The crypto market experienced its first and biggest crash in 2024 after beginning the new year with a bang. The recent report by Matrixport that stated that the SEC could reject Bitcoin ETFs has triggered a cascading liquidation, which caused Bitcoin to lose over 7% alongside altcoins, which exhibited single- and double-digit losses.

What you'll learn 👉

Impact of Matrixport’s SEC ETF Rejection Prediction

At the heart of the market turbulence is a prediction by Matrixport, suggesting a potential rejection of all Spot Bitcoin Exchange-Traded Funds (ETFs) by the U.S. Securities and Exchange Commission (SEC).

This unconfirmed forecast has triggered a ripple effect across various cryptocurrencies, prompting questions about the market’s sensitivity to regulatory speculation.

Rapid Market Response Within the Last 30 Minutes

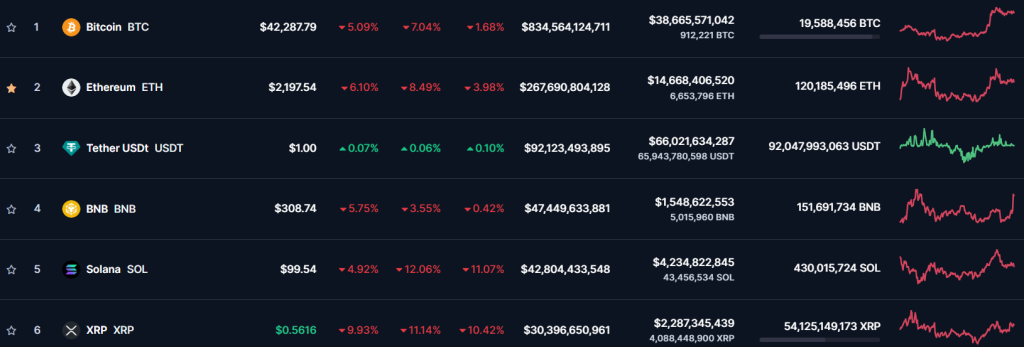

The market’s reaction has been swift, with a significant downturn observed within the last 30 minutes. As major cryptocurrencies register notable declines, including Bitcoin (BTC), Ethereum (ETH), Solana (SOL), Avalanche (AVAX), and Chainlink (LINK), the community is left to decipher the impact of speculative opinions on short-term market dynamics.

Navigating Speculative Volatility in the Crypto Landscape

The prevalence of speculative sentiments, as highlighted by Matrixport’s prediction, raises concerns about the susceptibility of the crypto market to unverified opinions.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +In response to the market turbulence, Bitcoin investor Lark Davis shares insights into the situation. Despite the challenges, Davis emphasizes the early stage of the crypto space, where market sentiment can be heavily influenced by individual opinions. His call to action encourages investors to view the downturn as an opportunity, aligning with the familiar crypto mantra of “buying the dip.”

Adding another layer to the story, Coinglass data reveals significant liquidations exceeding $600 million. The magnitude of these liquidations underscores the real-world consequences of the market downturn, particularly for leveraged positions.

In conclusion, the cryptocurrency market’s decline today is a multifaceted story, intertwined with speculative predictions, regulatory uncertainty, and the resilience of seasoned investors. As the community absorbs the implications, the focus remains on deciphering the true catalysts behind the downturn.

You may also be interested in:

- Kaspa Moves Similar to Solana in the Last Cycle, Analyst Shares Next Area of Interest for KAS

- Crypto Analyst Spots Bullish Pennant for Cardano (ADA) – But There’s a Catch

- Pullix (PLX) to Solve Liquidity and Transparency Issues – Captures Interest From Axie Infinity (AXS) and NEAR Protocol (NEAR) Traders

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.