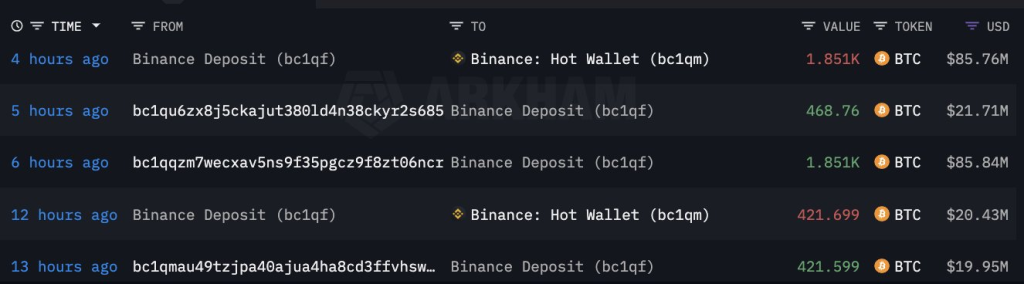

Amidst the hype surrounding the approval of the first spot Bitcoin ETFs in the US, one whale appears to be capitalizing on the market frenzy by cashing out over $74 million in BTC profits. According to on-chain data analyst Lookonchain, a single entity withdrew 2,742 BTC from Binance on December 29th, 2022, worth approximately $53 million at time of transfer.

Taking Profits After ETF Launch

This Bitcoin withdrawal came just months after the whale had deposited the same amount of BTC (2,742 coins worth $127.5 million at time of deposit) into Binance right as trading opened for the ProShares Bitcoin ETF (BITO). By Lookonchain’s calculations, the average purchase price for the whale’s BTC was around $19,337. Selling those coins at a price of over $53 million enabled the trader to lock in handsome returns.

“A whale deposited all 2,742 $BTC($127.5M) to #Binance to take profits after the #Bitcoin spot ETF opened trading,” explained Lookonchain about the on-chain transfers. The ability to time market moves around the ETF hype demonstrates this whale’s savvy in profiting from Bitcoin’s momentum.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Undermining Long-Term Confidence

While ETFs have been hailed for increasing mainstream crypto adoption, this whale’s actions point to a more pessimistic perspective. Rather than holding Bitcoin for future gains, the rapid exit with $74 million in profits hints at a lack of long-term conviction.

Such a massive BTC sell-off also produces negative pressures on price. If additional large holders join the selling spree, it could spiral momentum further downwards.

Bearish Indicators Emerge

So while the approval of spot BTC ETFs opened new avenues for crypto investments, the actions of whales tell a different story. Major liquidations following the ETF hype suggest lower confidence in continued uptrends.

As more entities look to cash out profits rather than sustain coins, bearish indicators emerge for Bitcoin’s trajectory. And the impacts have only begun, with this $74 million transfer setting precedents for other opportunistic holders.

Unless buyers step in to support declining prices, Bitcoin may end up as the latest victim of “sell the news” mentalities. For an asset class frequented by short-term speculators, even the most promising developments can flip to bearish catalysts when hype diminishes. This whale’s profits may mark only the beginning.

You may also be interested in:

- Bitcoin Fails To Rally On ETF News Due To 4 Key Factors; How To Capitalize On April’s BTC Halving With This Token

- 22,727 Kaspa (KAS) Will Make You Rich: Analyst

- Ethereum ($ETH) Steals Bitcoin’s Thunder On SEC ETF Approval By Surging 10% – Is $3,000 Coming This Week While $BTCMTX Continues Rising?

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.