According to Santiment, the leading analytics firm in the crypto space, September has been a month of highs and lows for the cryptocurrency market. This comprehensive report delves into the various factors that have shaped the market’s trajectory.

What you'll learn 👉

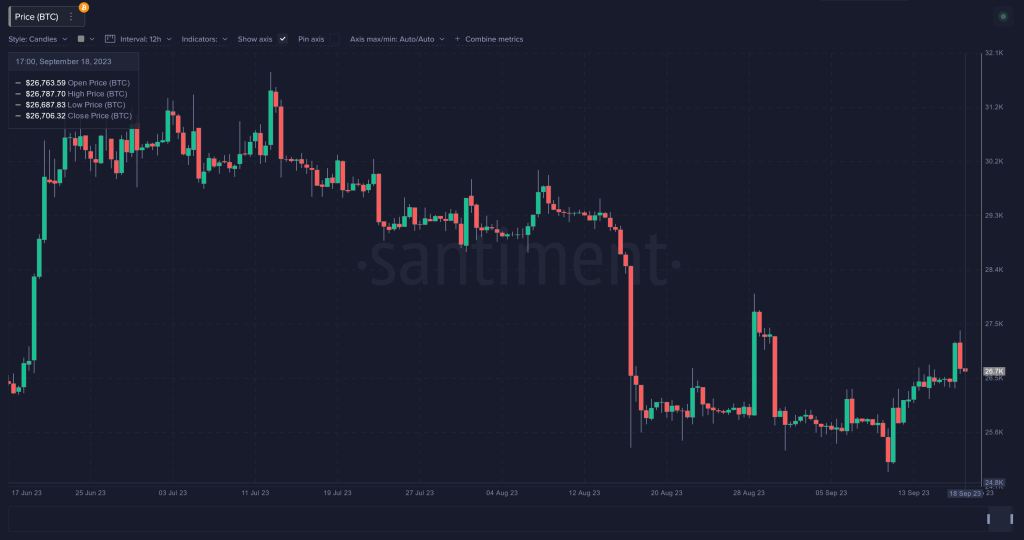

A Rocky Start to September

The month kicked off on a shaky note, with Bitcoin (BTC) experiencing a brief surge to $28,000 on August 29th, thanks to Grayscale’s legal triumph over the SEC. However, this optimism was short-lived. By September 1st, the price plummeted back to $25,000, leaving investors and traders in a state of uncertainty.

Source: Santiment – Start using it today

Mild Recovery and Altcoin Surprises

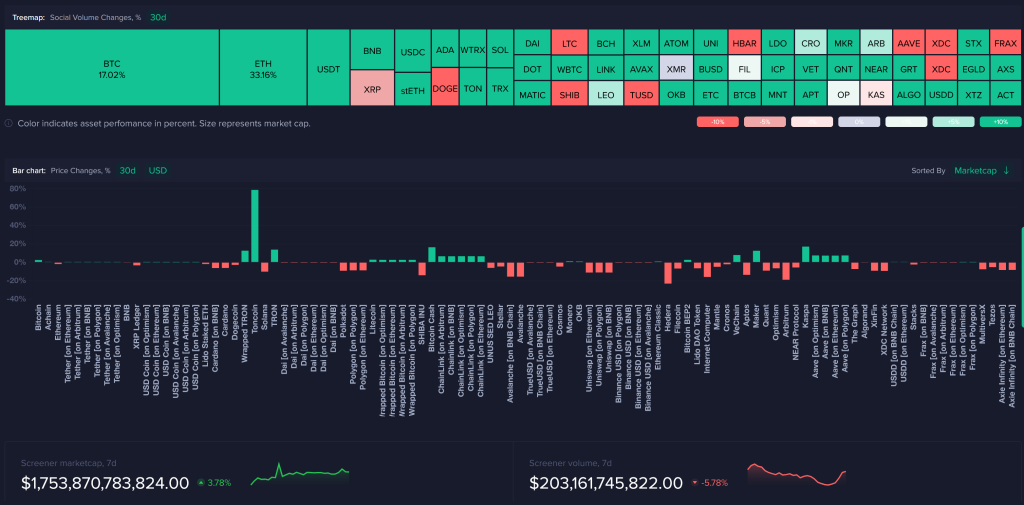

Since the initial drop, the market has seen a modest recovery, but nothing substantial enough to excite investors. Bitcoin Cash (BCH) has been a notable exception, gaining traction due to its potential inclusion in upcoming ETFs. Meanwhile, Toncoin has emerged as the month’s standout performer, soaring by more than 105% since August.

