BENQI (QI), a leading decentralized finance protocol enabling lending, borrowing, and liquid staking solutions for the Avalanche ecosystem, extended its vertical rally another 28% amid steadily improving adoption metrics.

Surging trade volumes have propelled the previously obscure QI token to trend both on Binance and CoinMarketCap – evidencing revived interest in the DeFi platform. We examine the latest catalysts driving this breakout.

What you'll learn 👉

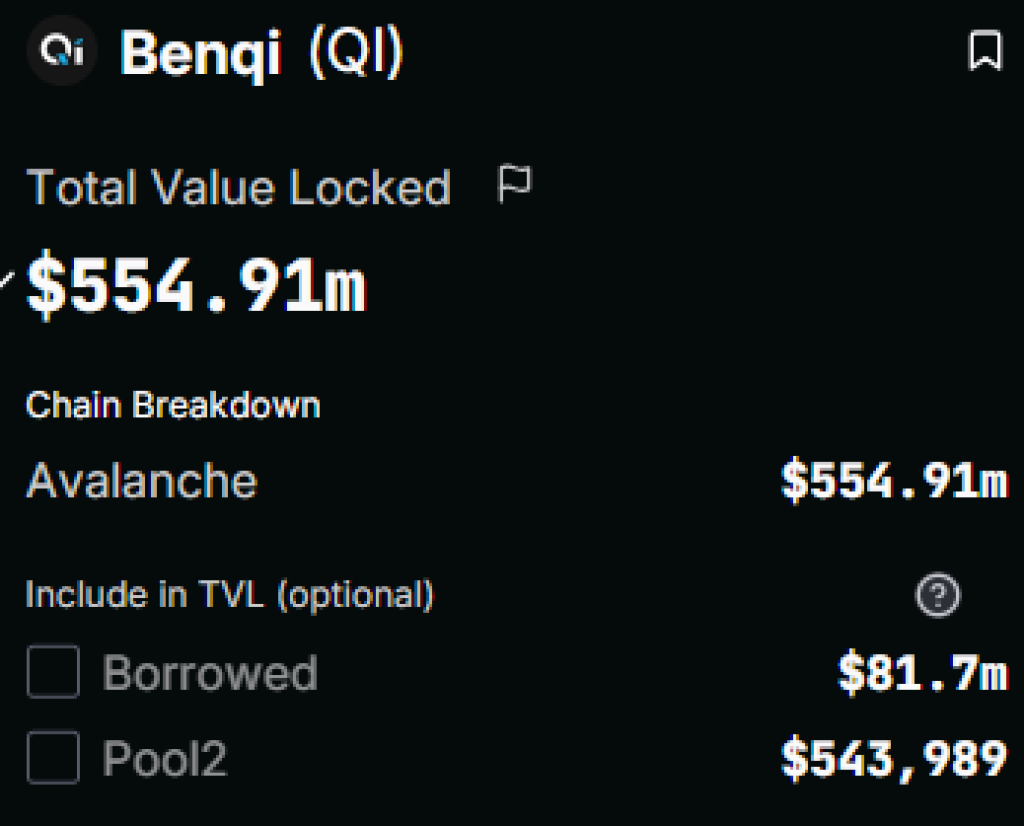

Total Value Locked Soars Above $500 Million

According to reliable TVL aggregator DefiLlama, BENQI now boasts over $550 million worth of total user funds deployed inside its smart contracts.

This sustained exponential growth reaffirms BENQI’s increasing mindshare among participants on the popular programmable blockchain Avalanche, where it offers attractive yield opportunities.

As more value floods into BENQI for lending or liquid staking services, the fixed supply governance token appreciates in tandem – explaining its abrupt 25% short term surge as a proxy for adoption.

Daily RSI Climbs To 69

Mirroring price appreciation, BENQI’s daily Relative Strength Index (RSI) gauge now stands around 69 after the latest rally – creeping toward the 70 threshold defining overbought short term conditions.

While not yet signaling the 1-3 day momentum has become critically overextended, readings at these levels do imply the vertical ascent exceeds sustainability without a period of cooldown.

Pullbacks remain likely before continuation materializes, so prudent trading plans should anticipate some two-sided choppiness looking ahead. Still, growing platform usage appears to support a durable strengthening of the price structure.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Analyst expects run to $0.041

According to crypto trader Decilizer, QI has gained momentum with a huge volume after it broke its resistance. The trader expects another run towards the $0.041 level.

QIhas surged form a 24 hour low of $0.0184 to a high of $0.02826 before falling to its current price of $0.02438. QI’s market cap stands at $108 million at press time.

Stepping back, QI’s breakout runs concurrent with a broader revival in activity and sentiment returning to Ethereum challenger Avalanche.

Just as DeFi insanity propelled the chain and token’s parabolic advance last summer, expectations of history repeating itself make AVAX and partners like BENQI prime candidates for explosive reruns if risk-on crypto tailwinds persist.

So in summary, the BENQI price stands firmly tied to its base blockchain – making the recent confirmation of user growth resurgence a bullish indicator of its own outpacing competitors and microcap valuations.

You may also be interested in:

- Expert Urges Caution on Long-Term Meme Coin Holdings; Dogecoin (DOGE), Shiba Inu (SHIB), and Others

- Stacks (STX) and Pyth Network (PYTH) Prices Pumping – Here’s Why

- SEC vs Ripple Lawsuit Prompts Investors to Turn Towards BlockDAG’s $2M Presale

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.