The crypto markets have pulled back sharply in recent days, leaving investors wondering—why is crypto down today? According to analysts CryptoCon and McKenna, excessive greed and euphoria surrounding the imminent Bitcoin ETF approvals appear to be key factors behind the latest selloff.

What you'll learn 👉

Greed and Euphoria Were Overheated

In a recent tweet, analyst CryptoCon argued that greed could not be higher and data could not look more overheated heading into the expected ETF approvals. As he states:

“Greed surrounding #Bitcoin ETFs couldn’t be higher, and data couldn’t look more overheated.”

CryptoCon believes Bitcoin likely topped out locally around $45k based on momentum indicators that are flashing warning signs. He thinks this euphoria needs to cool off and expects Bitcoin to retrace back towards the $30k zone before resuming its uptrend.

Unwinding of Excessive Speculation

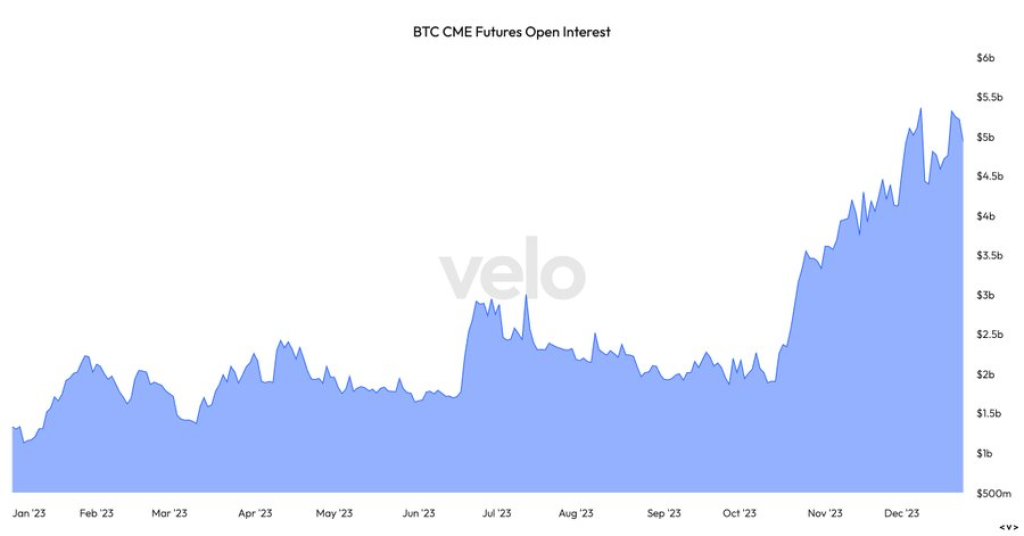

Analyst McKenna echoes similar sentiments about greed reaching extremes. He points to the massive build-up in open interest in CME’s Bitcoin futures, up over $3 billion since BlackRock filed for a spot Bitcoin ETF.

As McKenna notes, much of this activity looks to be excessive speculation that will need to unwind:

“These positions need to unwind & think many who were buying post FTX insolvency will begin to de-risk some of their position.”

He predicts this unwinding could lead to a 20-30% market-wide selloff in the short-term.

Don’t Panic, Corrections are Healthy

However, both analysts view these types of corrections as perfectly normal and even healthy after periods of rapid price appreciation. CryptoCon notes that the cycle is pausing to set up the next leg higher following this mid-cycle retracement. Similarly, McKenna remains net positive on crypto’s long-term outlook, forecasting an Ethereum breakout next year once the dust settles.

So while painful in the short-run, this cooling-off of unsustainable greed and euphoria could lay the foundation for the next major crypto bull run. Savvy investors may look to take advantage of the discounted prices to accumulate more coins ahead of the next rally.

In crypto markets, patience and discipline are often rewarded for those who can stomach the ups and downs. Maintaining perspective through these turbulent times is key.

You may also be interested in:

- What Does a $32M Solana Whale Deposit Mean for the SOL Price?

- Bitcoin Price Action and Fundamentals Align: Bulls Bet Big – What to Expect from BTC in 2024

- Crypto Analyst Dark Defender Remains Bullish on Ripple, Meme Moguls Launch $10,000 Giveaway, Bonk Scores Major Listing

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.