Trader Sentiment: A Mixed Bag

The lackluster price action has led to growing impatience among traders. Santiment’s data reveals a split in market sentiment. While some are optimistic about BTC reclaiming the $30,000 mark, others are astonished that the price has managed to hover above $25,000 amid a slew of negative news.

Binance’s Trust Issues

Adding to the market’s woes is the eroding consumer trust in Binance, the world’s largest crypto exchange. Recent SEC audits have cast doubts over the exchange’s collateralization, causing ripples of concern throughout the crypto community.

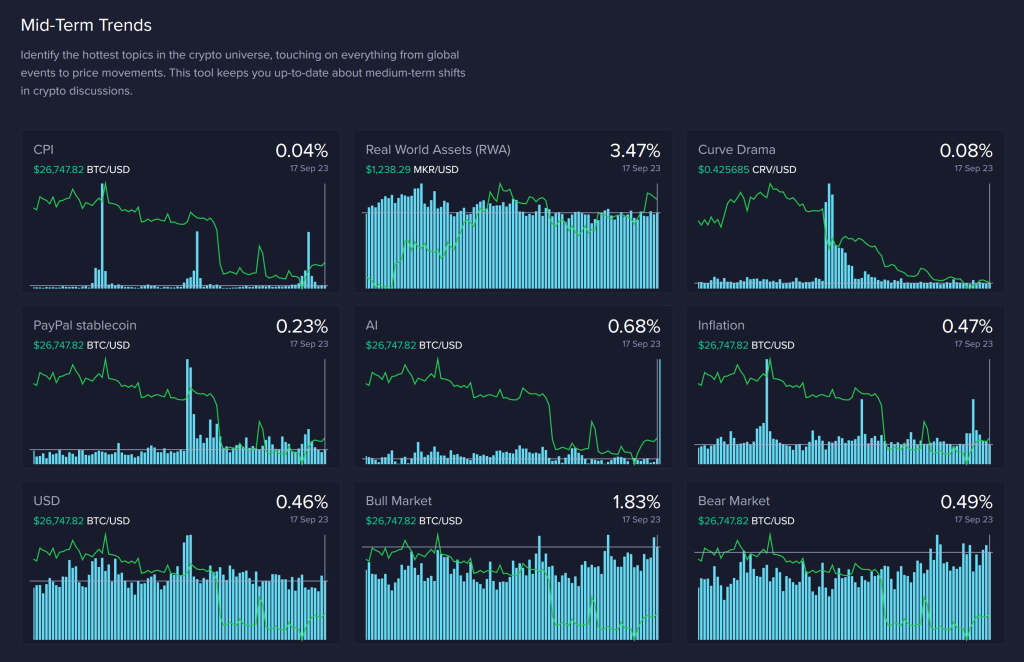

Economic Indicators and Market Reactions

On a positive note, the recent Consumer Price Index (CPI) report from the U.S. has indicated a slightly faster-than-expected economic growth, which seems to have given the market a minor boost. Conversations around CPI and inflation have surged, often coinciding with market lows, which could be a silver lining.

The Bull vs. Bear Debate

Interestingly, discussions labeling the current state as a ‘Bear Market’ have been rising at a faster rate than those favoring a ‘Bull Market.’ This increased vocalization from both camps could historically be a sign of market vitality, as apathy is the real enemy.

