According to Altcoin Daily, the Chainlink network and its LINK token could be poised for massive gains in the coming years. Some predict LINK prices could multiply 100x, fueled partially by potential adoption from Wall Street giant BlackRock.

What you'll learn 👉

The “Google of Web3”

Chainlink serves as middleware between blockchains and external data sources. It provides critical connectivity between smart contracts and APIs, IoT, and more. As both DeFi and traditional finance embrace blockchains, Chainlink is uniquely positioned as the leading blockchain oracle network.

This vital role has led investors like Kyle Chassé to compare Chainlink to “the Google of Web3.” With no real competitors, Chainlink could capture tremendous value as adoption expands.

Bridging DeFi and Traditional Finance

Chainlink also recently launched the Cross-Chain Interoperability Protocol (CCIP). CCIP enables seamless transfers of both value and data across different blockchains, sidechains, and layer-2 networks. Founder Sergey Nazarov believes this could be a game-changer, allowing decentralized systems to interoperate with traditional banking infrastructure.

This type of bridge between DeFi and mainstream finance is exactly what could make Chainlink appeal to major institutions like BlackRock. While only involved in Bitcoin currently, experts speculate BlackRock may want to integrate Chainlink services in the future as they expand crypto involvement.

LINK Looks Increasingly Bullish as Price Rallies

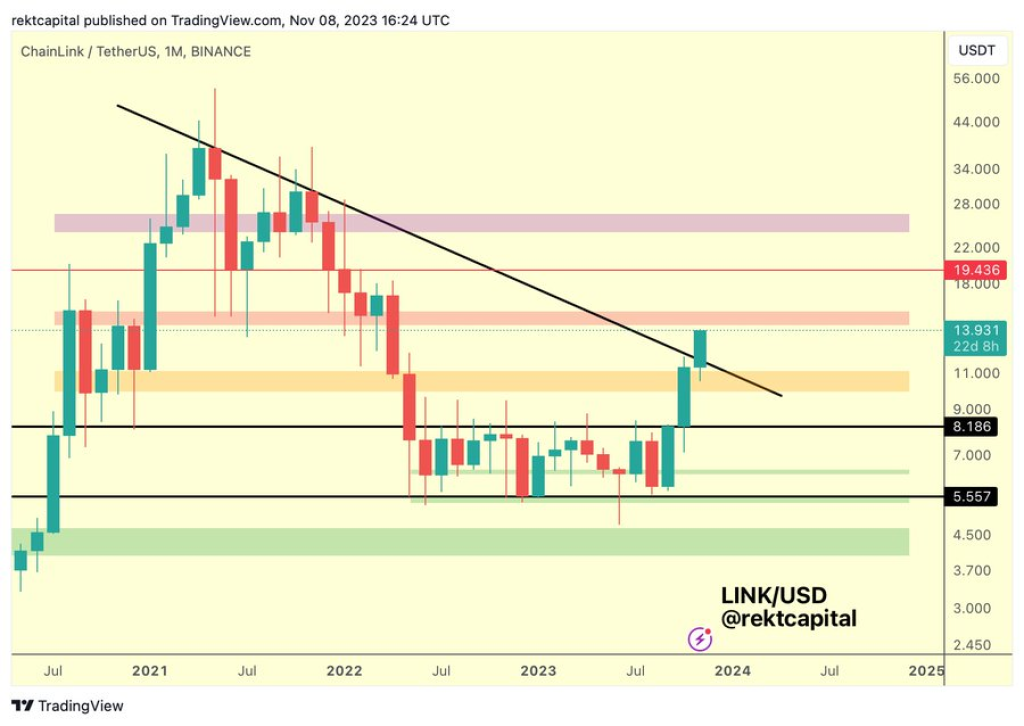

According to analyst Rekt Capital, LINK recently broke its key monthly macro downtrend, signaling a bullish shift in market structure. With this technical breakout achieved and upside momentum building, LINK looks poised to continue its rally, potentially reaching $30 in the near-term from current prices around $14.

Read also:

- Ripple (XRP) Poised for More Upside, Analyst Says This Level Is the Time To Be a Buyer

- This Token Could Be One Of The Biggest Gainers in 2024 – Learn Why Everyone’s Investing in Meme Kombat (MK)

- Which Cryptos Are ‘Likely’ To Rise Due to Upbit Conference?

Given Chainlink’s pole position as the leading decentralized oracle network, crucial role in expanding DeFi, bullish technicals, and bridging capabilities between blockchains and traditional finance, its long-term upside potential is substantial. A 100x price surge could materialize this decade if adoption reaches its full potential.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.