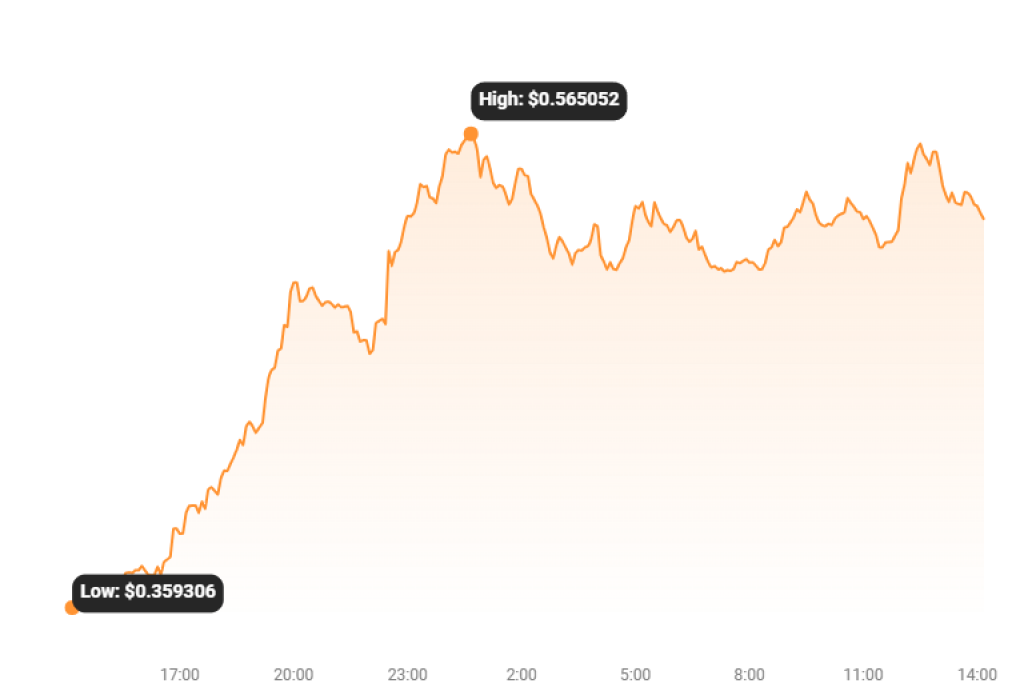

The Bancor Network Token (BNT) has been the story of the day in the cryptocurrency industry. The token is currently trading at $0.53, marking an impressive increase of nearly 50% in the last 24 hours.

But what’s driving this surge? Let’s delve into the insights provided by some top-notch analysts and well-known traders on Twitter.

Rick Barber (@Rick_Barber_), a renowned technical analysis expert, attributes the surge to a realization of BNT’s deflationary tokenomics model. He mentions that CarbonDeFixyz, a blockchain project, is directing most of its fees toward buying and burning BNT. This strategy, according to Barber, has previously driven the token to an all-time high of nearly $10 and is now very revenue-focused.

Milei Moneda is a new meme coin inspired by the political and economic views of Javier Milei, an Argentine president known for his libertarian and pro-Bitcoin stance. You have an opportunity with the ongoing low presale price to get in early!

Sponsored

Show more +The Bancorians (@bancorians), a group of famous Twitter analysts, highlighted a significant strategy placed on-chain by CarbonDeFixyz. They reported a $133k strategy to buy BNT at $0.39, with no intention of selling any acquired BNT as the linked sell order is disabled. This strategy can be tracked via the provided Etherscan link.

Bitpeaks (@bitpeaks), another well-known trader, noted that BNT bids are currently 6% higher than asks ($326,377 : $308,449), indicating a strong support level for buying at $0.5175.

Source: CoinStats

Luke BitPro (@LukeBitPro), a top-notch analyst, advises traders to avoid FOMO buying at this moment. He suggests waiting for the price to dip toward the $0.45 – $0.41 range for a better buying opportunity.

Eldar Capital (@eldarcap), a well-known trading firm, has also weighed in on the recent price movement of Bancor’s BNT. They find the price surge a bit peculiar, questioning whether it’s driven by people loading up on the token due to optimism about the growth potential of CarbonDeFixyz.

While acknowledging the innovative design of CarbonDeFixyz and its potential to gain increasing traction, Eldar Capital suggests that the current fundamentals might be a bit weak to justify such a high Fully Diluted Valuation (FDV) for BNT.

This analysis adds a note of caution to the bullish sentiment around BNT. An elementary examination of factors such as trading volumes, fees, Total Value Locked (TVL), the number of strategies, and user base reveals that Carbon is not yet on par with leading decentralized exchanges like Uniswap, Curve Finance, and Balancer.

A simple analysis of volumes, fees TVL, strategies number and users show that Carbon it yet nowhere near competition with leader DEX like Uniswap, Curve and Balancer says Eldar Capital

The surge in BNT’s price can be attributed to its deflationary tokenomics model and strategic buying. However, traders are advised to wait for a potential dip for a better buying opportunity. As always, it’s crucial to do your own research and consider the advice of experts like these before making any investment decisions.

About Bancor

Bancor is an ecosystem of decentralized, open-source protocols that promote on-chain trading and liquidity. Its main protocol, Carbon, is a decentralized trading protocol allowing users to perform automated trading strategies using custom on-chain limit orders and range orders, with the option of combining orders together to create automated buy low, sell high strategies.

By design, Carbon orders are irreversible on execution, easily adjustable directly on-chain, and resistant to MEV sandwich attacks. These capabilities give users an unprecedented level of control and automation to perform novel trading strategies on-chain. All Bancor ecosystem protocols are governed by the BancorDAO via staked BNT.

Disclaimer: We advise readers to do their own research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in cryptoassets is high-risk; consider the potential for loss. CaptainAltcoin is not liable for any damages or losses from using or relying on this content.