Bitcoin Cash (BCH), one of the leading cryptocurrencies, is witnessing a surge in price and investor interest ahead of its upcoming halving event scheduled for early April 2024. The spike in demand has been fueled by two key factors: the imminent reduction in new BCH supply and reports of massive accumulation by large investors, often referred to as “whales” in the crypto world.

The Halving Phenomenon

Every four years, Bitcoin Cash undergoes a process called “halving,” where the reward for miners who validate transactions on the network is cut in half. This upcoming halving will see the block reward for miners decrease from 6.25 BCH to 3.125 BCH per block mined.

Halving events are significant for cryptocurrencies like BCH because they directly impact the rate at which new coins are created and introduced into circulation. By reducing the supply of newly minted coins, the halving aims to control the total supply of BCH and maintain its value over time, following the principles of scarcity and supply-demand economics.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Whale Accumulation

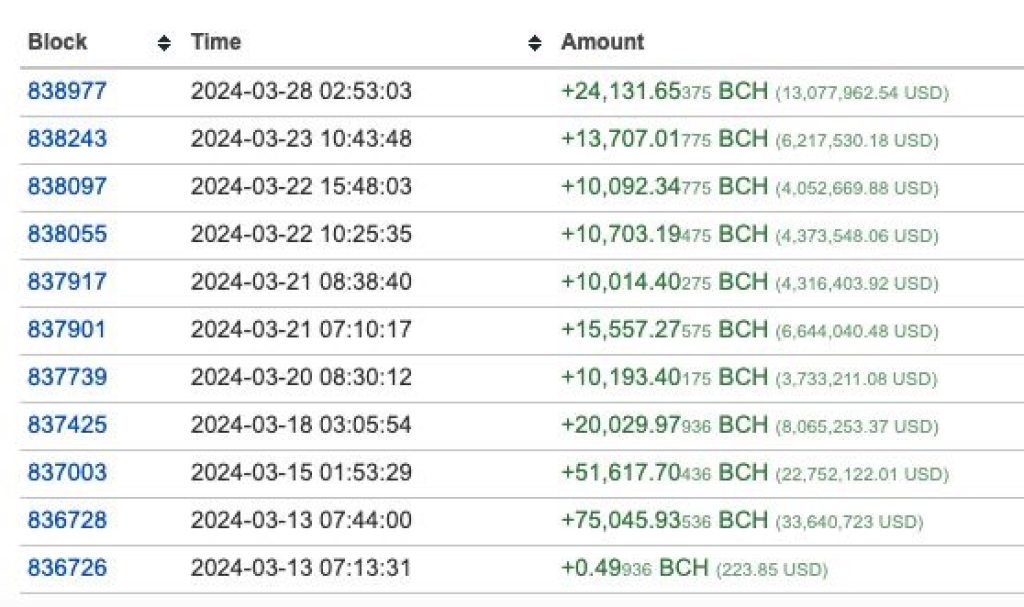

Adding fuel to the rally is a tweet from the controversial internet entrepreneur Kim Dotcom, who claims to have inside knowledge of whales – large investors with substantial holdings – aggressively buying up BCH. In his tweet, Dotcom states: “Big appetite for $BCH from whales. The big boys are buying. What do they know?”

The accumulation of BCH by whales is often seen as a bullish signal, as these deep-pocketed investors are believed to have a better understanding of market dynamics and potential future price movements.

Experts Weigh In

Cryptocurrency analysts and enthusiasts have mixed views on the BCH rally. Some believe that the halving event and the associated reduction in supply will inevitably drive up the price of BCH, as has been observed with previous halving events for other major cryptocurrencies like Bitcoin (BTC).

Others, however, argue that the impact of the halving has already been priced in by the market, and the real driver behind the price surge could be speculation and the fear of missing out (FOMO) among investors.

Regardless of the underlying reasons, the BCH rally has once again brought attention to the dynamic and often unpredictable industry, where market sentiment, supply dynamics, and investor behavior can all play a significant role in shaping price movements.

You may also be interested in:

- Dogecoin Successfully Retests Macro Downtrend and Breaks Out from Its Bull Flag: How High Can DOGE Go?

- 7 Tokens Accumulated by Insider Wallets with Potential for 6X Growth

- Analyst Shares Key Tips for Maximizing Profits from Elon Musk’s Tweets in Bull Market

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.