In the world of cryptocurrencies, where speculative investments and viral trends often collide, a new phenomenon has emerged: memecoins. These digital assets lack any inherent value, utility, or company affiliation. They are created and traded by anonymous founders, and their short lifespan is notorious, with 99% of them fading away within days or weeks. Yet, despite these red flags, people continue to invest and trade these memecoins, driven by the tantalizing promise of quick riches.

The story below is inspired by this thread on Twitter.

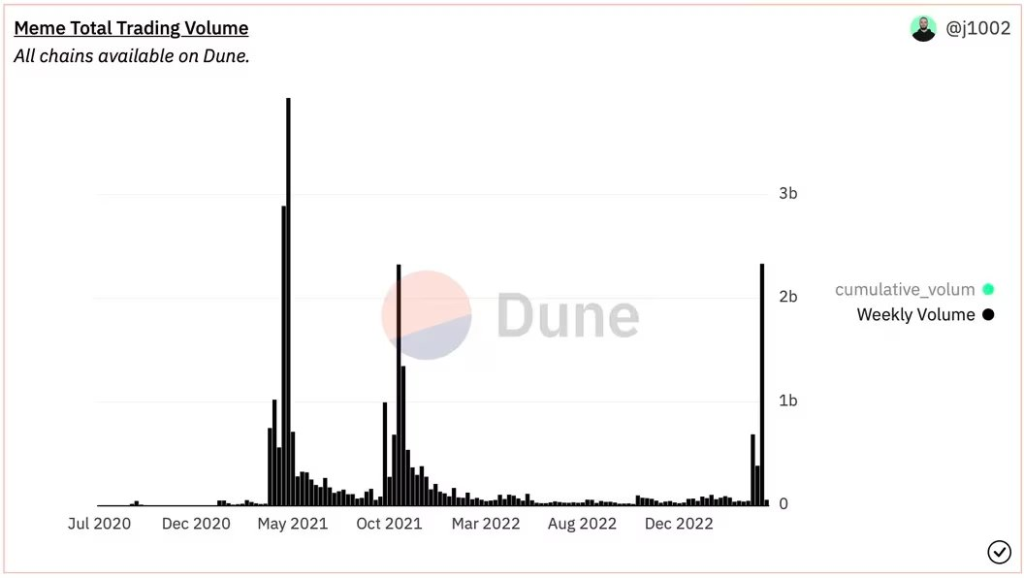

Last week, the meme coin market witnessed an unprecedented surge in trading volume, reaching a staggering $2.3 billion, a six-fold increase compared to the previous week’s $387 million. James Tolan’s visualization, made with the help of Dune Analytics, vividly captures the soaring popularity of these speculative assets.

Within this volatile landscape, a peculiar story unfolds. Enter Ben Armstrong, better known as @Bitboy_Crypto, one of the most recognizable and controversial figures in the cryptocurrency industry. Armstrong noticed a memecoin bearing his first name, $BEN, created by another individual, @eth_ben. Intrigued by this serendipitous connection, Armstrong began promoting $BEN to his substantial following, amplifying its visibility.

In a surprising turn of events, $BEN gained traction and its market capitalization skyrocketed. The value surged from an initial peak of $10 million to an astonishing $70 million, attracting significant attention. Seizing the opportunity, Armstrong struck a deal with @eth_ben to acquire the memecoin, the details of which remain undisclosed. With this move, Armstrong, in just a week, had amassed $6 million worth of $BEN.

However, instead of basking in his newfound wealth, anonymous user @eth_ben embarked on a risky venture. He initiated the creation of another memecoin, dubbed PSYOP, and appealed to his followers to send money to his wallet. Surprisingly, thousands of people, caught up in the fear of missing out (FOMO), complied with his request. The total amount collected reached nearly $6 million.

As the tension grew, doubts and concerns emerged among the cryptocurrency community. Many individuals nervously expressed their hopes that @eth_ben would not engage in a “rug pull,” a deceitful act where the creator of a memecoin absconds with the funds collected, leaving investors with worthless tokens. Cryptic tweets from the user only intensified these anxieties, ensuring that heart rates remained high.

One undeniable aspect of this saga is that @eth_ben capitalized on the hatred and controversy surrounding $BEN. His audacious moves drew attention from the entire Crypto Twitter community, with some individuals even forming a counter movement called Fu’kBen. Astonishingly, @eth_ben is one of the largest holders in this counter movement as well, creating an intriguing dynamic within the narrative.

The ultimate outcome of this story remains uncertain. Most people expect a disastrous conclusion for those who sent money to @eth_ben, fearing the potential loss of their investments. As the events unfold, cautionary voices rise, reminding individuals to exercise vigilance and prudence in their crypto dealings.

As the allure of quick wealth continues to captivate individuals within the cryptocurrency space, the consequences of unchecked greed persist, serving as a reminder to tread carefully in this volatile and often unpredictable market. The story of $BEN and PSYOP exemplifies the potential pitfalls that await those who succumb to the allure of memecoins and the unchecked greed that accompanies them.

The meteoric rise of $BEN, driven by the association with a prominent crypto influencer like Armstrong, fueled the frenzy surrounding memecoins. However, it also underscored the speculative nature of these digital assets. While some individuals saw $BEN as an opportunity for quick gains, others questioned its legitimacy, branding it a potential scam or a mere cult following.

The subsequent creation of PSYOP by @eth_ben introduced a new layer of complexity to the narrative. As thousands of people willingly sent money to the wallet associated with PSYOP, concerns mounted. How long would the sale last? What were the intentions behind this cryptic endeavor? And what did PSYOP symbolize?

Amidst these uncertainties, a palpable sense of anxiety pervaded the cryptocurrency community. People expressed their hopes that they would not fall victim to a “rug pull,” a term used to describe the abrupt disappearance of a memecoin’s creator with investors’ funds. Cryptocurrency enthusiasts began questioning the ethical boundaries of influencers like Armstrong, who seemingly exploited their followers for personal gain.

As the story unfolds, the ultimate outcome remains unclear. Speculation abounds, with many predicting a disastrous outcome for those who entrusted their money to PSYOP. The episode serves as a stark reminder of the risks inherent in the crypto market and the need for caution when navigating its treacherous waters.

While some individuals may argue that memecoins and their associated hype are detrimental to the reputation of the broader cryptocurrency industry, others perceive them as an inevitable part of the evolving digital landscape. Regardless of one’s perspective, the tale of $BEN and PSYOP raises fundamental questions about human greed and the dangers of unchecked speculation.

In conclusion, the story of $BEN and PSYOP is a cautionary tale, highlighting the potential pitfalls that arise when greed overshadows rational decision-making in cryptocurrency. It calls upon investors to approach speculative assets carefully and carefully, reminding them that the allure of quick wealth often conceals significant risks.

As the crypto market continues to evolve, the lessons learned from this narrative resonate as a reminder to tread carefully, research diligently, and exercise caution in the pursuit of financial gains.