If you are interested into cryptocurrencies such as Bitcoin, Litecoin etc., there is just a small chance that you have not heard about decentralization. It is one of the most important features of the digital currency. The word decentralized can have different meanings, but let’s take a look at what it means in the crypto world. Before we go there, we need to know what is the centralized currency.

What you'll learn 👉

Centralized Currency

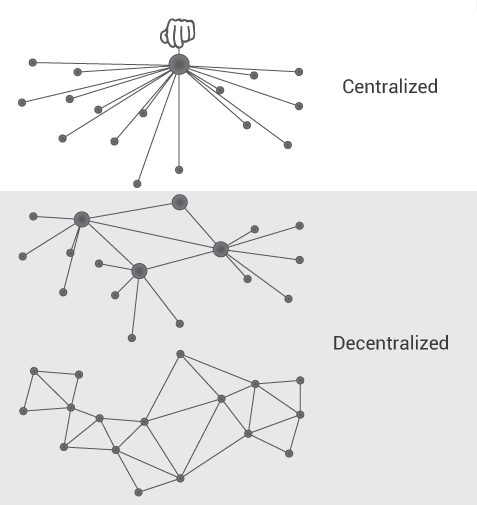

By definition, centralization is “the concentration of control of an activity or organization under a single authority.” Essentially, if something is centralized, there’s a single point that does all of the work involved in any given action. In the world of centralized currency it means that is controlled by the nation’s central bank. Each fiat currency such as USD or EUR is controlled by the central bank, or in this particular case FED or ECB respectively. All the decisions on the currency, such as increase or decrease of the supply, rely upon their decision which is made in accordance with their goals. The fiat currency is represented physically in the form of paper bills, coins etc.

Depending on their current needs, the central bank can decide to print new money, pump it into economy by purchasing securities, which will decrease the value of the currency or reduce the supply of cash by selling T-bills and T-bonds. Basically, it means that the value of money in your pocket depends on the decisions of your central bank. As long as they work in your best interest there are no problems, but it is not always like that.

Decentralized Currency

Accordingly, by definition decentralization is “the movement of departments of a large organization away from a single administrative center to other locations.” It means that if something is decentralized, there are multiple points that do the work.

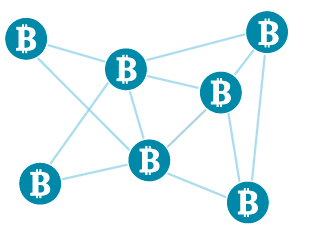

A decentralized currency has no single entity deciding the aspects of the currency. Cryptocurrencies are great example of decentralization. They use decentralized control as opposed to centralized electronic money and central banking systems. The decentralized control of each cryptocurrency works through a blockchain, which is a public transaction database, functioning as a distributed ledger. Bitcoin, created in 2009, was the first decentralized cryptocurrency. Since then, numerous other cryptocurrencies have been created. These are frequently called altcoins, as a blend of alternative coin.

Opposite to centralized currency, where central bank decides on the supply of money, decentralized currency like Bitcoin have total supply of twenty-one million bitcoin which are set to be released at a predictable rate. No more coins can ever be issued. No single institution is relied upon to create or distribute Bitcoin. Miners discover new coins, and are rewarded with the opportunity to spend them first. Unmined Bitcoin are accessible by anyone who commits the time and energy required to discover them. Its multiple, consumer driven, points of distribution keep Bitcoin secure from any single point of failure. When spent, mined coins will be injected directly into Bitcoins growing economy.

?You can also read review of Breadwallet, Armory wallet review and Edge (aka Airbitz) wallet guide.

The value of cryptocurrency is represented by the coin which is basically a computer code, extremely difficult to reproduce but very easy to verify. Each coin has two keys. There is a public key that is also known as your “address” or “addy”. This is a unique set of numbers or QR code that you show to people in order for them to send you Bitcoin payments, and there is private key that shows the blockchain network that you own the Bitcoin in your wallet.

Cryptocurrency is stored in an encrypted wallet and can be bought, held, sold or traded via peer-to-peer and/ or established cryptocurrency exchange services. Cryptocurrency’s value is determined by the normal supply-and-demand factors of the markets, without a central authority having influence over it.

Benefits

There are several important advantages of decentralized currencies and here are some:

- Low Fees – Transferring money via traditional banking system can be really expensive. Banks and credit card processing companies charge huge fees for their services. But with decentralized currencies, payments are borderless and cost a friction or nothing.

- No third party – You are the master of your money. You can keep it in your wallet and use it as per your wishes. There is no third party involved like a bank on whom you need to trust.

- Fast Settlements – Because there is no middle man or third party, settlements with cryptocurrencies are fast. Underlying blockchain technology removes delays, payment of fees and a host of other third party approval that might have been present. Due to the peer-to-peer nature of the networking the settlement is immediate and can be completed for a fraction of time and expense that it would have taken a traditional transfer.

- Highly secured – All your transactions will be secure as it is using NSA created cryptography. It is next to impossible for any person other than the owner of the wallet to make any payment from the wallet, unless they were hacked which there are many ways to protect yourself from.

- Anonymous – Some coins can help you stay anonymous but contrary to popular belief, not all of them can. Bitcoin is pseudonymous which means people won’t know exactly who you are on the blockchain but they can get some information from it.

- Identity Theft – When you give your credit card to a merchant, you give him or her access to your full credit line, even if the transaction is for a small amount. Credit cards operate on a “pull” basis, where the store initiates the payment and pulls the designated amount from your account. Cryptocurrency use a “push” mechanism that allows the cryptocurrency holder to send exactly what he or she wants to the merchant or recipient with no further information.

- Easy Access –With cryptocurrency, anyone can access it. You don’t need business account or withdrawal software. A mobile phone and internet is required to get started.

Final Words

All the advantages do not mean that there are no risks involved in decentralized currencies. Just like anything else financially, they are not perfect and there are drawbacks. For most people it is difficult to understand how it is all functioning. Cryptocurrencies are not yet widely accepted and due to lack of users’ knowledge are prone to hacking.

There is also a possibility of losing your wallet. If you have stored the money in the form of digital currency on your phone or computer, you better remember your password and not lose those devices. Losing your coins means you won’t be able to retrieve it, even with the help of legal assistance.

Please keep in mind that not all cryptocurrencies are decentralized. There are also great examples of centralized cryptocurrencies that are achieving great thins such as Ripple, NEO, IOTA and others.