Crypto analyst Zen (@WiseAnalyze) has shared insights on Toncoin (TON), focusing on a symmetrical triangle pattern that could indicate an impending breakout. The chart highlights the potential for price movement, with key price levels playing crucial roles.

Additionally, on-chain data from IntoTheBlock reveals growing network participation, while analyst Shiven Moodley examined liquidity dynamics in the TON ecosystem.

What you'll learn 👉

TON Pattern Points to Possible Breakout

Zen’s Toncoin chart show key patterns that indicate a potential breakout soon. Since September 12th, TON’s price action has been forming a symmetrical triangle. This pattern typically reflects a period of market indecision but is often a precursor to a price movement once a breakout occurs.

Adding to the technical setup are the distinct support and resistance levels outlined on the chart. The support zone around $5.185 and $5.033 has been tested several times without a breakdown, suggesting a strong buying interest at these levels.

Conversely, the resistance from $6.069 to $6.752 has temporarily capped any upward movements. The key to a bullish breakout would be a sustained move above the downward trend line, which has been a key barrier since it traces back to previous peaks.

Volume trends on the chart also support the potential for an upcoming breakout. Fluctuations in trading volume, with notable spikes on price movements, underline the correlation between volume and price action.

As of September 23rd, with the price nearing the apex of the symmetrical triangle, the conditions seem ripe for a breakout. This aligns with market analyst Zen’s observation that TON is “very attractive for breakout.”

On-Chain Data Suggests Growing Network Activity

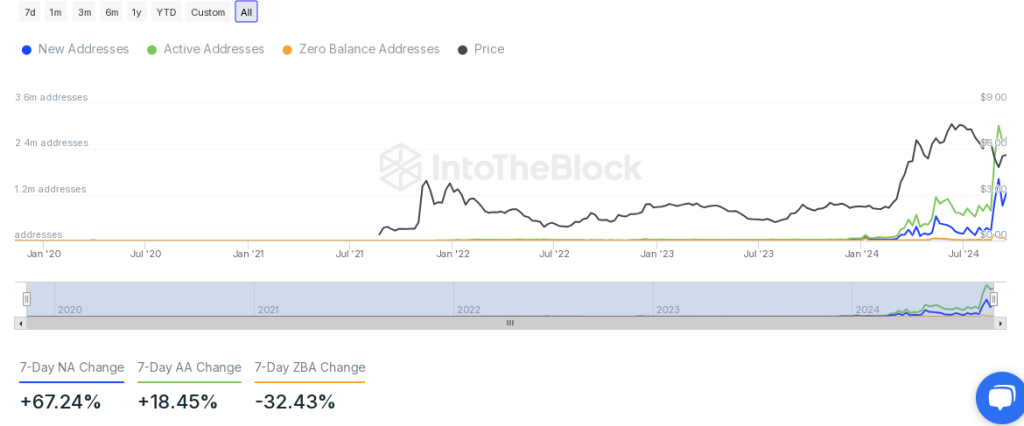

Data from IntoTheBlock further supports the bullish outlook on Toncoin by showing increased activity on the network. The number of new addresses (NA) has surged by 67.24% in the past week, indicating rising interest in the TON network.

Active addresses (AA), which measure user engagement through transaction activity, have also increased by 18.45%. This rise suggests that beyond simple holding, more users are actively participating in the Toncoin network.

The uptick in active usage points to growing confidence in Toncoin’s utility, particularly as it integrates with DeFi applications and other use cases.

A notable decrease in zero-balance addresses (ZBA) further strengthens the case for Toncoin’s increased adoption. A 32.43% reduction in empty wallets suggests that more participants are acquiring TON tokens, contributing to the network’s growing user base.

This accumulation aligns with Zen’s analysis, which predicts upward price movement based on increased interest and participation.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Read also: Sui Network Breaks $900 Million in TVL as SUI Price Explodes

Evaluating TON’s Liquidity and Market Performance

Analyst Shiven Moodley evaluated the liquidity dynamics of the TON network. According to Moodley, the network’s scalability is bolstered by its high throughput, which allows it to handle a growing number of transactions efficiently.

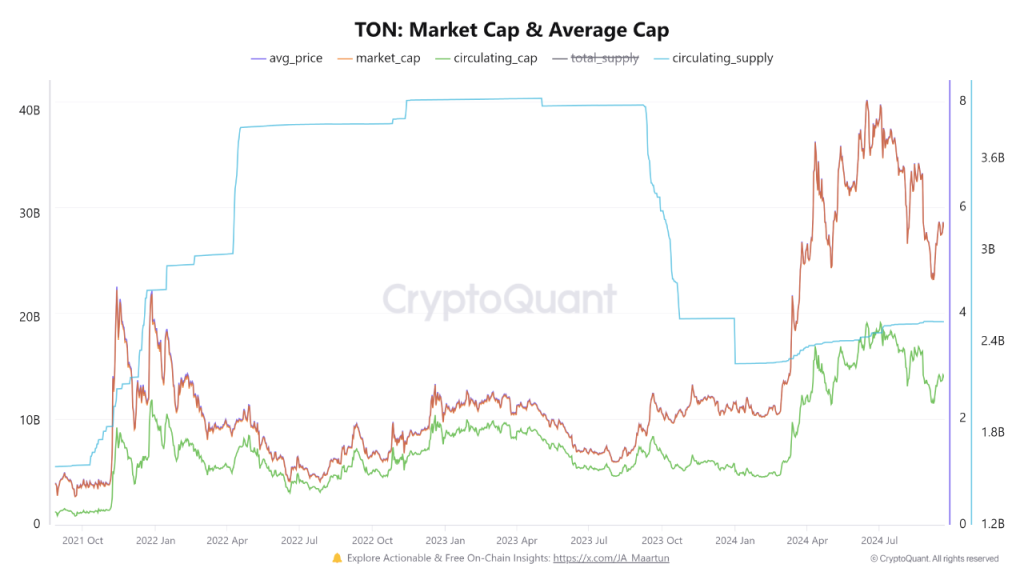

Toncoin’s collaboration with Telegram has also contributed to the network’s expansion, with increased market capitalization reflecting its growth.

However, Moodley noted a disparity between market capitalization and circulating supply, which may indicate that a portion of Toncoin’s supply is either locked or held for long-term investment. This divergence could impact liquidity, though it does not necessarily affect the overall market valuation.

A closer alignment between market capitalization and price suggests a rational market valuation, with much of the circulating supply actively contributing to Toncoin’s overall value.

Moodley’s analysis points to the importance of monitoring the relationship between market capitalization and price, as significant deviations could signal speculative behavior. However, at present, the TON network appears to be well-supported by its circulating supply, contributing to a stable market environment.

Follow us on X (Twitter), CoinMarketCap and Binance Square for more daily crypto updates.

Get all our future calls by joining our FREE Telegram group.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.