VeChain (VET), a leading enterprise-grade public blockchain focused on supply chain management IoT solutions, has staged an impressive price recovery in recent weeks. Now, respected analyst Rekt Capital examines the constructive technical developments unfolding to assess likely next moves.

What you'll learn 👉

Breakout Tracks Toward the Next Resistance Zone

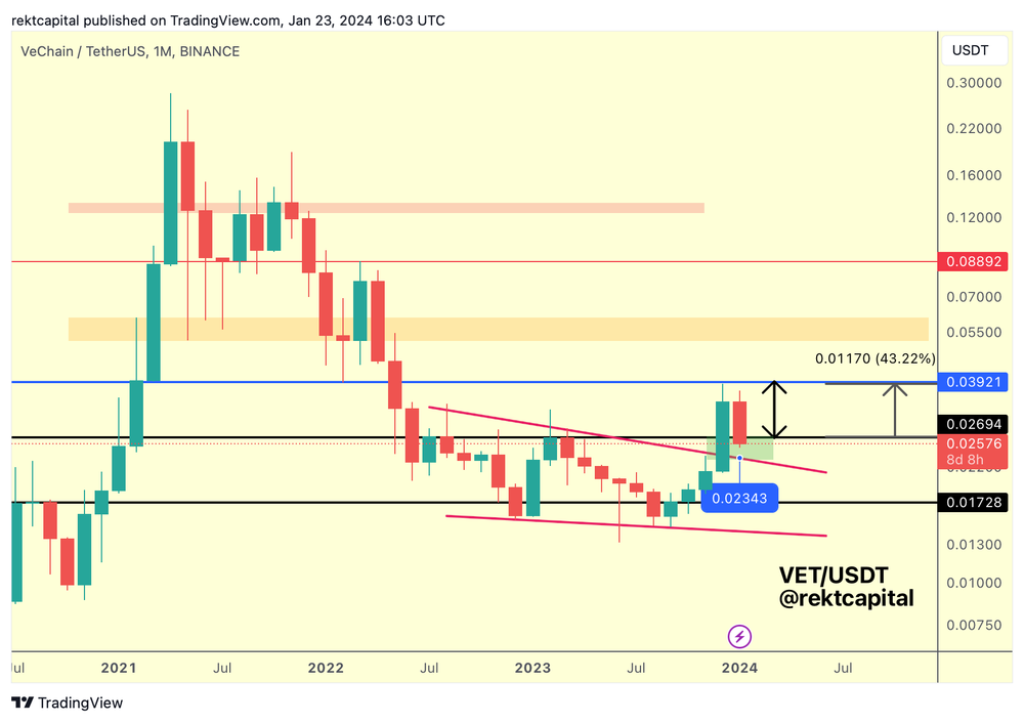

Analyzing VET’s journey on the higher timeframe charts, Rekt Capital details the early February move, which saw VET break out of its prior multi-month range between approximately $0.025 support and $0.035 resistance. This decisive move flipped previous resistance into support – confirming VET’s nascent uptrend.

Zooming into the current price action, Rekt notes that following this breakout, VET affirms its bullish standing by swiftly retesting the former range resistance as new support – establishing this zone as a reliable floor going forward.

“VET indeed dipped with the intent to retest the Range High, however, there was no picture-perfect retest, narrowly, very narrowly missing out on that picture-perfect contact,” Rekt stated. While not an aesthetically perfect validation, the swift buying response effectively served its purpose in holding the $0.035 level.

With its new staging ground preserved, VET now takes aim at the next minor resistance level around $0.04 in the near term. Reclaiming this would open a greater recovery toward 2022 highs.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Healthy Support Foundations Set the Stage for the Next Growth Wave

If VET closes February with strength above its former range ceiling, it minimally cements an even higher value accumulation zone at $0.035 for its next consolidation phase. In Rekt’s assessment:

“In this case, VET would’ve broken out from one macro range to enter another. In this case, there would technically be scope for downside into the Range Low area as part of normal, range-bound consolidation.”

Thus, even routine cooling off bodes is well provided VET holds its latest progress intact upon revisiting lower supports. Each successful retest offers traders improved risk-reward opportunities to ride the next bull wave higher when momentum returns.

With market conditions continuing to strengthen and VeChain unveiling meaningful adoption growth, the technical table looks set for substantial upside continuation if proceeding along recent constructive patterns. Now VET must convert potential into realized gains.

Fundamental Catalysts Could Accelerate Breakout

While chart analysis dictates likely trajectories, real-world project developments help propel prices. On this front, an upcoming major VeChain announcement at the high-profile MWC Barcelona technology conference could introduce the type of catalyst to spark VET’s next leg higher ahead of schedule.

If the news combo proves impactful enough, traders could front run technical levels – so staying alert on all fronts gives flexibility to capture surprises before formal indicators trigger. Still, by sticking to retested support zones, investors protect against adverse turns while awaiting the next confirmed VET uptrend.

You may also be interested in:

- Expert Urges Caution on Long-Term Meme Coin Holdings; Dogecoin (DOGE), Shiba Inu (SHIB), and Others

- Stacks (STX) and Pyth Network (PYTH) Prices Pumping – Here’s Why

- SEC vs Ripple Lawsuit Prompts Investors to Turn Towards BlockDAG’s $2M Presale

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.