We are now 80 days out from Bitcoin’s upcoming halving event in May 2024. Prominent analyst Metaquant has provided an epic 29-point analysis explaining why “2024-2025 will be the biggest bull market ever.” Even if you missed the recent rally, the best is yet to come for crypto.

However, he noted that we are still far away form where we were in 2021.

Historically around the 75 day mark before halvings, Bitcoin tends to see “2-4 juicy dips” to buy per Metaquant. We likely saw the last major dip back in January. From here, around 50 days pre-halving, BTC grinds upwards with traders front-running the event – Metaquant notes 70%+ rallies in the past.

Right before halvings some profit-taking is common. In 2016 a 30% pre-halving dump occurred, and 2020 saw a 20% dump. Metaquant believes magnitude of volatility decreases each cycle. Once the halving passes, BTC enters 4-5 month accumulation before breaking out.

The 2020 halving coincided with unprecedented global QE from COVID-19 – so that data is less indicative. This time, markets are predicting the Fed’s first rates cuts to hit as early as March 2024. This means liquidity influxes resume in H2. Plus, China has restarted printing money already.

Metaquant also highlights Bitcoin’s recent hashrate and mining dynamics. Fees earned from ETHW transactions are providing meaningful revenues, better securing the chain. Between halvening reductions and transaction fees, miners may stay solvent through turmoils.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

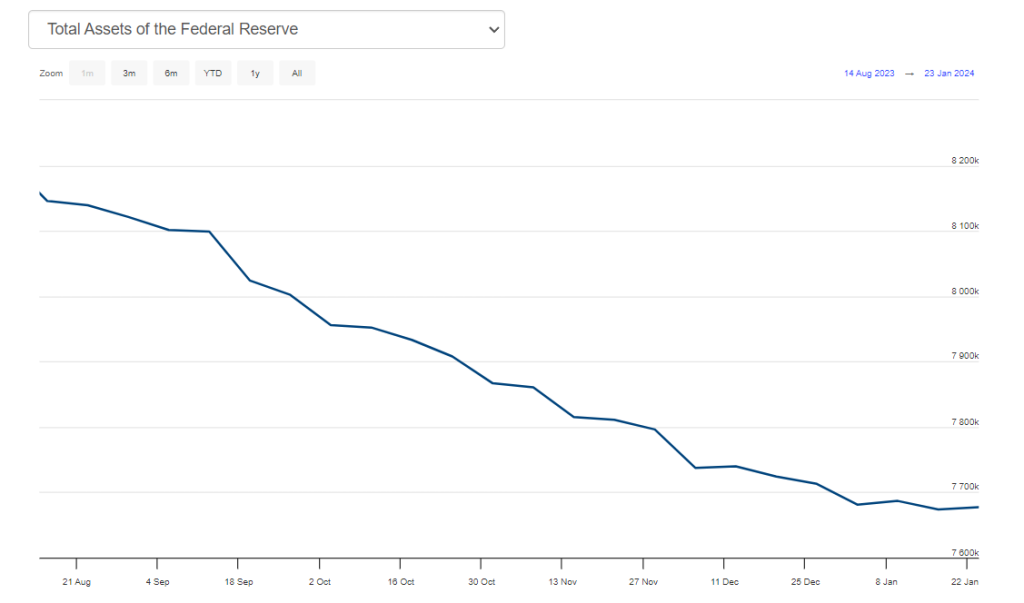

Show more +When examining the Fed balance sheet’s channel, stablecoin market cap, and other risk assets – liquidity clearly correlates to crypto market uptrends. And currently global liquidity has seen just 25% of its expected inflow per Metaquant’s analysis. When central bank stimulus joins the mix, stand back.

On the macro level, the Fed’s balance sheet has likely bottomed after nearly 2 years of quantitative tightening. Markets are already pricing in the first rate cuts to occur in March or May. This means liquidity will start flowing back into risk assets in the 2nd half of 2024, just as the halving kicks in to further constrain Bitcoin’s supply.

At the same time, China has restarted its money printer. Combine this global liquidity influx with capital inflows from Bitcoin ETFs, projected to reach $14 billion in 2024, $27 billion in 2025, and $39 billion in 2026. Not to mention the hype around the 2024 US elections potentially boosting markets.

In summary, from both a halving cycle and global liquidity standpoint, everything is aligning for the biggest Bitcoin bull run yet over the next 2 years. We have seen nothing compared to the parabolic mania soon to come. As Metaquant said, “The best is yet to come.” Now is the time for “Front-running the Front-runners.”

- How Crypto Trader Yielded Over $800K with DOT’s Rival Token

- Will Cardano Reclaim $0.65? Coinpedia Analysis Says ADA Upside Looking Likely

- $5SCAPE Will Be At The Forefront of the Next VR and AR Wave in 2024 – Here’s Why

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.