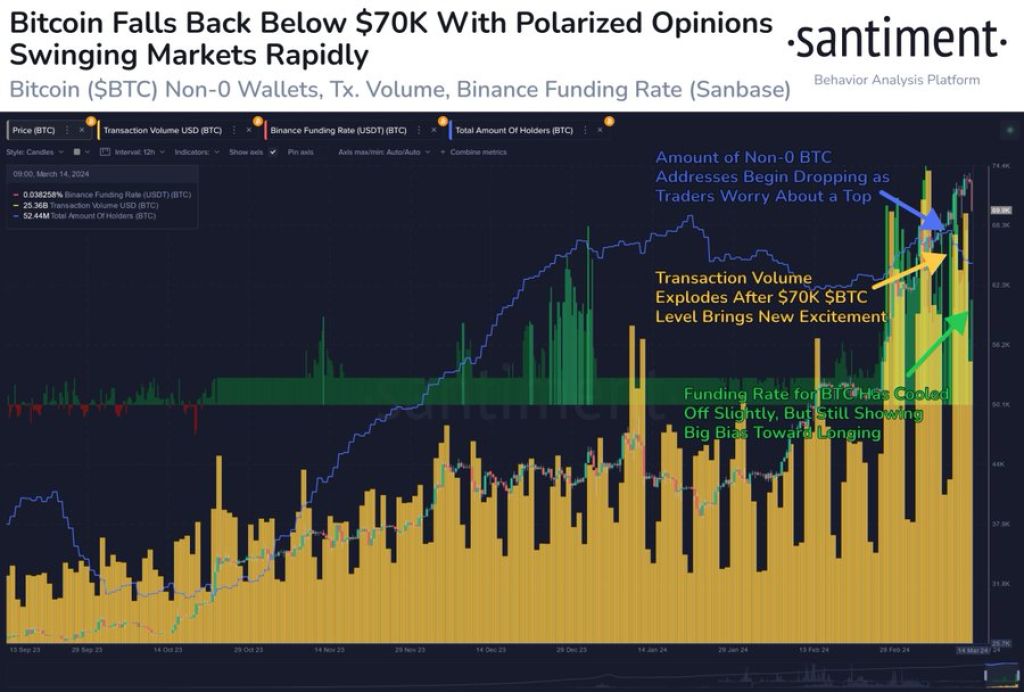

Bitcoin (BTC), the world’s largest cryptocurrency by market capitalization, has once again dipped below the crucial $70,000 level, marking the second time in just three days that the digital asset has breached this support. According to on-chain data from Santiment, a leading blockchain analytics platform, the drop in Bitcoin’s price coincides with a surge in on-chain transaction volume, indicating heightened activity on the network.

Source: Santiment – Start using it today

While increased transaction volume is typically viewed as a positive sign, reflecting robust adoption and usage, Santiment highlights a concerning trend – the number of long positions on exchanges remains elevated. This suggests that a significant portion of traders are still betting on further price appreciation, which could potentially exacerbate selling pressure if market sentiment shifts.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +On the bright side, Santiment notes that the number of Bitcoin holders is dropping, a phenomenon often referred to as “capitulation” in crypto parlance. Capitulation occurs when investors, exhausted by prolonged price declines, decide to exit their positions, typically marking a potential bottom in the market cycle.

