalanche

- Top Analyst Explains What to Expect from Arbitrum (ARB) in 2024, Sets Bullish Price Targets

- Analysts Anticipate a Period of Consolidation for Cardano and Exponential Growth for InQubeta

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.