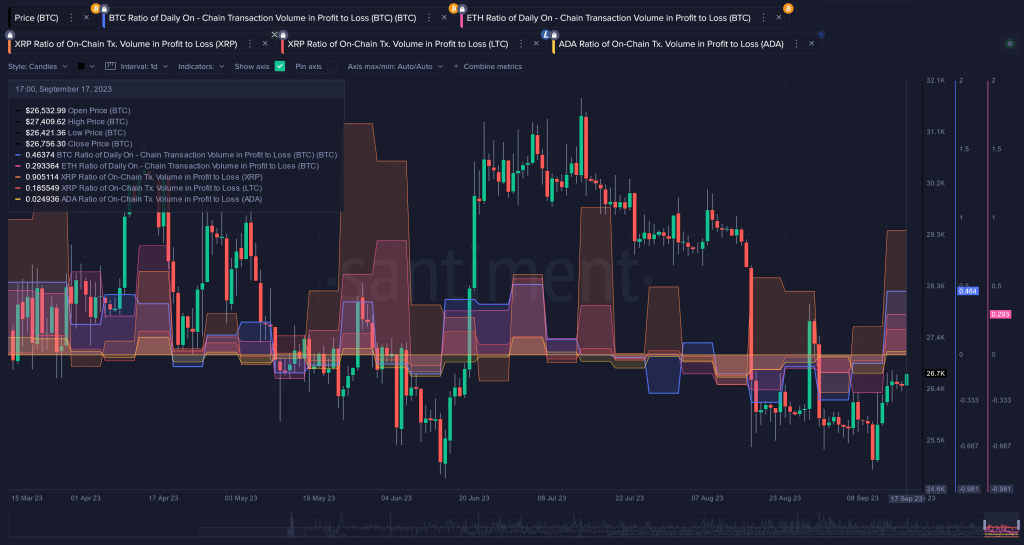

Profit-Taking Among Top Assets

As markets began to rebound last week, Bitcoin saw its highest ratio of profit-taking to loss-taking since early July. This could be a red flag, signaling that the market might be running out of steam in the short term.

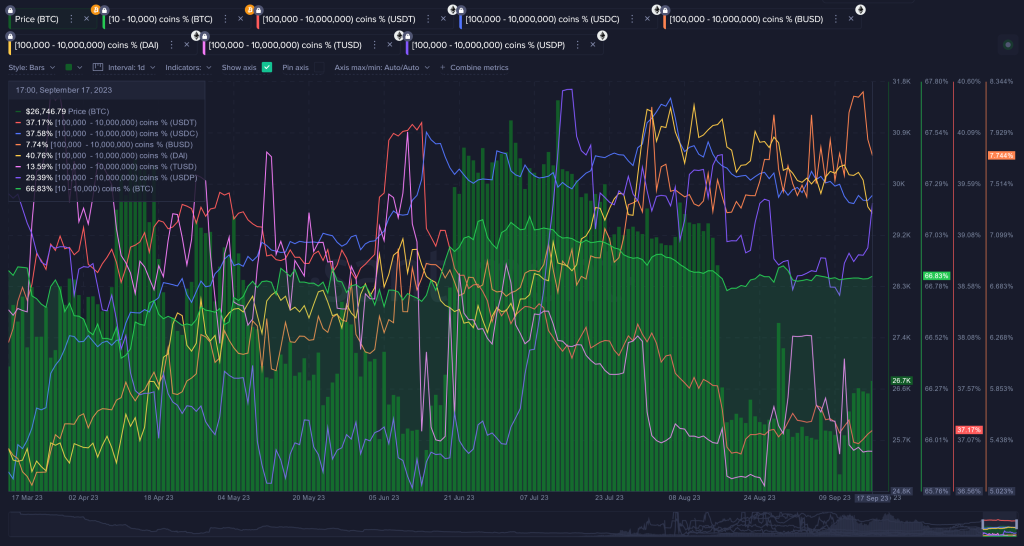

Bitcoin’s Diminishing Dominance

The ratio of discussions related to Bitcoin versus other crypto projects has returned to average levels. Earlier in the year, Bitcoin dominated the conversation, but its stagnant price performance has shifted the focus towards more speculative assets.

Whale Watch

Whale activity has remained relatively flat, with addresses holding between 10 to 10,000 BTC making up just over two-thirds of Bitcoin’s total supply. This lack of movement suggests that large investors are currently in a holding pattern.

