According to popular analyst Jacob Canfield (@JacobCanfield), the recent Uniswap (UNI) price surge to over $10 may not be over yet. The price has finally surged over 70% in the last 24 hours. In a recent tweet, Canfield stood by his previous $29 price target for UNI:

Crypto analyst Jacob Canfield had previously made a bullish price prediction for Uniswap’s UNI token, stating he believed it could reach $29. This target was met with skepticism and criticism from some in the crypto community. However, Canfield stood by his analysis.

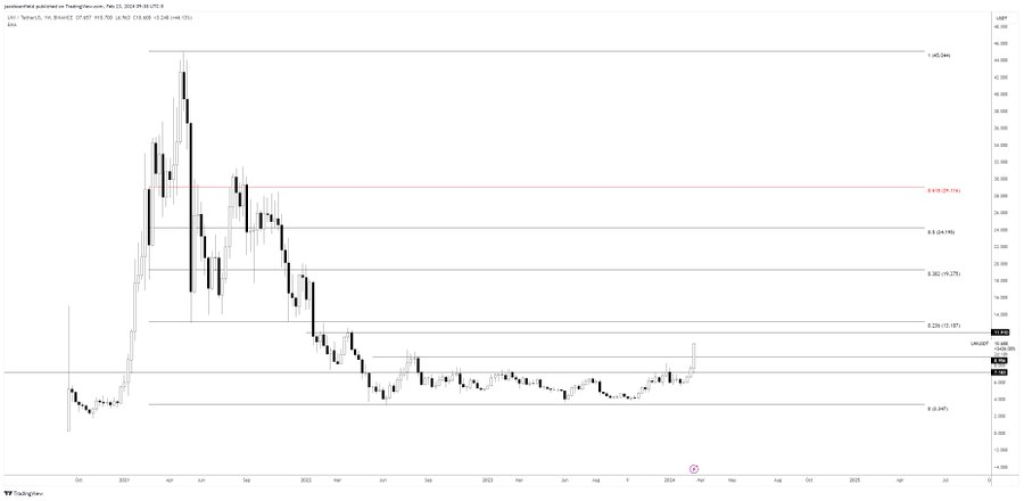

As Uniswap’s price broke out above $10, Canfield pointed out that this breakout validated his earlier prediction. He noted UNI had broken through key weekly resistance levels, showing the uptrend still has momentum. Canfield further explained his $29 target is based on the Fibonacci retracement levels from the previous high to recent low.

With UNI surging on the anticipation of the upcoming Uniswap v4 announcement, Canfield believes this rally could very well extend to hit his original $29 target before topping out. Rather than alter his target in the face of criticism, he is holding firm in his conviction on where this UNI price surge can go.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Large Holder Realizes $1.49 Million in Profits

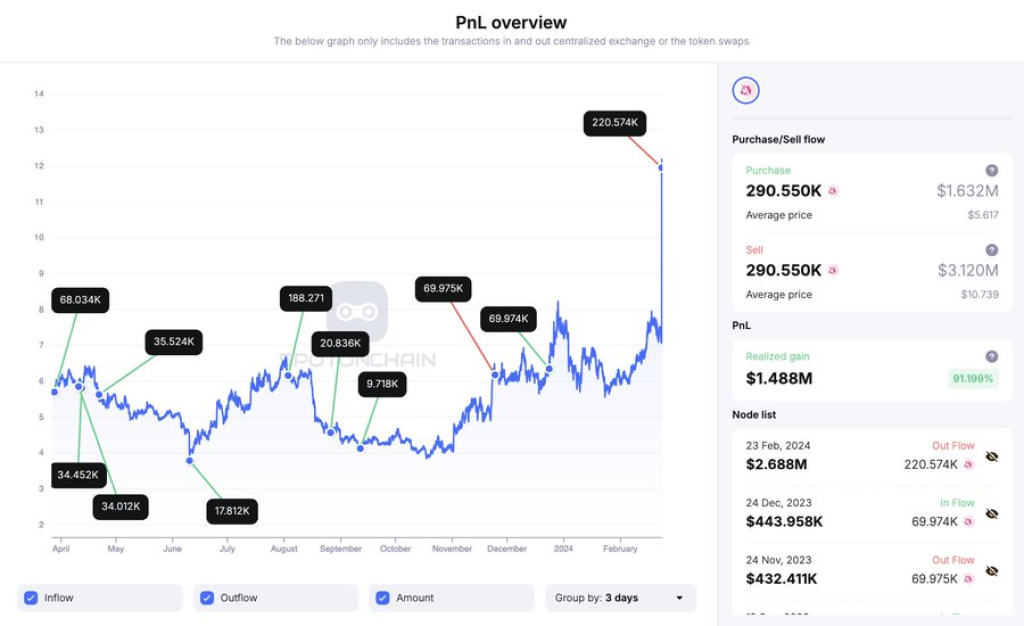

According to on-chain analytics provider Spot On Chain (@spotonchain), a large UNI holder recently realized substantial profits as the price spiked 60%.

Spot On Chain tweeted that 3 wallets, likely controlled by the same person, deposited 220,574 UNI ($2.69 million) to Binance after the price surge. These wallets had previously been withdrawing UNI from Binance at lower prices and buying back in at higher prices.

The analytics provider estimates this trader has realized $1.49 million in profits so far from UNI, for an impressive 91% return. This shows some large players are profiting from UNI’s volatility.

Concluding Thoughts

The recent UNI price surge has confirmed some analysts’ bullish outlooks, while also allowing some large holders to take substantial profits. Additional announcements and developments for the Uniswap protocol may continue to push the UNI price higher in the short term. However, the long-term price outlook remains uncertain. Traders should continue monitoring both on-chain data and analyst perspectives around UNI in the coming days and weeks.

You may also be interested in:

- Why is XAI Token Surging? Analyst Says ‘Consolidation Breakout Retested’ – Here’s His Outlook

- Starkent (STRK) and Filecoin (FIL) Prices Pumping – Here’s Why

- Meet The Viral Cryptos – Bitcoin Minetrix and BlockDAG (BDAG) Raise Millions In Their Ongoing Presales While Jupiter Surges

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.