As Bitcoin continues to break new ground and capture the attention of investors worldwide, many are wondering when the current bull market might reach its peak.

Renowned analyst Rekt Capital has delved into historical data to provide insights into the potential timing of Bitcoin’s next market top, based on the cryptocurrency’s past performance.

What you'll learn 👉

Historical Patterns Suggest a Peak in Late 2024 or Early 2025

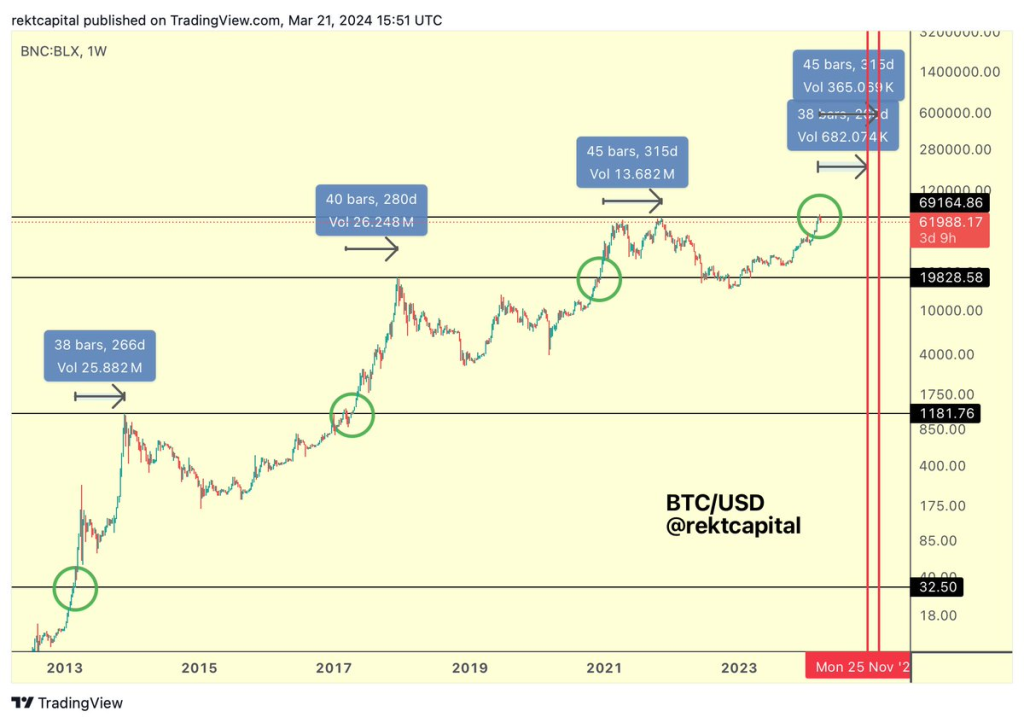

According to Rekt Capital’s analysis, Bitcoin tends to reach its bull market peak between 266 and 315 days after breaking its previous all-time high (ATH). With Bitcoin having surpassed its old ATH last week, this suggests that the next market top could occur in late November 2024 or late January 2025.

However, Rekt Capital observes that the current cycle might be faster than previous ones, which might affect when the peak occurs.

Lengthening Cycles: Bitcoin Spending More Time Above All-Time Highs

Interestingly, the data reveals that the number of days Bitcoin spends above its previous ATH has been increasing with each successive bull market.

In 2013, Bitcoin rallied for 268 days before reaching its peak. This figure rose to 280 days in 2017, an increase of 14 days compared to the previous cycle. The 2021 bull market saw Bitcoin spend 315 days above its previous ATH, an additional 35 days compared to 2017.

Historically, the number of days Bitcoin has spent beyond its old ATH has increased by approximately 14 to 35 days per cycle.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Projecting the Next Bull Market Peak

Taking into account the historical trend of lengthening cycles, Rekt Capital suggests that Bitcoin could spend between 280 and 350 days above its previous ATH before reaching its next market peak. This projection is based on adding the historical increase of 14 to 35 days to the initial bull market peak range of 266 to 315 days.

If this pattern holds true, the Bitcoin bull market peak could potentially occur between mid-December 2024 and mid-February 2025.

Understanding the potential timing of Bitcoin’s bull market peak is crucial for investors and traders looking to maximize their returns and manage risk effectively. By considering historical patterns and the lengthening of cycles, market participants can make more informed decisions about when to enter or exit positions.

However, it is essential to note that past performance does not guarantee future results, and the cryptocurrency market is known for its volatility and unpredictability. Investors should always conduct thorough research, consider their risk tolerance, and employ sound risk management strategies when engaging with the market.

You may also be interested in:

- FLOKI and PEPE Coin Prices Pumping: Here’s Why

- Uniswap Faces Crucial Test at Former Resistance: Analyst Shares How Low Can UNI Plummet

- Crypto Whales Opt For the InQubeta (QUBE) Presale Over Uniswap (UNI) and Bonk (BONK), What Do They Know?

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.