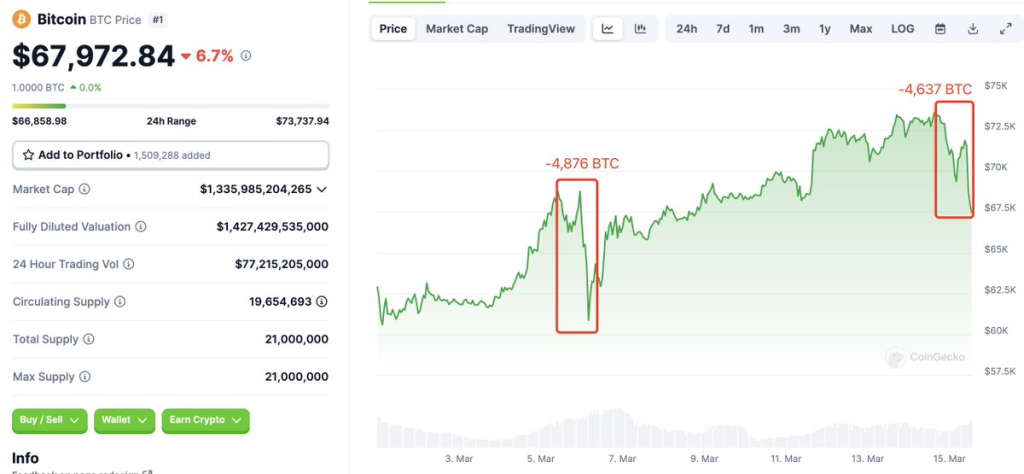

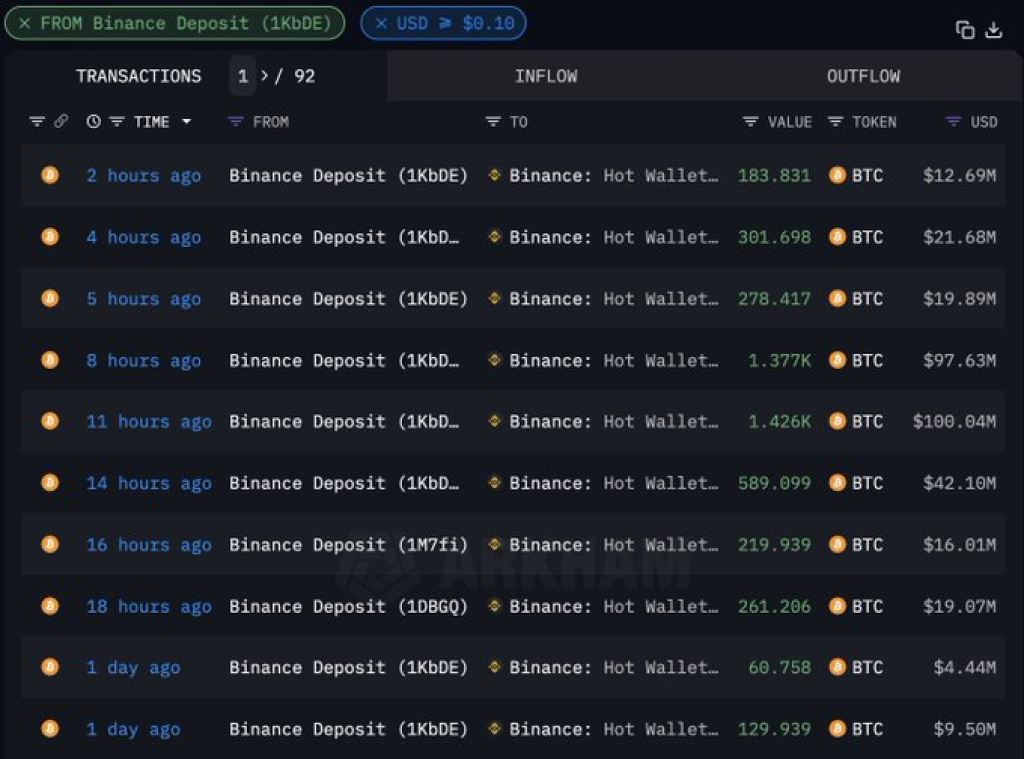

Corroborating Santiment’s findings, blockchain analytics firm Lookonchain has identified substantial Bitcoin inflows to Binance, one of the world’s largest cryptocurrency exchanges. Specifically, Lookonchain observed that a Binance deposit wallet moved 4,637 BTC (worth approximately $329 million at current prices) to a Binance hot wallet – a type of wallet used for facilitating transactions – within the past 24 hours.

Notably, a similar transfer of 4,876 BTC (around $319 million) from the same deposit wallet to Binance’s hot wallet occurred on March 5, coinciding with a previous dip in Bitcoin’s price. Such large inflows to exchanges are often interpreted as a bearish signal, as they may precede increased selling pressure from traders looking to offload their holdings.

As Bitcoin continues to grapple with volatility, market participants will closely monitor on-chain metrics and exchange flows for clues about the asset’s potential future trajectory. While capitulation could signal a bottoming-out phase, sustained inflows to exchanges may prolong the current downtrend, leaving investors on edge as they navigate the ever-changing crypto landscape.

You may also be interested in:

- Why Bitcoin (BTC) Price Could Reach $1 Million This Year or the Next

- Is Maker (MKR) Poised for Correction Amidst Upcoming Launch? Bullish Whale Bets vs. Technical Warning Signals

- Binance Coin (BNB) Investors Join New $0.0018 Altcoin Predicted 1000% Growth

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.