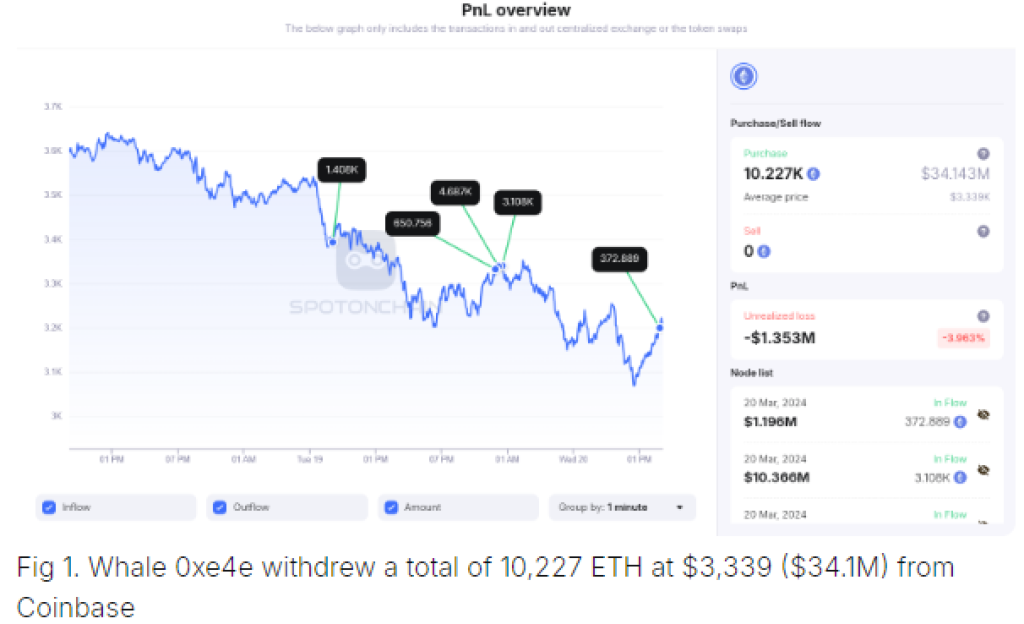

A crypto whale, identified by the address 0xe4eefc9f3b40eba64d28cb1468cad0ac83a56c39, has withdrawn substantial amounts of Ethereum (ETH) from the crypto exchange Coinbase according to data from on-chain analytics firm Spotonchain.

In a notable transaction, the whale withdrew 372.88941 ETH, valued at approximately $1.19 million, from Coinbase. This withdrawal is part of a larger trend, where the whale has allegedly extracted 10,227 ETH, worth $34.1 million, from Coinbase over the past day.

What you'll learn 👉

A Significant Loss Amidst a Declining ETH Price

Notably, the whale’s accumulation of ETH has occurred during a period of price decline for the cryptocurrency. The price of ETH has dropped nearly 21% in the past week according to the Spotonchain’s report.

Consequently, the whale has incurred an estimated total loss of $1.35 million due to the unfavorable market conditions. However, the whale’s actions suggest a long-term bullish sentiment towards ETH, capitalizing on the dip to accumulate more holdings.

In a separate but equally significant development, another cryptocurrency whale, identified by the address 0x22162dbba43fe0477cdc5234e248264ec7c6ea7c, has made a massive on-chain purchase of ETH. This whale acquired 13,574 ETH by spending 42.57 million USDC, at an average price of $3,136 per ETH, over the past 45 minutes.

A Diversified Portfolio and Liquidity Provision

Moreover, this whale has been actively accumulating ETH over the past 18 hours, spending a total of 81.57 million USDC to acquire 25,828 ETH at an average price of $3,158. Significantly, 12,280 ETH, now valued at $37.95 million, along with 19.79 million USDC and 25,000 ETHFI tokens (worth $73,800), have been added to liquidity pools on the decentralized exchange Uniswap.

The whale’s diversified portfolio spans various platforms, holding a total of 61,789 ETH, currently valued at $190.9 million. This includes 20,007 ETH ($61.82 million) in ether.fi, making the whale the second-largest depositor, 14,002 ETH ($43.27 million) across Uniswap’s liquidity pools, 10,001 ETH ($30.9 million) in Renzo, 13,584 ETH ($41.97 million) in the wallet, and 4,202 ETH ($12.98 million) in Swell.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +The aggressive accumulation of ETH by these two whales amidst a price dip suggests a strong belief in the long-term potential of the cryptocurrency. Their diversified holdings and participation in liquidity provision underscore their commitment to the Ethereum ecosystem.

You may also be interested in:

- Polkadot ‘Looks Good’ Long-term Says Elite Trader, Predicts new ATH for DOT

- This Indicator Nailed Polygon (MATIC) Price Predictions Since Mid-February: Here’s What It Flashes Now

- The Next Big Meme: Koala Coin (KLC) Gains Rapid Popularity Among Shiba Inu (SHIB) & Bitcoin Cash (BCH) Supporters

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.