In the world of cryptocurrencies, the fascinating and sometimes convoluted story of a pseudonymous crypto influencer known as “Ben.ETH” stands out. Here’s a tale of meme coin creation, mysterious multi-million-dollar transactions, the involvement of a four-time world kickboxing champion, and a potential eight-figure lawsuit.

What you'll learn 👉

1. A Meme Coin Empire

Ben.ETH’s story begins with the sudden rise of $PEPE, a meme coin that launched in late April and quickly exploded in popularity. Many early holders of $PEPE saw their initial investments grow by up to 100x, with some turning mere hundreds of dollars into over a million. This unprecedented boom captured the attention of not only Crypto Twitter, but the broader crypto community.

$PEPE managed to secure a staggering market cap of $600m. Inspired by its success, a flood of new meme coins emerged. Among these were $WOJAK, $BOB, $LAMBO, $CHAD, and $WEED. Participants in the crypto world were eagerly seeking the next potential 1000x opportunity.

2. The Rise of @eth_ben

One figure that capitalized on this meme coin trend was the mysterious Ben.ETH, a relatively unknown influencer in the crypto space at the time. He saw an opportunity and launched his own token, $BEN. This token languished initially until crypto influencer Bitboy publicly endorsed it.

However, Bitboy faced harsh criticism for buying a significant portion of $BEN’s supply without public disclosure. His actions raised speculation about potential regulatory or legal repercussions due to what some saw as memecoin pump-and-dump behavior.

3. The Limelight and $PSYOP

Despite the controversy, Ben.ETH found himself in the spotlight due to $BEN’s success. His follower count grew rapidly, marking his rise as a significant influencer within the space.

Seeking to capitalize on his newfound influence, Ben.ETH announced the creation of a new token, $PSYOP. He asked interested parties to send Ethereum (ETH) to his wallet address in anticipation of the token’s imminent launch. The result was an unexpected windfall of $7 million in ETH.

4. Allegations and Lawsuits

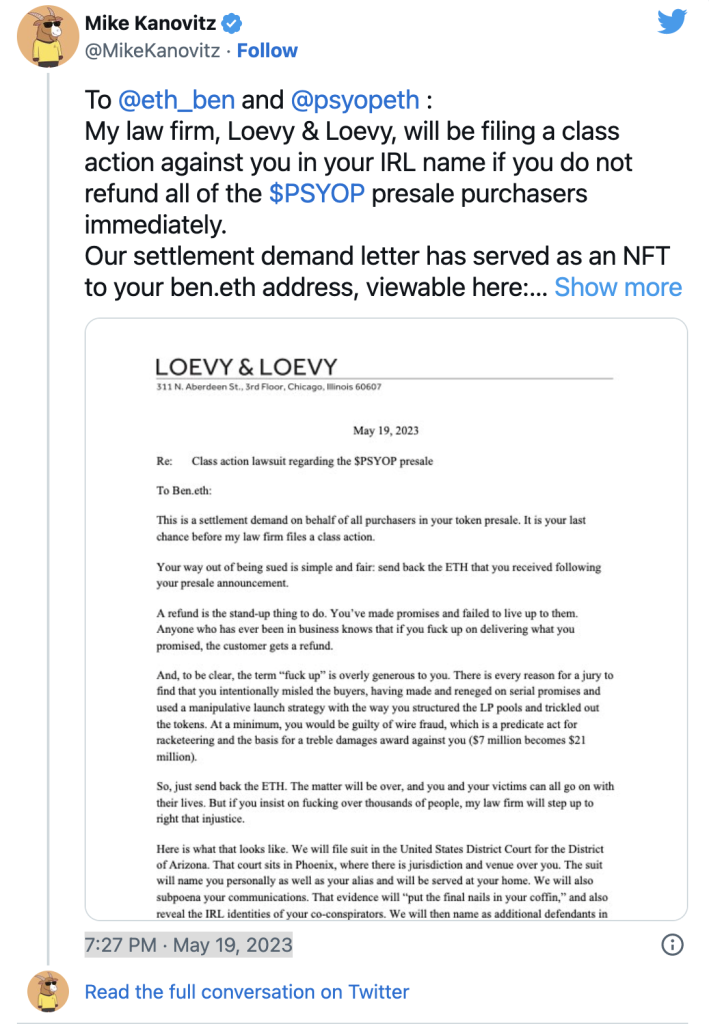

However, the launch of $PSYOP was marred by multiple issues, including a proliferation of fake tokens and confusing pool setups. A person claiming to be a developer for Ben.ETH revealed allegations of deliberate unfairness in the token’s structure.

