Crypto expert John Squire has highlighted how Wall Street giants are looking to offer XRP ETFs. These XRP ETFs are expected to attract billions of dollars in inflows from Wall Street investors, similar to the BTC and ETH ETFs. Meanwhile, Paydax Protocol (PDP) is providing an opportunity for Wall Street to unlock fresh capital from these XRP ETFs.

What you'll learn 👉

Paydax Offers An Opportunity To Unlock Liquidity For Illiquid Assets Like XRP ETFs

Wall Street investors have long struggled to utilize illiquid assets, such as XRP ETFs, to secure loans and access new capital. As a result, Wall Street investors have always had to sell these assets just to fund new ventures or explore new opportunities. However, Paydax Protocol (PDP) is offering these Wall Street investors a better option.

The platform accepts real-world assets (RWAs), such as XRP ETFs, as collateral, enabling Wall Street investors to access fresh capital while protecting their long-term investments. Loans on the platform have:

- A loan-to-value (LTV) ratio of 97%.

- A fixed interest rate of between 5% and 7%.

- Transparent fee structure.

- Automated safeguards to reduce the risk of sudden liquidation.

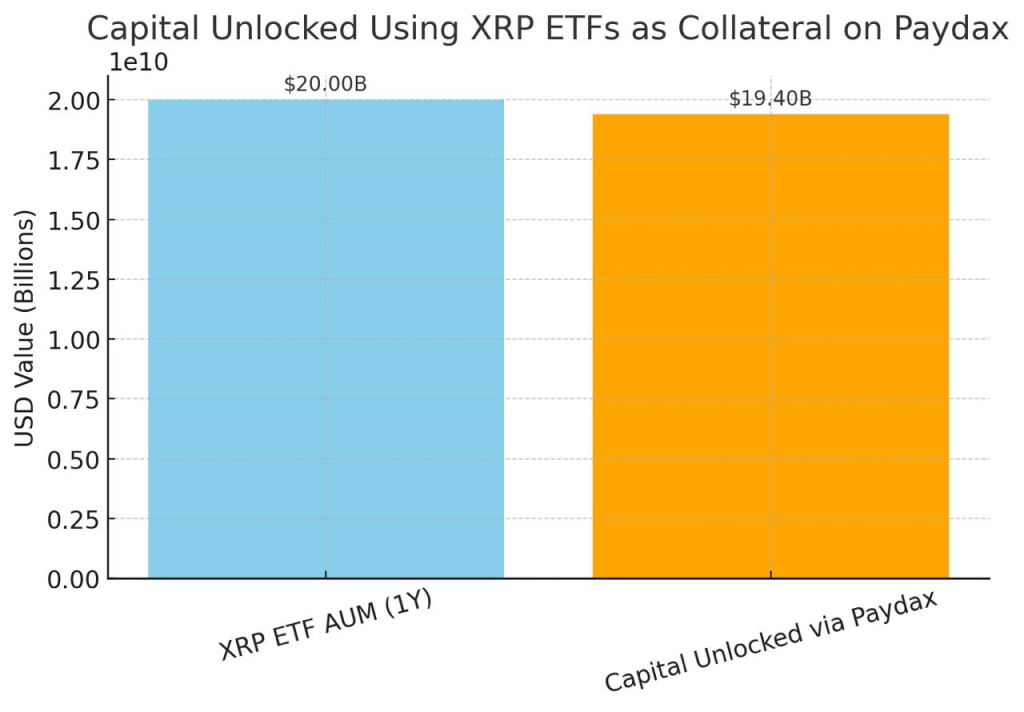

Based on projections that the XRP ETFs could hit $20 billion in assets under management (AuM) in a year, this means that these funds alone could unlock up to $19.40 billion in fresh liquidity.

