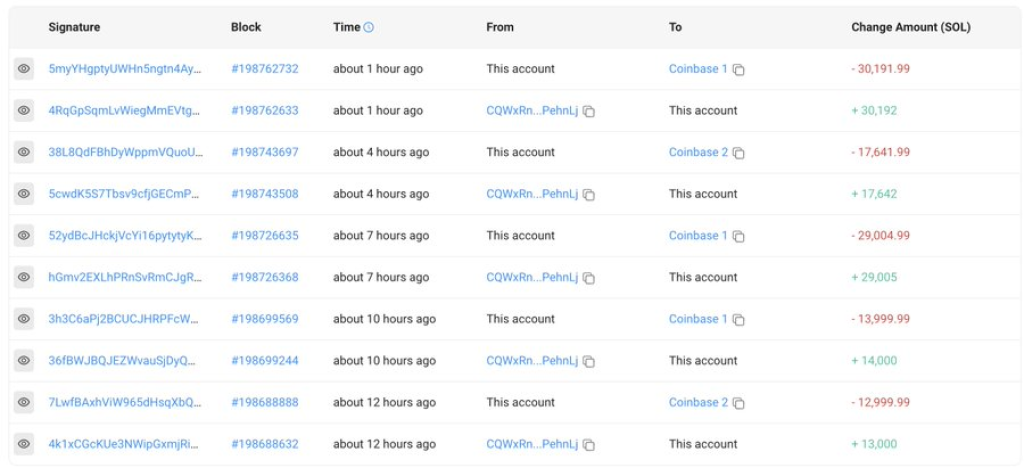

A massive whale, identified as “6brjeZ,” has made a significant move in the Solana (SOL) cryptocurrency market, depositing a staggering 681,746 SOL tokens, equivalent to $9.54 million, onto exchanges. The transfer occurred 15 hours ago, with the majority of the funds, 576,009 SOL ($8.2 million), finding their way into prominent platforms like Binance, Coinbase, and Kraken.

This notable event comes amidst an ongoing legal battle between the Securities and Exchange Commission (SEC) and Coinbase, where SOL has been labeled as an unregistered security. However, the Solana Foundation strongly refutes this classification and remains firm in its belief that SOL does not qualify as a security. It’s worth noting that the SEC has also implicated other cryptocurrencies, including Cardano (ADA) and Polygon (MATIC), in its recent lawsuits against various crypto exchanges.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +The ramifications of holding or trading securities vary depending on the specific circumstances. Engaging in insider trading, which involves trading securities while possessing material nonpublic information and breaching a duty to withhold such information, is considered illegal. The repercussions for insider trading include hefty fines, imprisonment, the need for restitution, and severe damage to one’s reputation and career.

Adding to the mounting pressure, Robinhood, a prominent trading platform, has announced that it will delist SOL, ADA, and MATIC tokens on June 27, 2023, due to regulatory pressure from the SEC. As a result of the SEC’s identification of these tokens as securities, their prices have experienced a significant decline in recent days.

These recent developments in the Solana ecosystem and the wider crypto landscape have left investors and enthusiasts closely monitoring the situation. The whale’s substantial deposit of $SOL tokens onto exchanges highlights the ongoing controversy surrounding SOL’s security classification, while the impending delisting of SOL, ADA, and MATIC tokens by Robinhood has further intensified the regulatory concerns in the market. As the legal battle unfolds, stakeholders eagerly await further updates regarding the outcome and potential implications for the future of these cryptocurrencies.

Technical Analysis: Solana (SOL) Price Declines Amidst Regulatory Pressure

The price of Solana (SOL) has experienced a significant decline today, reflecting the regulatory pressures faced by the cryptocurrency. As of the latest data, SOL is currently priced at $14.48, with a 24-hour trading volume of $1,080,985,188. This indicates a substantial decrease of -21.86% in the past 24 hours and a -31.59% decline over the past 7 days.

With a circulating supply of 400 million SOL tokens, Solana currently holds a market capitalization of $5,758,889,0391. These figures demonstrate the impact of recent events, including the SEC lawsuit against Coinbase and the impending delisting of SOL, ADA, and MATIC tokens by Robinhood, on the market sentiment surrounding SOL.

From a technical analysis perspective, market analysts are closely monitoring the support levels for SOL. The next significant support level is anticipated to be around $101. Should Solana’s price continue to decline, the $10 level is considered crucial and will likely attract considerable attention from traders and investors.

As the regulatory landscape continues to evolve, and with SOL’s classification as a security still under dispute, it remains crucial for market participants to exercise caution and closely monitor the price movements of SOL and related cryptocurrencies.

Disclaimer: This article is for informational purposes only and should not be considered financial or legal advice. Please conduct your own research and consult with professionals before making any investment decisions.