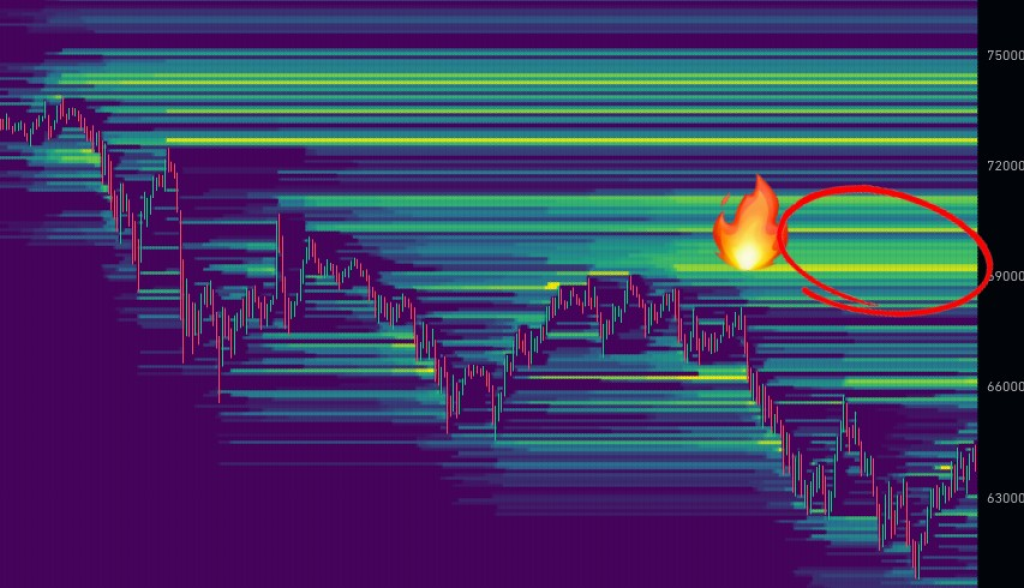

The price of Bitcoin has taken a tumble, dropping from its new all-time high of $73,000 down to around $60,000. While it has since recovered somewhat to $67,000, there are doubts about whether the world’s largest cryptocurrency can maintain this level, let alone revisit its previous highs near $69,000 any time soon, especially seeing that price rejected from there three time before finally breaking to the new all time high.

Several factors appear to be behind Bitcoin’s recent slump, according to market analysts. Ash Crypto, a prominent crypto analyst, cited three key reasons:

- Grayscale Bitcoin Trust saw redemptions over the past two days totaling $1.1 billion, likely driving selling pressure.

- Today’s Federal Open Market Committee (FOMC) meeting, where the Fed will decide on interest rates, is causing investor jitters. If Fed Chair Powell sounds hawkish, it could mean more “red candles” or price drops for Bitcoin.

- It’s currently tax season in the U.S., so investors may be taking profits on Bitcoin after its huge rally over the past year.

However, Ash Crypto remained bullish long-term, noting “we’re still in a bull market” with major players like BlackRock and Fidelity accumulating BTC. The analyst predicted the next “halving” event for Bitcoin in 2024 will be positive, as will potential future rate cuts.

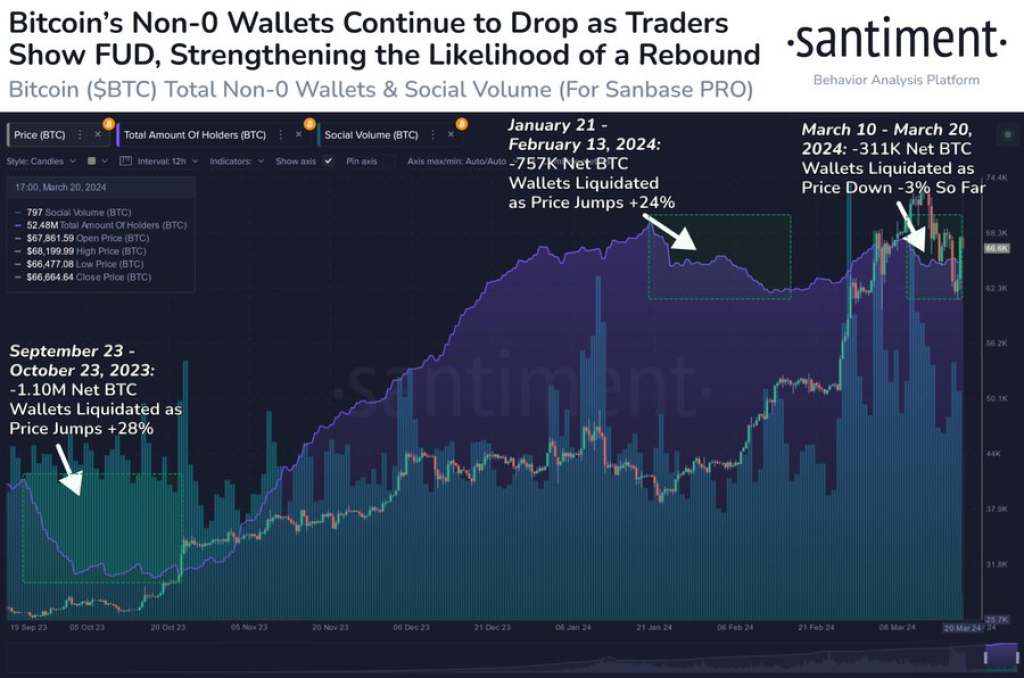

Santiment presents a more optimistic view, pointing to historical cases where declines in active Bitcoin wallets preceded price increases of over 20% for BTC. They argue that the recent drop of 311,000 “non-zero” wallets could reflect smaller holders capitulating and selling to larger “whale” wallets accumulating coins – a potential contrarian bullish signal.

Source: Santiment – Start using it today

Santiment states: “If history is any indication, Bitcoin has a strong chance of putting up positive returns before this exodus of non-0 wallets this round (due to traders thinking the top is in) finally stops.”

This analysis suggests Bitcoin could bounce back and potentially retest the $69,000 level in the relatively short term as the large wallet inflows may foreshadow an upswing.

On the other hand, Jesper has a more definitively bullish stance, outright stating “We’re coming back up, just have patience and HODL fierce warriors!!” This implies Jesper expects Bitcoin to reclaim $69,000 without giving a specific timeframe.

So while Santiment presents data-driven reasons why $69,000 could be achievable for BTC soon based on past cycles, Jesper voices more overt confidence that it will surpass that level again if investors just remain patient and hodl (hold on for dear life) their Bitcoin.

You may also be interested in:

- Elite Crypto Analyst Shares Top 10 Mistakes To Avoid This Bull Run

- Shiba Inu Team Member Predicts “Miracle Recovery” and New SHIB ATH Before Bitcoin Halving

- Crypto Whales Monitor Rising Altcoins Scorpion Casino, Memeinator & Scotty AI As They Project 100x Gains

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.