Broad Collateral Support

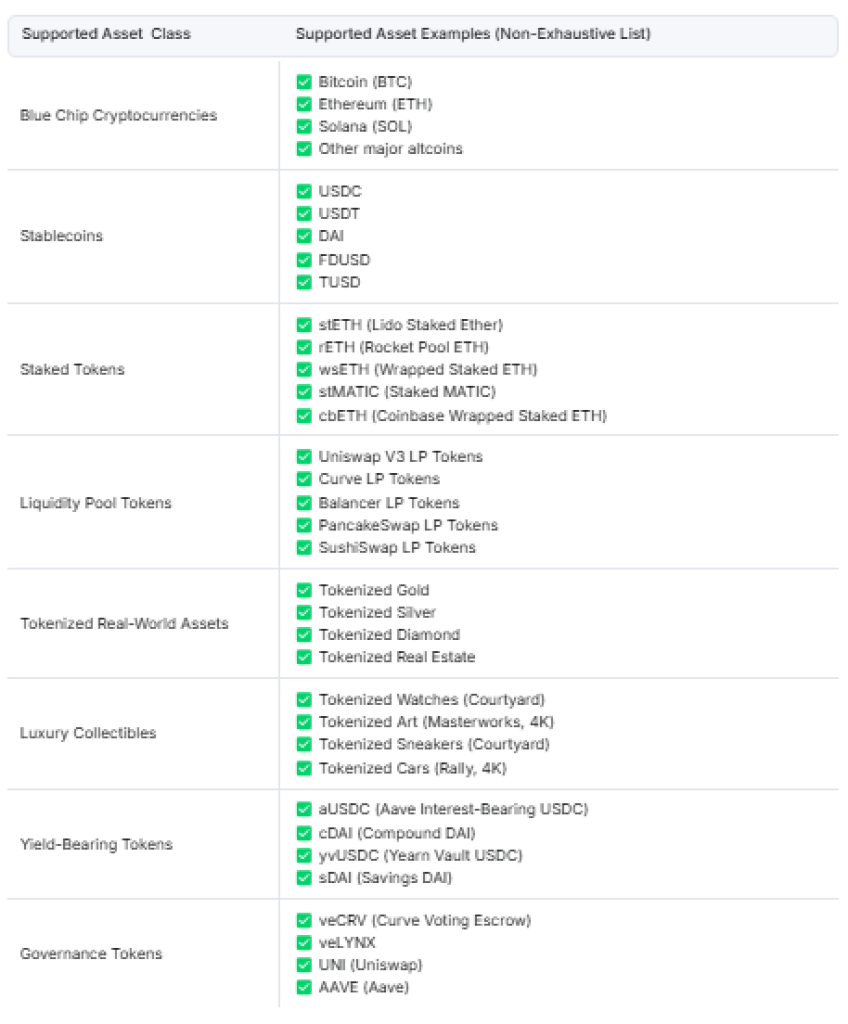

Paydax Protocol (PDP) offers broad collateral support for unlocking liquidity, which makes it stand out from other DeFi platforms such as Aave, Compound, and MakerDAO. In addition to supporting RWA like the XRP ETFs as collateral, the platform also accepts the following as collateral:

- Blue-chip crypto assets like Bitcoin, Ethereum, Solana, and XRP.

- Stablecoins

- Staked tokens

- Liquidity Pool tokens

- Governance tokens

- Yield-bearing tokens

An Excellent User Experience For Borrowers

Paydax Protocol (PDP) provides an exceptional user experience for borrowers like Wall Street investors, thanks to its straightforward vault system, which enables them to access instant liquidity.

- Borrowers lock approved collateral, such as the XRP ETFs, into the Lending Pool.

- They can then borrow assets against their collateral at a fixed rate between 5% and 7%.

- As PDP token holders, they can receive fee discounts on loan transactions.

- They must maintain a healthy Health Factor above 1.0 to avoid liquidations.

Lenders Get To Earn Up To 12.5% APY On Idle Assets

Lenders on the Paydax Protocol (PDP) can earn up to 12.5% annual percentage yield (APY) through the peer-to-peer (P2P) lending feature. That way, they can put their idle assets to work rather than depositing them in the bank. Users on the platform can also earn 6% APY on protocol staking and through DeFi vaults, 20% by staking in the redemption pool, and 41.25% APY from leveraged yield farming.

Meanwhile, PDP token holders also enjoy benefits, including governance rights, which enable them to participate in decision-making on the Paydax Protocol (PDP). Token holders are also eligible to a share of the revenue earned on the platform. Paydax boasts a sustainable revenue model, earning from loan origination fees, interest spread on loans, liquidation penalties, and trading fees.

Presale Opportunity

The Paydax Protocol (PDP) token presale is currently ongoing and is still in its initial stage, with the token selling at a low entry price of $0.015. Thanks to this presale opportunity, Wall Street investors have the chance to start borrowing, lending, and earning yields of up to 41.25% right from now.

The first stage of the PDP token presale is almost halfway done, after which the token’s price will rise to $0.017. There are also planned exchange listings, which are expected to spark a rally for the DeFi token. As such, this is undoubtedly the best time for market participants to bet on Paydax’s success as the first fully on-chain financial system. Those who join the presale today can use the promo code ‘PD80BONUS’ to get additional tokens.

Join the Paydax Protocol (PDP) presale and community:

Website ~ Telegram ~ X (Twitter) ~ Whitepaper

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.