Ethereum has seen tremendous growth over the past month, with the price of ETH increasing over 30% and gaining another 17% just this week. The cryptocurrency broke above $2,000 on Thursday and while prices have pulled back slightly, ETH is still up more than 9% today. This recent surge seems poised to continue, according to analysis from several crypto experts.

What you'll learn 👉

Bullish Network Growth Fuels Optimism

Source: Santiment – Start using it today

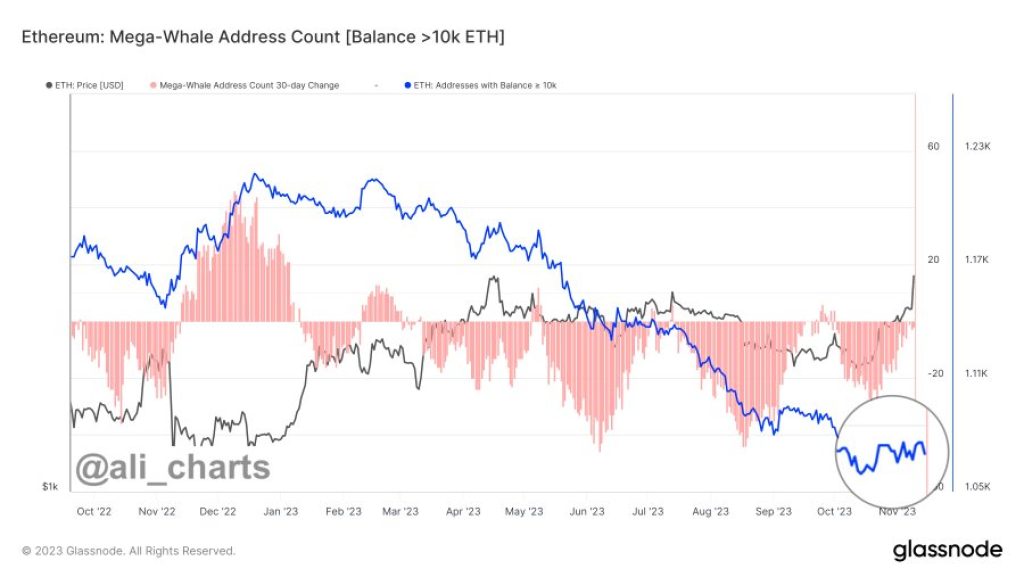

As noted by Santiment, Ethereum’s market value has jumped 38% in just 4 weeks. This growth has been powered by expanding network activity, particularly among small ETH holders. Micro-addresses holding less than 0.1 ETH have surpassed 100,000 wallets for the first time, showing strong adoption at the retail level. Larger wallet tiers holding between 0.1-10 ETH and over 10,000 ETH are also finally trending upward again after months of decline.

This resurgence in users and activity levels points to strengthening fundamentals for Ethereum. As more individuals and organizations build on the network, utilize DeFi protocols, and acquire ETH, natural demand rises. This network effect helps drive prices over the long run.

Technical Milestones Attained

Not only have usage metrics turned favorable, but ETH has also reclaimed key technical levels recently. As noted by Ali, Ethereum has moved back above the $2,000 mark. This is a psychologically important threshold that could drive further momentum, especially considering the next major resistance level sits around $2,800 – the yearly high.

Reclaiming $2,000 is even more impressive given that large ‘whale’ wallets have not yet begun accumulating ETH in this recent run, according to Ali. This means there is substantial dry powder waiting on the sidelines that could propel prices higher once these large players enter.

Read also:

- Will History Repeat as Solana (SOL) Faces Tough Resistance Again?

- Polygon Market Cap Surges +54% in 3 Weeks as Whales Continue to Accumulate MATIC

- Bitcoin ETF Token Crosses $100K With BTC Price Surge – 1 Day Left in the Presale Stage

In summary, Ethereum is exhibiting a textbook mix of strong on-chain activity, technical breakouts, and speculation around products like ETFs. These factors point to a continued ETH price surge in the coming weeks and months.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.