Ondo Finance (ONDO) has been leading the charge in real-world asset (RWA) tokenization, and according to top voices in the space, it might only be getting started.

The analyst CryptoED (@Crypto_ED7), known for consistently tracking early trends, called buying ONDO below $1 a “gift” after pointing to several powerful partnerships and ecosystem milestones achieved in just one week. These include collaborations with JPMorgan, PayPal, Solana, Chainlink, BlackRock, and even Ripple.

What you'll learn 👉

ONDO’s Growing Impact and Major Integrations

JPMorgan recently completed a tokenized U.S. treasury trade using the Ondo blockchain, marking a significant moment as one of the first major banks to use a public chain for real asset tokenization. The trade was enabled by Chainlink’s Cross-Chain Interoperability Protocol and coordinated by JPMorgan’s Kinexys. This not only shows the viability of public blockchains for institutional finance but puts Ondo front and center as the technical foundation.

Another game-changing move was the Ondo x PayPal integration. ONDO now allows instant redemptions of tokenized U.S. treasuries using PayPal USD (PYUSD). This 24/7 liquidity setup has made ONDO even more attractive to institutions and DeFi users alike. Following this announcement, the ONDO price jumped by over 35%, reflecting how seriously the market took the news.

Solana is also part of the ONDO ecosystem now. A new bridge built using LayerZero now lets ONDO’s USDY token move across chains without relying on third-party pools. This removes inefficiencies and creates a faster and safer way to transfer value. USDY has over $170 million locked and is integrated with more than 15 protocols on Solana alone.

In addition, Ondo is helping BlackRock’s BUIDL fund tokenize U.S. treasuries and is working closely with Ripple to bring $185 million in tokenized assets onto the XRP Ledger. This will use Ripple’s RLUSD stablecoin and furthers the institutional reach of the ONDO network.

Representation at the Saudi-US Investment Forum and participation in SEC Crypto Task Force discussions also show that ONDO is now in the same room as BlackRock, Nasdaq, and Fidelity. The topic? How tokenization can make traditional finance faster, cheaper, and more open.

CryptoED also pointed out that the ONDO team is pushing hard behind the scenes. He highlighted that ONDO’s total value locked (TVL) just hit another all-time high. The suggestion is that when ONDO takes off again, the market will likely FOMO back in. But for those watching now, sub-$1 levels remain a strong long-term opportunity.

Read Also: How Many ONDO Tokens Do You Need to Become a Millionaire?

ONDO Price Analysis: Is a Rally Brewing?

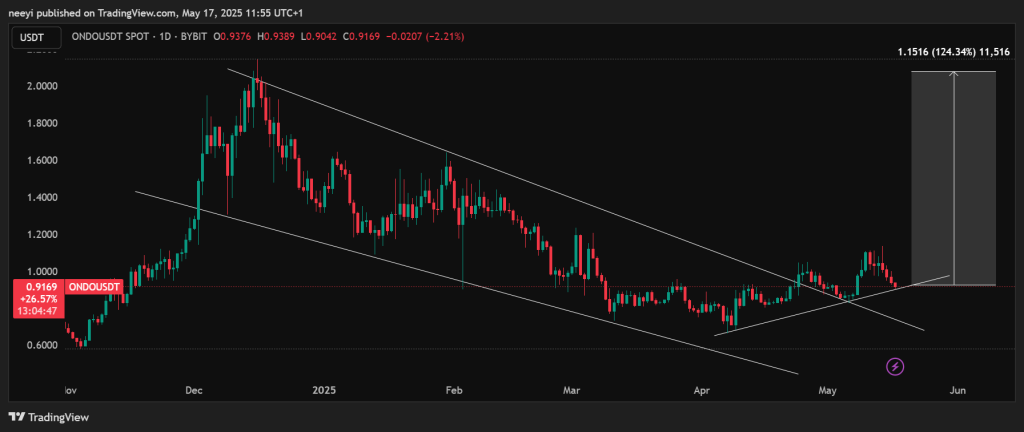

Since breaking out of a descending channel in late April, the ONDO price has been moving higher but gradually. The structure now looks bullish as each move up is being supported and sustained.

The chart shows a clear setup for a rally continuation. If this structure plays out, ONDO could potentially double in the coming days or weeks. A 100% rally would bring it up to around $2.09, which is the upper boundary of the previous price channel.

That zone will likely act as resistance, but a break above it could trigger price discovery. If that happens, ONDO could reach a new all-time high during this market cycle.

Momentum is slowly building, and the fundamentals are lining up perfectly with technical signals. Buying ONDO below $1 might actually be, as CryptoED put it, a gift for those paying attention.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.