The conversation around crypto predictions for 2026 is already heating up as investors look beyond short-term volatility and focus on projects with long-term strength. Among the names frequently entering discussions are Binance coin (BNB), Ripple (XRP), and an emerging defi crypto project that is steadily gaining attention during its presale phase — Mutuum Finance (MUTM). While established coins bring history and liquidity, early-stage platforms with working utility are often where the highest growth stories begin.

What you'll learn 👉

Binance Coin (BNB)

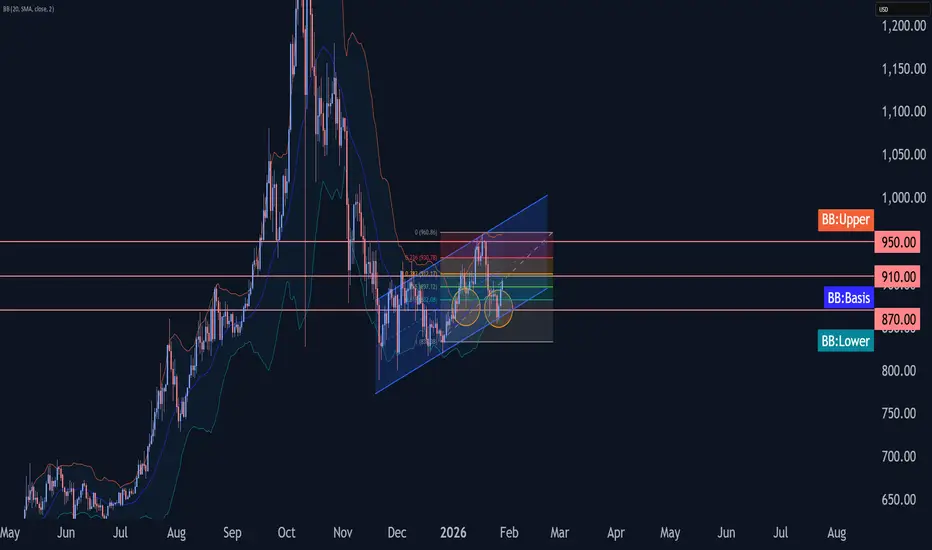

Binance coin (BNB) recently reversed upward from the key support zone around $870, reinforced by the daily uptrend channel from November and the 61.8% Fibonacci retracement of December’s impulse. The lower daily Bollinger Band also coincided with this support, signaling a potential bullish bounce. With this strong technical base, BNB is positioned to move toward the next resistance at $950, which previously capped the last impulse wave. The combination of trendline support, Fibonacci alignment, and momentum indicators suggests that buyers are stepping in, making a rise toward $950 likely in the near term.

Ripple (XRP)

XRP appears to be repeating its 2017 fractal pattern, signaling a potential strong upside. The 2-week RSI shows oversold conditions, resetting to the same “launchpad zone” that preceded the 2017 parabolic run. Recently, XRP successfully retested the $1.55–$1.95 breakout level, confirming it as solid support. With the fractal pattern pointing to a vertical expansion next, historical behavior combined with current technical indicators suggests buyers are stepping in. Momentum is aligning for a potential sharp upward move, making XRP’s near-term outlook highly bullish if history rhymes as expected.

Mutuum Finance (MUTM)

In many crypto predictions, strong utility is the key factor separating hype from sustainability. Mutuum Finance (MUTM) is being designed as a dual-model lending protocol, combining Peer-to-Contract and Peer-to-Peer systems in one ecosystem.

In the P2C model, users will deposit assets into shared liquidity pools. These pools will power borrowing activity and generate yield. Depositors will receive mtTokens that represent both their share and the interest they earn. These mtTokens will also be usable as collateral, adding flexibility and capital efficiency.

In the P2P model, borrowers and lenders will be matched more directly, allowing for customized terms between participants. The difference is simple: P2C relies on pooled liquidity and algorithmic rates, while P2P allows more direct, agreement-based lending. Together, these models are designed to make the platform adaptable to different user preferences and market conditions.

Mutuum Finance (MUTM) is currently in presale phase 7, and momentum is continuing to build. The project has a total supply of 4 billion tokens, and across all presale phases so far, around $20.40 million has already been generated. The current token price sits at $0.04, with more than 19,000 holders participating throughout the presale journey. In this active phase alone, 15% of the allocated 180 million tokens have already been sold, showing steady demand as new participants position themselves ahead of launch.

Delay in investing would cause you to lose the first mover advantage. To understand the potential upside often mentioned in crypto predictions, consider a simple numerical scenario of early entry. An early participant invested $3,000 in phase 2 at a much lower price, and their effective entry averaged around $0.02, they would hold 150K MUTM tokens. At today’s $0.04 presale price, that allocation is already valued at $6,000. If future realistic milestones of $0.5 are reached, that same holding will be worth $75K.

What Could Make MUTM Explode

Unlike many failed projects that just create hype on promises, Mutuum Finance (MUTM) is an entirely different working product. The recent launch of its initial version on the Sepolia testnet represents the project’s first live deployment in an environment that closely mirrors mainnet conditions. This phase allows users to test lending and borrowing features without risk, helping them understand how the protocol functions while giving the team valuable insights from real user activity. V1 introduces key building blocks such as asset-based liquidity pools, interest-earning mtTokens, transparent debt tokens, automated liquidations, and support for ETH, USDT, LINK, and WBTC.

The testnet protocol’s structure creates a healthy cycle within the ecosystem. Lenders earn yield, borrowers gain flexibility, and the protocol remains active. Launching on testnet first encourages early participation and enables the protocol to be refined through real usage.

Mutuum Finance (MUTM) is not only building lending features; it is also designing token demand directly into platform activity. As users lend, borrow, and stake, MUTM will be increasingly tied to ecosystem participation. The platform will introduce a buy-and-distribute mechanism where a portion of protocol revenue will be used to repurchase MUTM tokens from the open market. These tokens will then be distributed to mtToken stakers as rewards.

This structure is intended to create continuous buy pressure as usage grows. More borrowing and lending activity will mean more revenue, which will mean more token buybacks and more rewards for participants. In many defi crypto models, this kind of circular demand system is viewed as a powerful long-term value driver.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.