Adding fuel to the fire, a lawyer threatened to file a class-action lawsuit against Ben.ETH, alleging wire fraud against early investors, and demanding damages of up to $21 million.

5. Meme Growth and Market Speculation

Despite these challenges, the meme behind $PSYOP thrived. The chaos surrounding the token fed into its narrative, fuelling speculation and interest.

Amidst the drama, a rumor circulated that four-time world kickboxing champion, Andrew Tate, was involved with $PSYOP. He quickly released a video dismissing the rumor, further adding to the speculation and uncertainty, inadvertently driving the meme—and the coin’s popularity—further.

6. The Billion-Dollar Wallet

As the meme grew, so did the value of Ben.ETH’s wallet, from a handful of bored apes and some ETH to over $1.77 billion in valuation. Despite the high valuation, these tokens lacked liquidity. A market dump, if Ben.ETH attempted it, would yield a mere ~$225k.

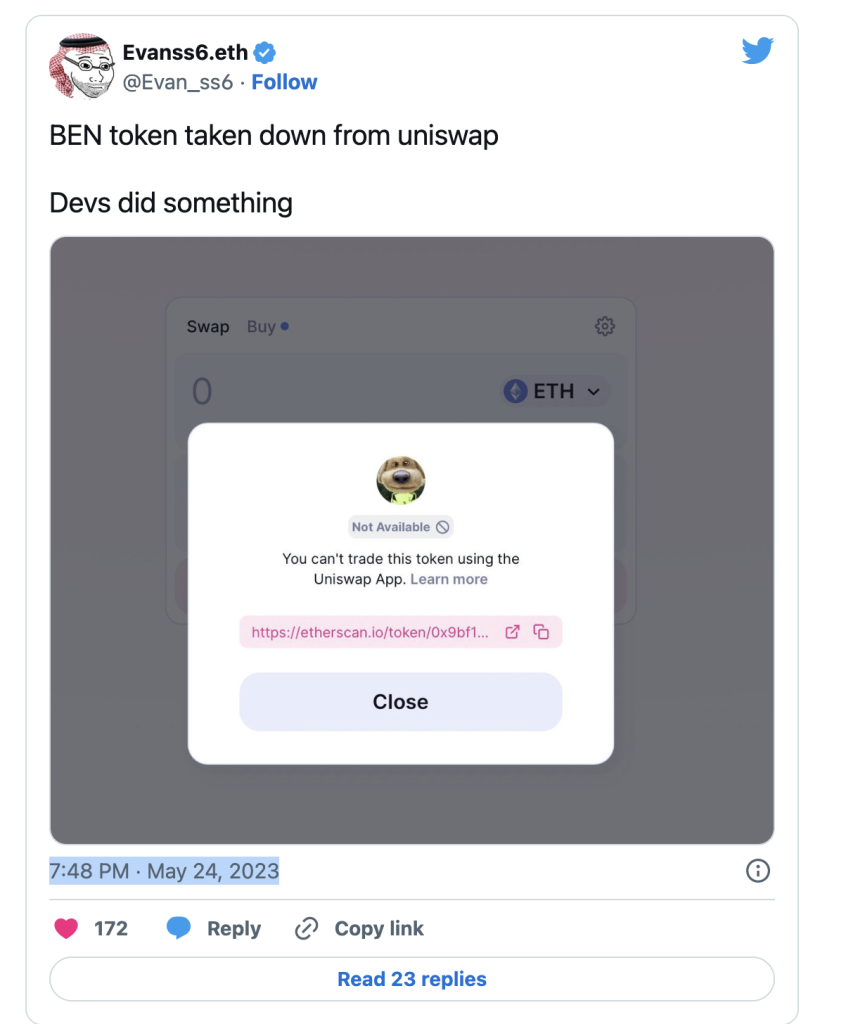

7. Uniswap Ban and Regulatory Concerns

Recently, the Uniswap front end suspended user trading of the $BEN token, an action potentially tied to anticipated regulatory enforcement. The specific reasons remain unconfirmed, but it adds another twist to an already convoluted tale.

8. Crypto: A Wild West?

The saga of Ben.ETH provides a fascinating case study for the unpredictable nature of the cryptocurrency world. It prompts questions about the future of this new financial system. Is the lure of striking it rich with unregulated, often scam-riddled meme coins a feature or a flaw of this system? The story of Ben.ETH is just one example of the wild west nature of the cryptoverse—where fortunes are made, lost, and made again.