Uniswap (UNI), the governance token of the popular decentralized exchange, has been on a rollercoaster ride in recent weeks. According to renowned analyst Rekt Capital, UNI is currently in the process of retesting a key resistance level as a new source of support, which could have significant implications for the token’s future price action.

What you'll learn 👉

Flipping Resistance into Support

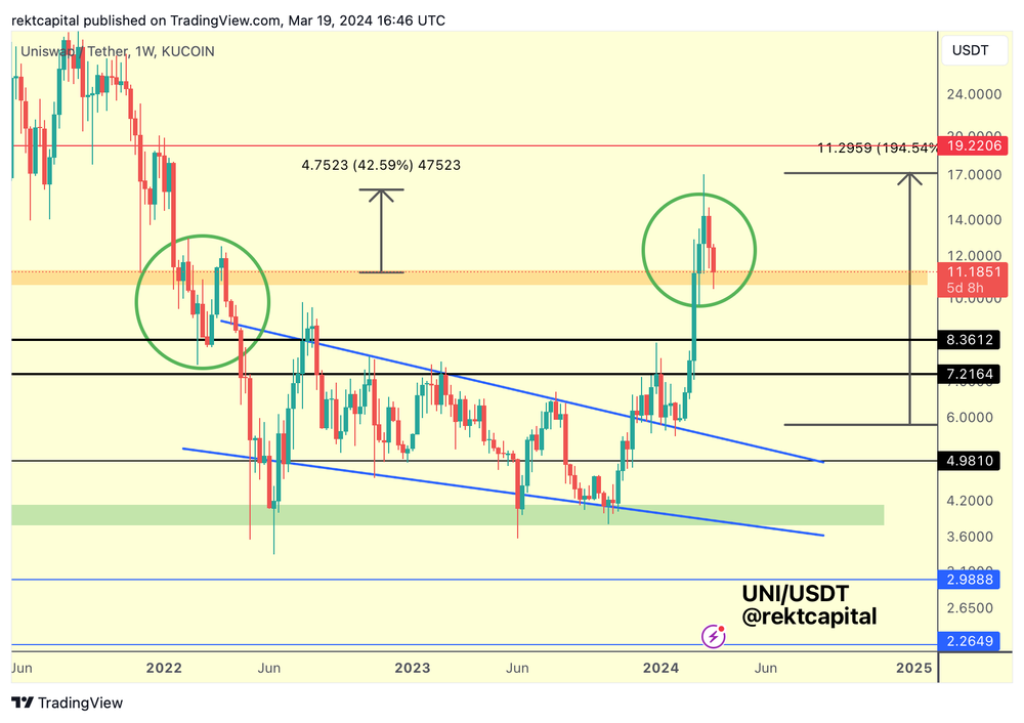

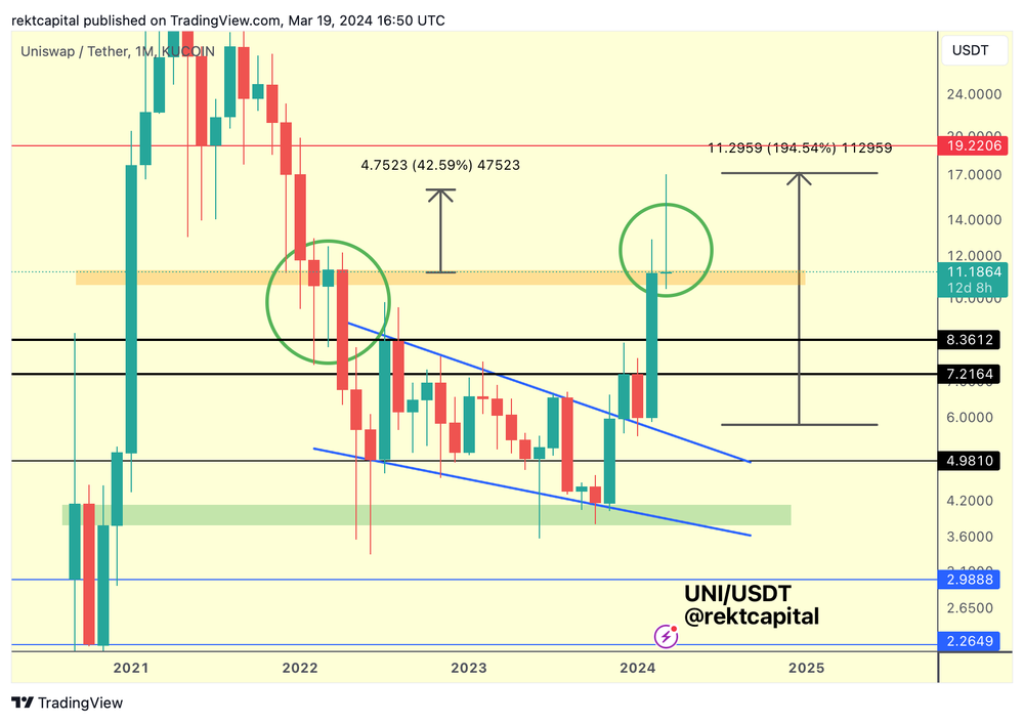

Last week, Rekt Capital highlighted how UNI was positioning itself for a retest of the orange region that it had previously broken above. This week, the analyst provided an update, confirming that UNI is indeed in the process of retesting this former area of resistance as a new support level.

The green circle on the chart showcases how this region acted as a point of rejection in early 2022. However, the current green circle demonstrates how this same price area could potentially flip into a base from which UNI might be able to springboard in the future.

Potential for Volatility in the Monthly Timeframe

While the retest of the former resistance area as support is a bullish sign, Rekt Capital warns that the monthly timeframe suggests this retest could become more volatile. An attempt at a similar retest in early 2022 ultimately failed, with the support area indicating the possibility of significant downside wicks during the process.

If UNI is going to undergo a volatile retest this time around as well, Rekt Capital points to the black $8.36 level as a potential region for the price to tag. Furthermore, there is scope for the price to wick even lower, into the black-and-white range of $7.21–$8.36.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Impact of the Bitcoin Pre-Halving Retrace

The potential for a volatile retest of the former resistance area as support for UNI is particularly relevant in the context of the ongoing Bitcoin pre-halving retrace. If this retrace continues, Rekt Capital suggests that the scenario of UNI tagging the $8.36 level or even wicking lower into the $7.21–$8.36 range is worth keeping in mind.

As Uniswap (UNI) navigates this critical juncture, investors and traders will be closely monitoring the token’s price action to see if it can successfully flip the former resistance area into a new support level. A successful retest could pave the way for future price appreciation, while a failure to hold this level may lead to further downside pressure.

It is essential for market participants to consider the potential impact of the ongoing Bitcoin pre-halving retrace on UNI and other altcoins. By staying informed and adapting to changing market conditions, investors can make more strategic decisions and better navigate the complex world of cryptocurrency trading.

You may also be interested in:

- Elite Crypto Analyst Shares Top 10 Mistakes To Avoid This Bull Run

- Shiba Inu Team Member Predicts “Miracle Recovery” and New SHIB ATH Before Bitcoin Halving

- Crypto Whales Monitor Rising Altcoins Scorpion Casino, Memeinator & Scotty AI As They Project 100x Gains

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.