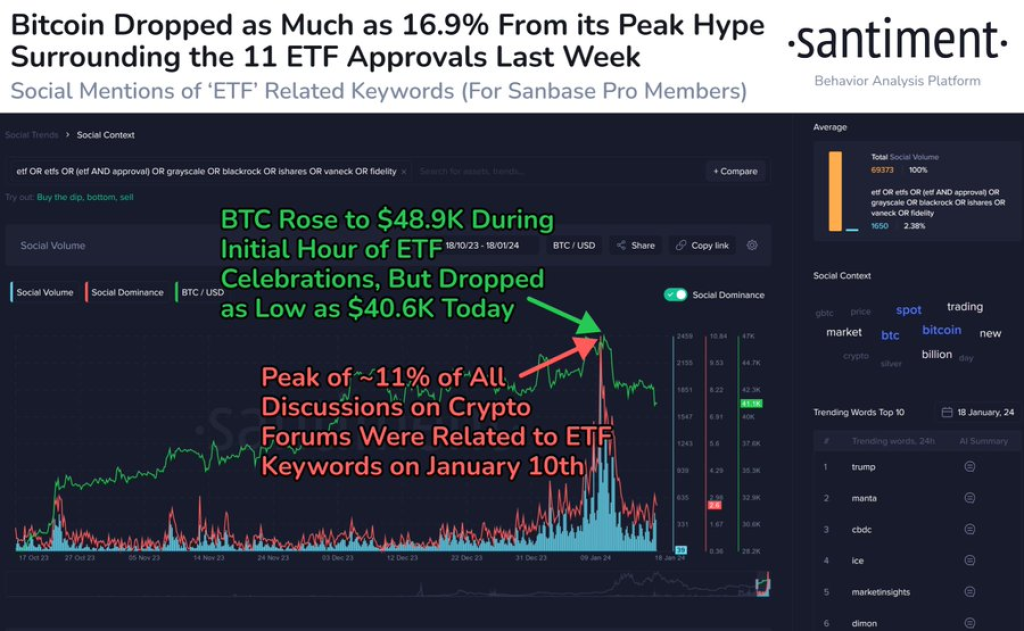

While still optimistic long-term, Santiment notes the Bitcoin ETF approvals likely marked a local crypto top. The anticipation and FOMO surrounding these events arguably peaked prices, with the foregone conclusion already priced in.

After $BTC dropped 16.9% from its peak following the approvals, Santiment says to watch if ETF narrative turns negative. Specifically, they advise monitoring for FUD-filled associations like “scam,” “ripoff,” or “disaster” as novice traders sell in panic.

Source: Santiment – Start using it today

Signs of Capitulation Sparking Bounce

If bearish ETF sentiment emerges after previously pumping prices, it could signal capitulation nears. As Santiment explains, the FUD and panic selling that washes out weak hands enables patient accumulators to spark a rebound at lower levels.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +In other words, the same factor that initially pumped prices (ETF optimism) flipping bearish could ignite the next bounce if it achieves peak panic. These opportunistic conditions tend to mark reversal points.

So traders should closely monitor for extreme ETF fear signaling the bottom may be forming, according to this top on-chain analyst.

You may also be interested in:

- Choppy Waters Ahead? Here’s the Risk of a Pre-Halving Bitcoin Selloff

- Solana (SOL) Turns Bullish Across All Timeframes but Analyst Insists This Resistance Must Break First

- BlockDAG Unveils Miners for Profitable Mining as Bitcoin’s Funding Rate Hits 66%, and Litecoin Expects a Rally

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.