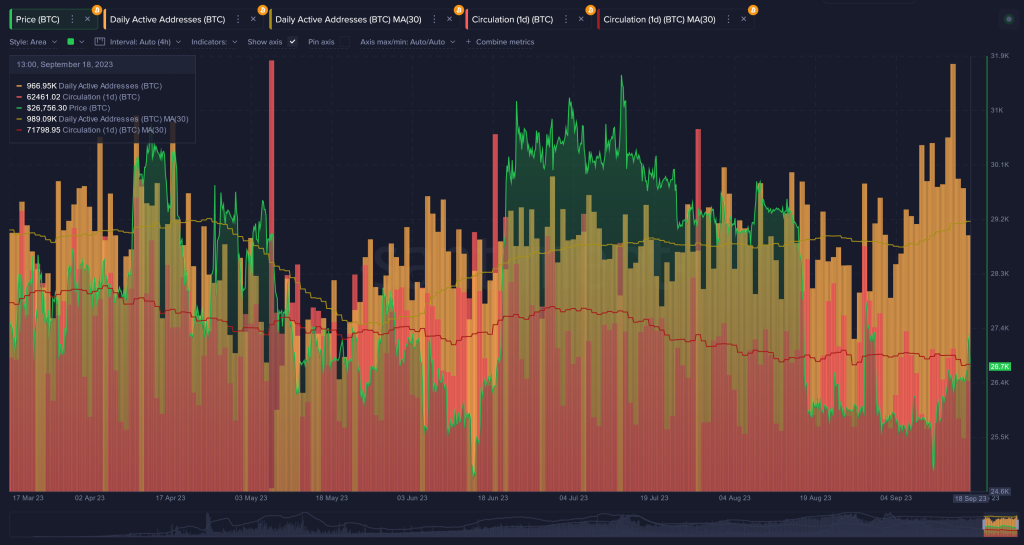

Network Activity and FTX Liquidations

In a noteworthy development, there has been a significant uptick in active Bitcoin (BTC) addresses on the network. This pattern mirrors a similar increase observed in Ethereum (ETH) addresses last week. The prevailing theory attributes this surge to the initiation of FTX liquidations, which were recently greenlit.

As a result, numerous addresses that had been dormant for nearly a year are now re-engaging with the network. While this reactivation of old coins is a positive sign, indicating their re-entry into active trading pools, it’s crucial to note that this surge may be short-lived, lasting only until these coins are fully liquidated from FTX’s official wallets.

The impact of this activity is particularly evident on the Ethereum network. Just a week ago, the average “dollar age” of ETH held in wallets was 518 days; it has now dropped sharply to 494 days. This metric, known as the mean dollar age curve, is often considered a leading indicator of potential bull runs.

The hope is that this downward trend continues, signifying that older coins are becoming “younger” as they re-enter circulation. Whether this is a temporary blip due to FTX liquidations or the precursor to a larger market movement remains to be seen.

Altcoin Trends and Anomalies

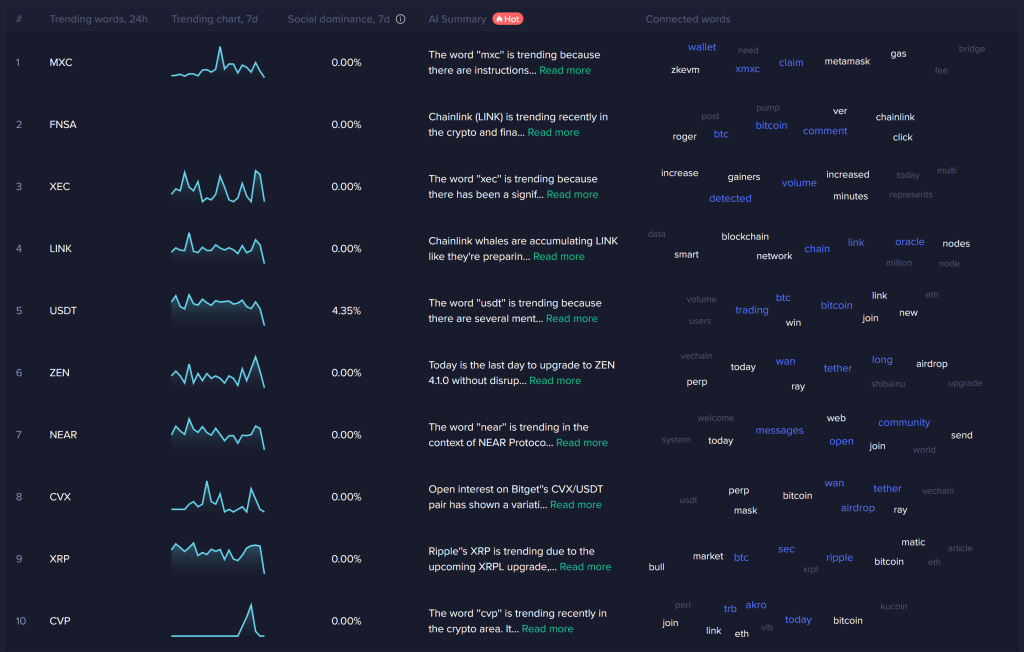

Santiment’s new Trending Tokens page and Anomaly Finder matrix offer insights into rising assets and unusual activity. Tokens like LINK, USDT, and XRP are currently trending, while projects like Frontier and Powerpool are experiencing high levels of unusual activity.

As we approach the end of September and look forward to Bitcoin’s next halving in less than six months, the market remains a complex web of metrics, sentiments, and external factors. Stay tuned for further updates as we continue to monitor these evolving conditions.

For more in-depth analysis and metrics, visit Santiment’s platform and explore their range of analytical tools.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.