Recent market activities have raised concerns about the potential for a significant price drop in Ethereum (ETH). Two key events have caught the attention of crypto analysts and investors: a high-leverage short position by Frog Nation’s former CFO, sifu.eth, and the sudden sale of a large amount of ETH by a wallet that had been dormant for four years. This article delves into the details of these events and what they could mean for the future of Ethereum.

What you'll learn 👉

High-Leverage Short by Frog Nation’s Former CFO

According to data from Perps Watcher, sifu.eth, the former CFO of Frog Nation, has recently increased his short positions on Ethereum through the Kwenta platform. The short position is leveraged at 4.14x, with an average entry price of $1,626.16. The total position size is nearly $20 million, and the liquidation price is set at $1,990.75.

Implications

High-leverage short positions like this can be indicative of a bearish outlook on the asset. If the price of Ethereum falls below the entry price, the short position would yield significant profits. However, it’s worth noting that high-leverage positions also come with high risks. If the price of Ethereum rises above the liquidation price, the position would be liquidated, resulting in a loss.

Dormant Wallet Springs to Life

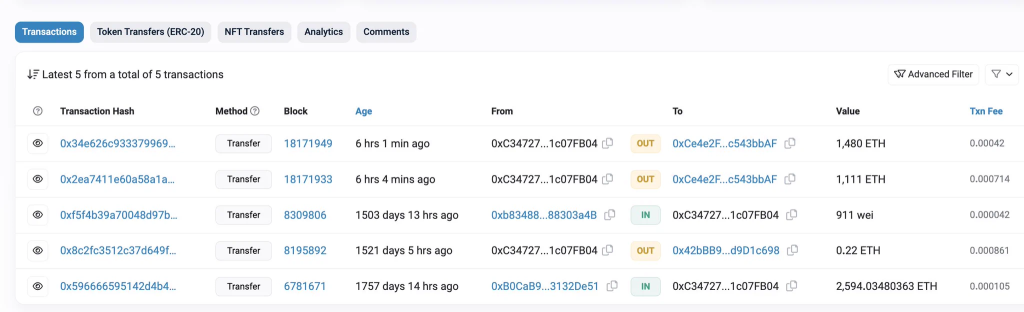

In another intriguing development, a wallet that had been dormant for four years recently sold all of its holdings—2,591 ETH—for $4.18 million in stablecoins. The transaction occurred just six hours before it was reported by Lookonchain.

Implications

The sudden sale of a large amount of Ethereum by a long-dormant wallet could be a sign that early adopters or “whales” are looking to cash out, possibly anticipating a downturn in the market. Such large sales can also trigger panic selling, further driving down the price.

Combined Impact

Both events—high-leverage shorts and large sales from dormant wallets—could be precursors to a bearish trend for Ethereum. While these actions alone do not guarantee a price drop, they do add to the growing concerns about Ethereum’s short-term price stability. Investors should exercise caution and closely monitor market developments.

Conclusion

While the crypto market is notoriously volatile and unpredictable, the recent activities by sifu.eth and the dormant wallet have raised red flags. Both seem to indicate a bearish sentiment, which could potentially lead to a significant price drop in Ethereum. As always, investors are advised to conduct their own research and exercise due diligence when trading in volatile markets.

Check $RECQ Meme Coin

ICO stage, offering tokens at a discounted price

Facilitates a smooth and efficient economy within the arcade, supporting both arcade and in-game transactions.

Grants access to a diverse range of gaming experiences in the Rebel Satoshi Arcade,

Contributes to a decentralized, community-driven RebelSatoshi platform that integrates gaming with elements of revolution, freedom, and unity, appealing to users who value such principles.