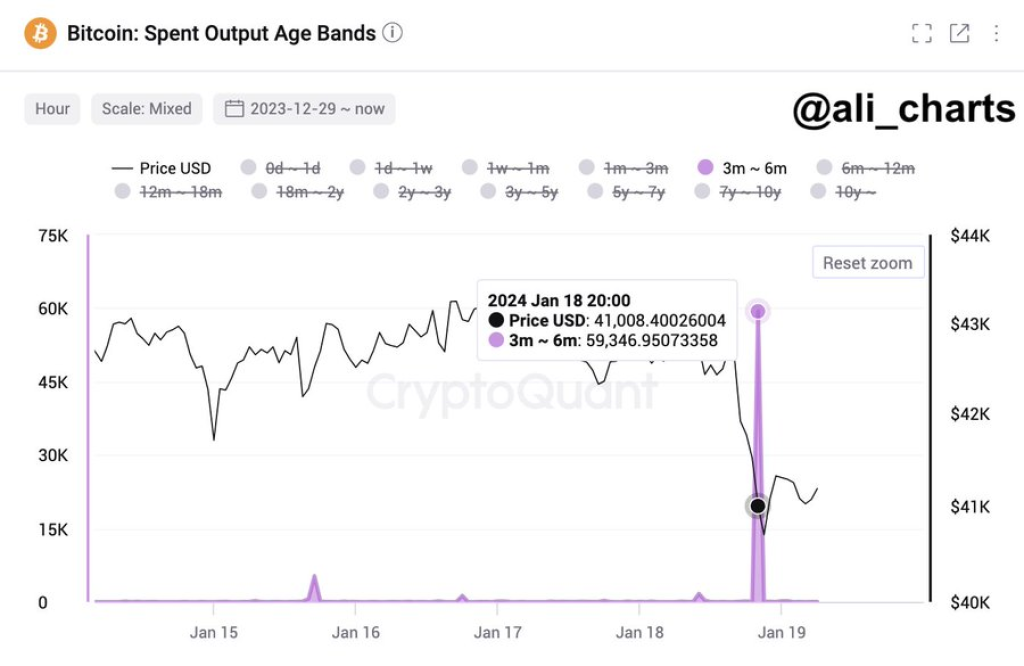

According to analyst Ali, a staggering 59,000 BTC was recently sold by large investors who initially purchased around $26,000. This sale netted an impressive 57.69% profit equating to total gains of approximately $885 million.

Continuing Price Weakness

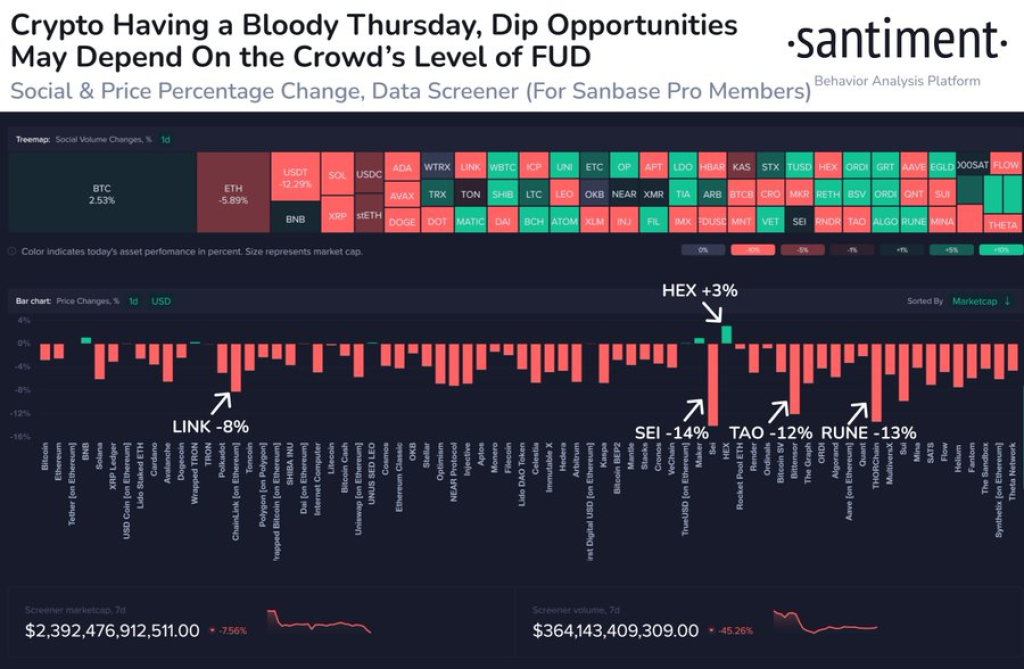

As Santiment points out, crypto continues to see concerning price declines with total market caps falling 7.5% over the past week. The recent Bitcoin ETF approvals appear to be a “buy the rumor, sell the news” event contributing to weakness.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Hope for Potential Rebound

However, Santiment offers a glimmer of hope in pointing out that excessive bearish sentiment can sometimes trigger a major bounce. As panic selling sets in and negativity reaches an apex, it establishes the conditions for a reversal by washing out the weak hands. The market bottoms when the selling has climaxed.

Source: Santiment – Start using it today

As Santiment notes, “If traders begin to panic, their big sell-offs and #bearish sentiment may trigger a bounce.” In other words, there is a chance the intensity of the current selling could exhaust itself, allowing savvy dip-buyers to come in and spark a relief rally. These bounces induced by overwhelming pessimism tend to be fast and technical in nature.

So while heavy dumping continues currently, Santiment suggests keeping an eye out for capitulation signals. If price action shows evidence of panic reaching a crescendo, a bounce could swiftly materialize. However, pinpointing the precise bottom is difficult.

You may also be interested in:

- Choppy Waters Ahead? Here’s the Risk of a Pre-Halving Bitcoin Selloff

- Solana (SOL) Turns Bullish Across All Timeframes but Analyst Insists This Resistance Must Break First

- BlockDAG Unveils Miners for Profitable Mining as Bitcoin’s Funding Rate Hits 66%, and Litecoin Expects a Rally

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.