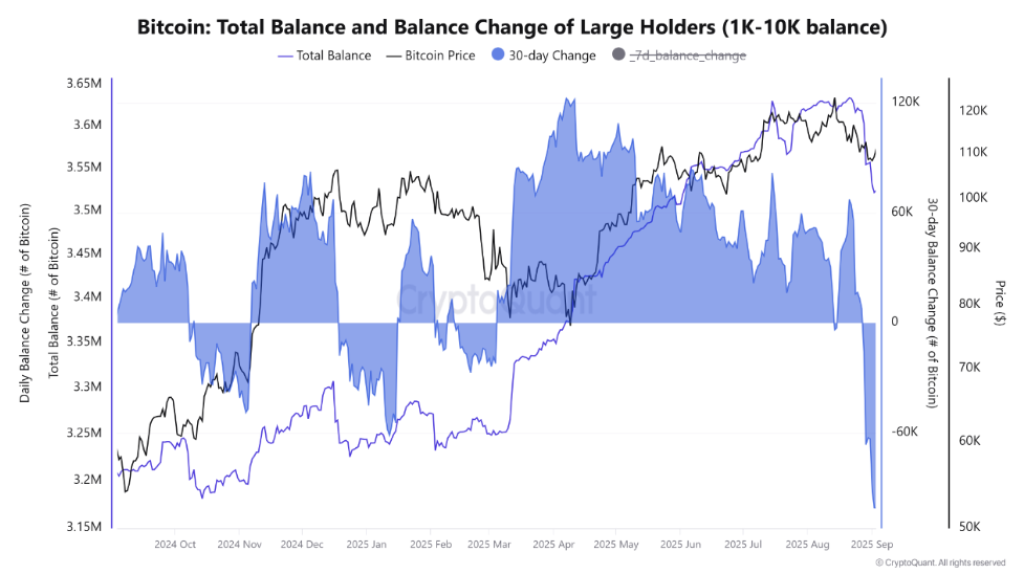

Bitcoin is under pressure today, holding near the $110,000 mark, as new on-chain data reveals one of the largest whale distribution events in years. According to analyst @caueconomy on CryptoQuant, large holders with 1,000–10,000 BTC have cut down their reserves by more than 100,000 BTC over the past 30 days.

Whale Distribution Hits Hard

The chart shows that whales, who collectively hold millions of BTC, have sharply reduced their exposure in August and September. The 30-day balance change has plunged into negative territory, marking the steepest decline since 2022.

- Total balance of whales: dropped from around 3.55M BTC to below 3.45M BTC.

- 30-day change: currently near –100,000 BTC, showing a rapid selloff.

- Bitcoin price reaction: price slipped under $108,000 as this selling pressure mounted.

This distribution trend signals that large investors are locking in profits or de-risking their positions, which has historically been a bearish sign in the short term.

Price Structure Under Pressure

Bitcoin’s price (black line) has closely followed these whale moves. Whenever whales accumulated (highlighted in the blue shaded areas above zero), BTC rallied higher. Conversely, when they distributed, the market faced corrections.

The current downturn in whale balances coincides with the recent slide from $120,000 highs to around $110,000, suggesting that whales are actively capping Bitcoin’s momentum.

For now, the crypto market remains in downturn mode, with altcoins showing weakness across the board. Bitcoin’s ability to hold near $110,000 will be key. If whale selling continues, we could see further pressure on support levels in the $105,000–$108,000 zone.

On the flip side, if this distribution slows and demand picks up, Bitcoin could attempt to reclaim the $115,000–$118,000 resistance range.

Read also: Here’s How XRP Price Could Hit $637 if Bitcoin Reaches a $500 Trillion Market Cap

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.